Juliette White is a head of household taxpayer with a daughter named Sabrina. They live at...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

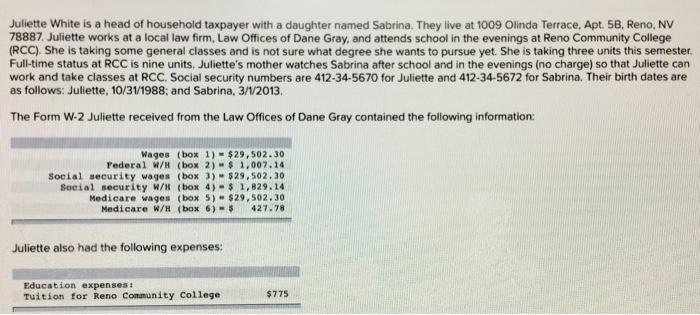

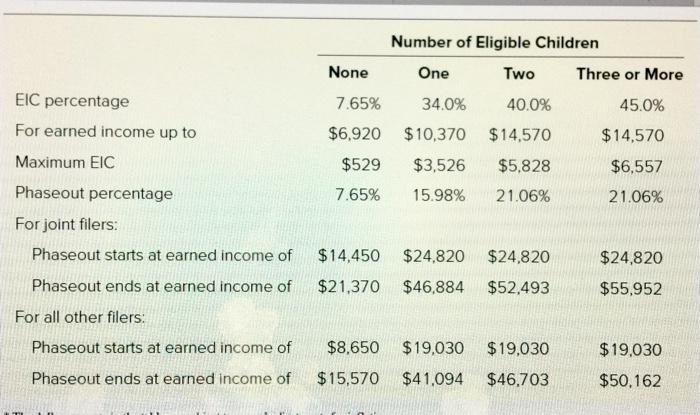

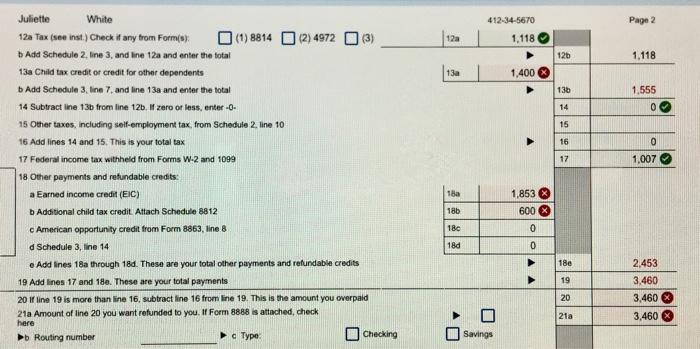

Juliette White is a head of household taxpayer with a daughter named Sabrina. They live at 1009 Olinda Terrace, Apt. 58, Reno, NV 78887. Juliette works at a local law firm, Law Offices of Dane Gray, and attends school in the evenings at Reno Community College (RCC). She is taking some general classes and is not sure what degree she wants to pursue yet. She is taking three units this semester. Full-time status at RCC is nine units. Juliette's mother watches Sabrina after school and in the evenings (no charge) so that Juliette can work and take classes at RCC. Social security numbers are 412-34-5670 for Juliette and 412-34-5672 for Sabrina. Their birth dates are as follows: Juliette, 10/31/1988; and Sabrina, 3//2013. The Form W-2 Juliette received from the Law Offices of Dane Gray contained the following information: Wages (box 1)- $29,502. 30 Federal W/H (box 2) -$ 1, 007.14 Social security wages (box 3) - $29,502.30 Social security W/H (box 4) -$ 1,829.14 Medicare wages (box 5) $29,502.30 Medicare W/H (box 6)-$ 427.78 Juliette also had the following expenses: Education expenses: Tuition for Reno Community College $775 Number of Eligible Children None One Two Three or More EIC percentage 7.65% 34.0% 40.0% 45.0% For earned income up to $6,920 $10,370 $14,570 $14,570 Maximum EIC $529 $3,526 $5,828 $6,557 Phaseout percentage 7.65% 15.98% 21.06% 21.06% For joint filers: Phaseout starts at earned income of $14,450 $24,820 $24,820 $24,820 Phaseout ends at earned income of $21,370 $46,884 $52,493 $55,952 For all other filers: Phaseout starts at earned income of $8.650 $19,030 $19,030 $19,030 Phaseout ends at earned income of $15,570 $41,094 $46,703 $50,162 Juliette White 412-34-5670 Page 2 口() 814 口2)4972 □3) 12a Tax (see inst.) Check if any trom Form(s) 12a 1,118 b Add Schedule 2, line 3, and ine 12a and enter the total 12b 1,118 13a Child tax credit or credit for other dependents 13a 1,400 b Add Schedule 3, line 7, and ine 13a and enter the total 1,555 136 14 Subtract line 13b from line 12b. H zero or less, enter -0- 14 15 Other taxes, including self-employment tax, from Schedule 2. line 10 15 16 Add lines 14 and 15. This is your total tax 16 17 Federal income tax withheld from Forms W-2 and 1099 17 1,007 18 Other payments and refundable credits: a Earned income credit (EIC) 18a 1,853 b Additional child tax credit Attach Schedule 8812 18b 600 18c c American opportunity credit from Form 8863, line 8 d Schedule 3, ine 14 18d e Add lines 18a through 18d. These are your total other payments and refundable credits 18e 2,453 19 Add lines 17 and 18e. These are your total payments 19 3,460 20 If line 19 is more than ine 16, subtract line 16 from line 19. This is the amount you overpaid 20 3,460 21a Amount of line 20 you want refunded to you. If Form 8888 is attached, check here 21a 3,460 D Routing number C Type Checking Savings Juliette White is a head of household taxpayer with a daughter named Sabrina. They live at 1009 Olinda Terrace, Apt. 58, Reno, NV 78887. Juliette works at a local law firm, Law Offices of Dane Gray, and attends school in the evenings at Reno Community College (RCC). She is taking some general classes and is not sure what degree she wants to pursue yet. She is taking three units this semester. Full-time status at RCC is nine units. Juliette's mother watches Sabrina after school and in the evenings (no charge) so that Juliette can work and take classes at RCC. Social security numbers are 412-34-5670 for Juliette and 412-34-5672 for Sabrina. Their birth dates are as follows: Juliette, 10/31/1988; and Sabrina, 3//2013. The Form W-2 Juliette received from the Law Offices of Dane Gray contained the following information: Wages (box 1)- $29,502. 30 Federal W/H (box 2) -$ 1, 007.14 Social security wages (box 3) - $29,502.30 Social security W/H (box 4) -$ 1,829.14 Medicare wages (box 5) $29,502.30 Medicare W/H (box 6)-$ 427.78 Juliette also had the following expenses: Education expenses: Tuition for Reno Community College $775 Number of Eligible Children None One Two Three or More EIC percentage 7.65% 34.0% 40.0% 45.0% For earned income up to $6,920 $10,370 $14,570 $14,570 Maximum EIC $529 $3,526 $5,828 $6,557 Phaseout percentage 7.65% 15.98% 21.06% 21.06% For joint filers: Phaseout starts at earned income of $14,450 $24,820 $24,820 $24,820 Phaseout ends at earned income of $21,370 $46,884 $52,493 $55,952 For all other filers: Phaseout starts at earned income of $8.650 $19,030 $19,030 $19,030 Phaseout ends at earned income of $15,570 $41,094 $46,703 $50,162 Juliette White 412-34-5670 Page 2 口() 814 口2)4972 □3) 12a Tax (see inst.) Check if any trom Form(s) 12a 1,118 b Add Schedule 2, line 3, and ine 12a and enter the total 12b 1,118 13a Child tax credit or credit for other dependents 13a 1,400 b Add Schedule 3, line 7, and ine 13a and enter the total 1,555 136 14 Subtract line 13b from line 12b. H zero or less, enter -0- 14 15 Other taxes, including self-employment tax, from Schedule 2. line 10 15 16 Add lines 14 and 15. This is your total tax 16 17 Federal income tax withheld from Forms W-2 and 1099 17 1,007 18 Other payments and refundable credits: a Earned income credit (EIC) 18a 1,853 b Additional child tax credit Attach Schedule 8812 18b 600 18c c American opportunity credit from Form 8863, line 8 d Schedule 3, ine 14 18d e Add lines 18a through 18d. These are your total other payments and refundable credits 18e 2,453 19 Add lines 17 and 18e. These are your total payments 19 3,460 20 If line 19 is more than ine 16, subtract line 16 from line 19. This is the amount you overpaid 20 3,460 21a Amount of line 20 you want refunded to you. If Form 8888 is attached, check here 21a 3,460 D Routing number C Type Checking Savings

Expert Answer:

Answer rating: 100% (QA)

Federal Income Tax Summary for Juliette White INCOME Wages salaries tips etc 295... View the full answer

Posted Date:

Students also viewed these accounting questions

-

Juliette White is a head of household taxpayer with a daughter named Sabrina. They live at 1009 Olinda Terrace Apt. 5B, Reno, NV 78887. Juliette works as a receptionist at a local law firm, Law...

-

Jennifer is divorced and files a head of household tax return claiming her children, ages 4, 7, and 17, as dependents. Her adjusted gross income for 2018 is $211,200. What is Jennifers total child...

-

Jennifer is divorced and files a head of household tax return claiming her children, ages 4, 7, and 17, as dependents. Her adjusted gross income for 2019 is $81,200. What is Jennifers total child and...

-

The quantity called mass density is the mass per unit volume of a substance. What are the mass densities in SI units of the following objects? a. A 215 cm 3 solid with a mass of 0.0179 kg. b. 95 cm 3...

-

Martin's Service Station is considering entering the snowplowing business for the coming winter season. Martin can purchase either a snowplow blade attachment for the station's pick-up truck or a new...

-

What is the purpose of independent verification of performance?

-

Two objects A and B having inertias \(m_{a}=m\) and \(m_{b}=3 m\) are moving with velocities \(v_{a}=v\) and \(v_{b}=3 v\). Find the velocities of the two objects in the zero-momentum frame of...

-

Nelson Corporation has made the following forecast of sales, with the associated probabilities of occurrence noted. Sales Probability $200,000 ...... 0.20 300,000 ........ 0.60 400,000 ........ 0.20...

-

1. Your program asks the user how many bananas they want to buy, and what the price is. This information is then passed to getTotal to calculate the total cost. System.out.println("How many bananas...

-

DM Yard Services has now added residential and commercial customers and is providing services on a regular basis. Review the Income Statement and Sales by Customer Summary Report: January 1 - May 31....

-

Write a paper about the Communication process, find a web site that has an about us section or a press release section. Write a paper addressing the following: identify the web site, the sender, and...

-

The square root of the variance is the a. expected value. b. standard deviation. c. area under the normal curve. d. all of the above.

-

Least squares is a technique used a. in regression analysis. b. to determine the accuracy of a forecasting model. c. to determine an exponential smoothing model. d. none of the above.

-

Airline fares have declined in real terms since the introduction of the Douglas DC-3 throughout the regulated era. What has enabled this decline?

-

Can fuel hedging lower fuel cost? Why do some airlines hedge fuel prices?

-

Air fares between a major hub city and a spoke city are often higher than for another city-pair of comparable distance and city sizes. Why?

-

Do the following exercises from the book. Show all work. Round percent answers to the nearest whole percent and money to the nearest cent where appropriate. 7.2 page 111 - 116 (ONLY PROBLEMS 2, 4, 6,...

-

A company has the following incomplete production budget data for the first quarter: In the previous December, ending inventory was 200 units, which was the minimum required, at 10% of projected...

-

Can we conclude that the old ratings have a direct causal effect on the new ratings? Explain briefly. For Exercises 13, refer to the combined cityhighway fuel economy ratings (mi/gal) for different...

-

For 10 pairs of sample data, the correlation coefficient is computed to be r = -1. What do you know about the scatterplot?

-

In a study of global warming, assume that we have found a strong positive correlation between carbon dioxide concentration and temperature. Identify three possible explanations for this correlation.

Study smarter with the SolutionInn App