Question: Note for 11-14, 11-17, 11-18: In order to be consistent with the examples in this chapter, perform calculations without correcting for the lost degree of

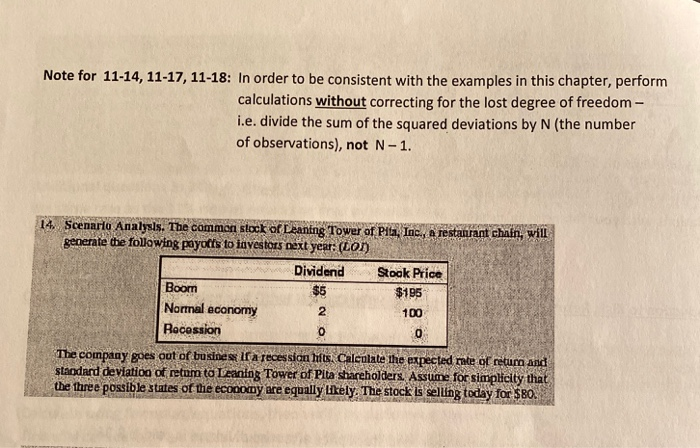

Note for 11-14, 11-17, 11-18: In order to be consistent with the examples in this chapter, perform calculations without correcting for the lost degree of freedom - i.e. divide the sum of the squared deviations by N (the number of observations), not N-1. 14. Scenario Analysis. The common stock of Leaning Tower of Pita, Inc., a restaurant chain, will generate the following payudts to investors next year: (ton Dividend Stock Price Boom $195 Normal economy 100 Recession The company goes out of business a recession hits. Calculate the expected mate o return and standard deviation of retom to Leaning Tower of Pita shareholders. Assume for simplicity that the three possible states of the economy are equally likely. The stock is selling today for $80. O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts