Question: JUI 14.50% and is considering a project that requires a cash outlay of $2,150 now with cash inflows of $775 at the end of year

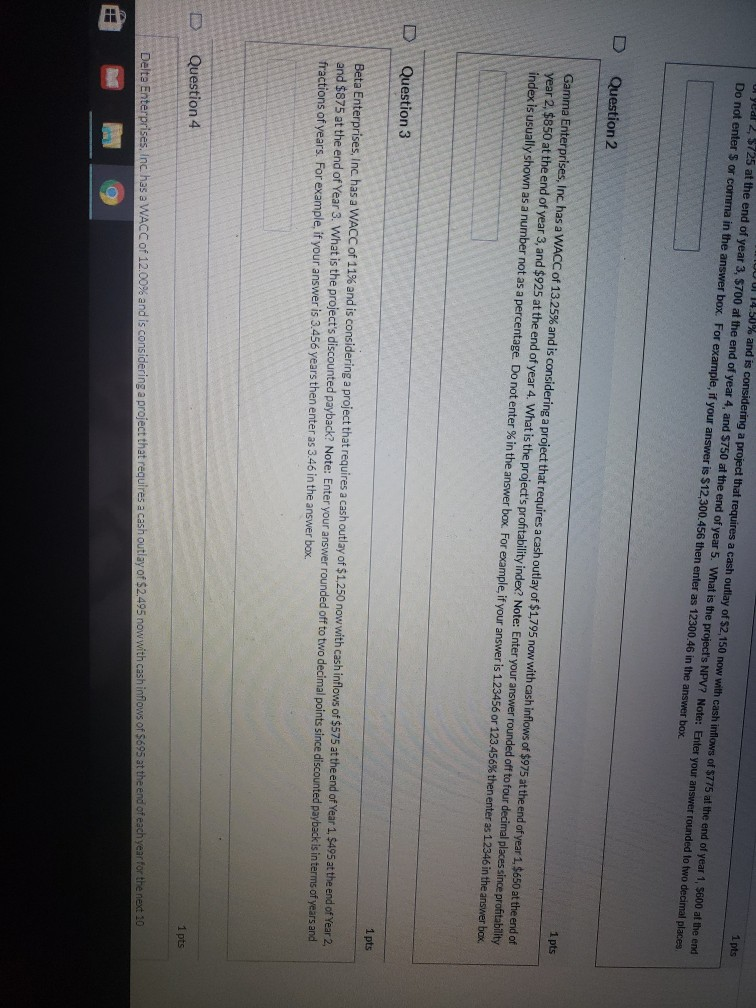

JUI 14.50% and is considering a project that requires a cash outlay of $2,150 now with cash inflows of $775 at the end of year 1, $600 at the end yed 2, 3725 at the end of year 3, $700 at the end of year 4, and $750 at the end of year 5. What is the project's NPV? Note: Enter your answer rounded to two decimal places Do not enter $ or comma in the answer box. For example, if your answer is $12,300.456 then enter as 12300.46 in the answer box 1 pts Question 2 Gamma Enterprises, Inc. has a WACC of 13.25% and is considering a project that requires a cash outlay of $1,795 now with cash inflows of $975 at the end of year 1. $650 at the end of year 2, $850 at the end of year 3, and $925 at the end of year 4. What is the project's profitability index? Note: Enter your answer rounded off to four decimal places since profitability index is usually shown as a number not as a percentage. Do not enter % in the answer box. For example, if your answer is 1.23456 or 123.456% then enter as 12346 in the answer box 1 pts Question 3 1 pts Beta Enterprises, Inc has a WACC of 11% and is considering a project that requires a cash outlay of $1,250 now with cash inflows of $575 at the end of Year 1, $495 at the end of Year 2 and $875 at the end of Year 3. What is the project's discounted payback? Note: Enter your answer rounded off to two decimal points since discounted payback is in terms of years and fractions of years. For example, if your answer is 3.456 years then enter as 3.46 in the answer box Question 4 1 pts Delta Enterprises, Inc. has a WACC of 12.00% and is considering a project that requires a cash outlay of $2,495 now with cash inflows of $695 at the end of each year for the next 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts