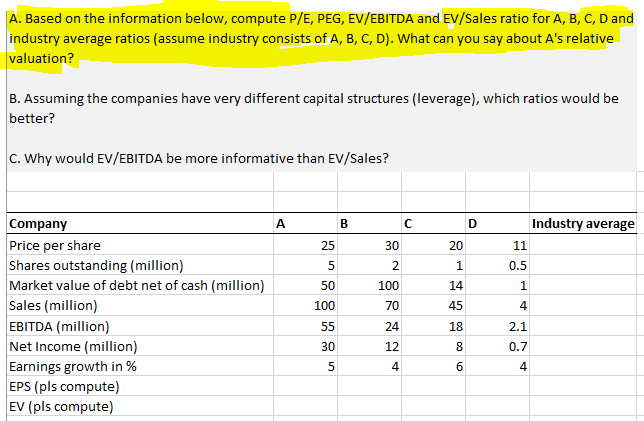

Question: just A please A. Based on the information below, compute P/E, PEG, EV/EBITDA and Ev/Sales ratio for A, B, C, D and industry average ratios

just A please

A. Based on the information below, compute P/E, PEG, EV/EBITDA and Ev/Sales ratio for A, B, C, D and industry average ratios (assume industry consists of A, B, C, D). What can you say about A's relative valuation? B. Assuming the companies have very different capital structures (leverage), which ratios would be better? C. Why would EV/EBITDA be more informative than EV/Sales? A B D Industry average 11 25 30 20 5 2 0.5 14 1 50 100 55 100 70 45 Company Price per share Shares outstanding (million) Market value of debt net of cash (million) Sales (million) EBITDA (million) Net Income (million) Earnings growth in % EPS (pls compute) EV (pls compute) 4 2.1 24 12 30 18 8 6 0.7 5 4 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts