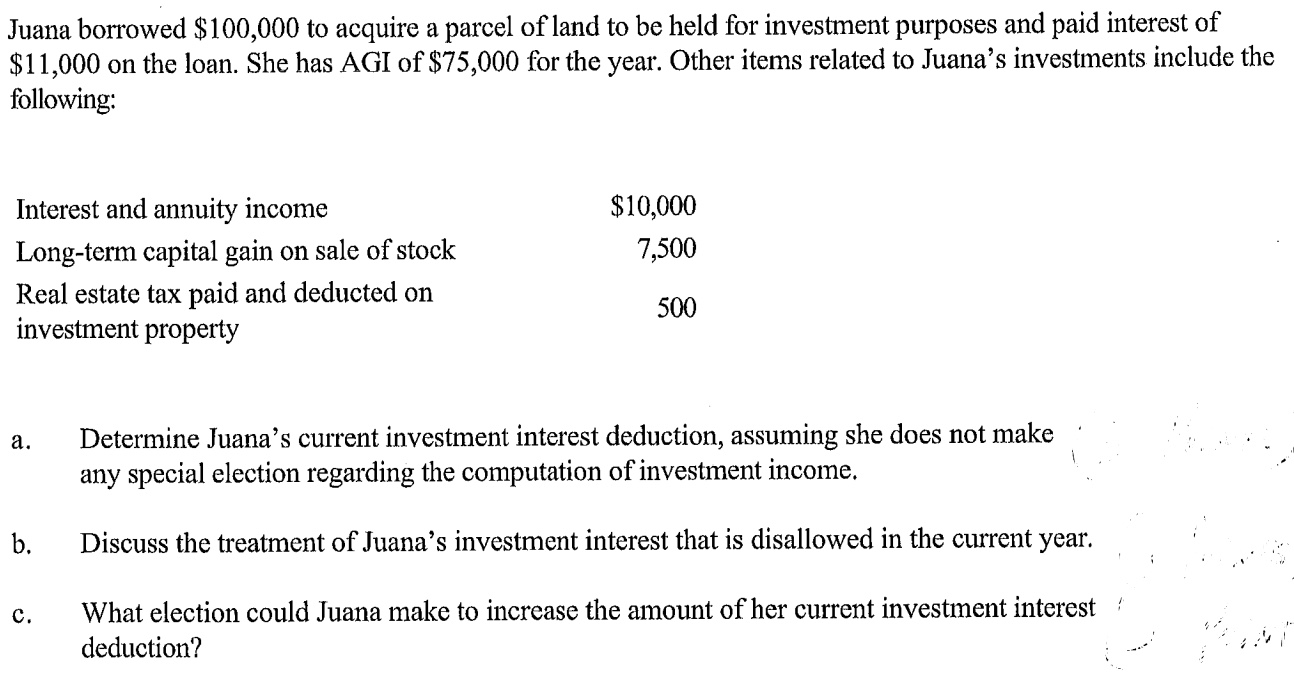

Question: Juana borrowed $ 1 0 0 , 0 0 0 to acquire a parcel of land to be held for investment purposes and paid interest

Juana borrowed $ to acquire a parcel of land to be held for investment purposes and paid interest of

$ on the loan. She has AGI of $ for the year. Other items related to Juana's investments include the

following:

a Determine Juana's current investment interest deduction, assuming she does not make

any special election regarding the computation of investment income.

b Discuss the treatment of Juana's investment interest that is disallowed in the current year.

c What election could Juana make to increase the amount of her current investment interest

deduction? READDDDD THIS WELL To calculate the deductible amount of investment interest, start by subtracting any expenses related to the investment property from the total investment income. Then, you can determine the portion of the investment interest that is eligible for deduction.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock