Question: just #18 please - use note for standard deviation The company goes out of business Ir a recession hits. Calculate the expected me of return

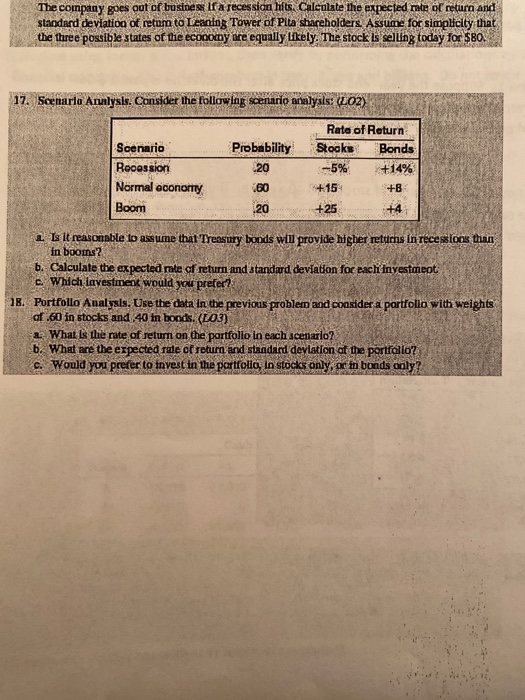

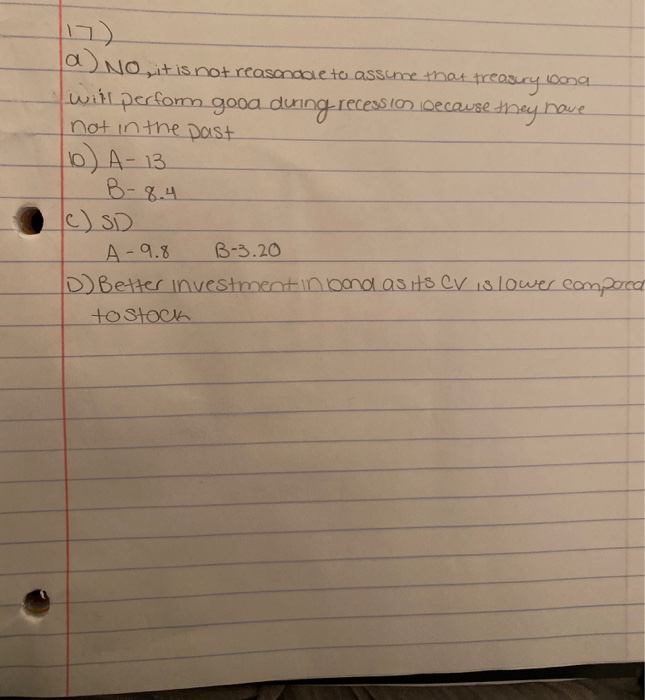

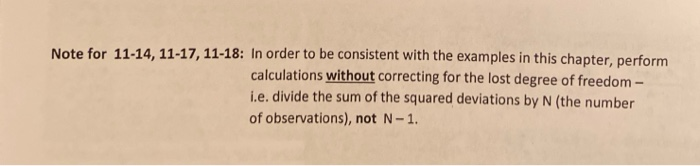

The company goes out of business Ir a recession hits. Calculate the expected me of return and standard deviation of retum to Leaning Tower of Pita shareholders. Assume for simplicity that the three possible states of the economy are equally likely. The stock is selling today for $80 17. Scenario Amulysis. Consider the following scenario salysis: (202) Probability 20 Scenario Recession Normal economy Boom Rate of Return StocksBonds -5% +14% +15 +25 60 +B . .. 20 4. Is it reasonable to assume that Treasury boods will provide higher returns in recessions than in boons? b. Calculate the expected rate of return and standwud deviation for each investmeot e. Which lavestment would you prefer? 28. Portfolio Analysis. Use the data in the previous problem and coordder a portfolio with weights of .60 in stocks and 40 in bonds. (L03) . What is the rite of return on the portfolio in each scenarlo? b. What are the expected rate of return and standard deviation of the portfolio c. Would you prefer to invest in the portfolio, in stocks only, or in bonds only? O NO it is not reasondae to assume that treasury long, wir perfom good during recession loecause they have not in the past (10) A-13 (C) SD A-9.8 B-3.20 D) Better investment in bond as its CV is lower comparar to stock Note for 11-14, 11-17, 11-18: In order to be consistent with the examples in this chapter, perform calculations without correcting for the lost degree of freedom- i.e. divide the sum of the squared deviations by N(the number of observations), not N-1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts