Question: Just answer C I already solved A and B, please help a girl out I only got 10min left please... Question 6 (20 points) Your

Just answer C I already solved A and B, please help a girl out I only got 10min left please...

Just answer C I already solved A and B, please help a girl out I only got 10min left please...

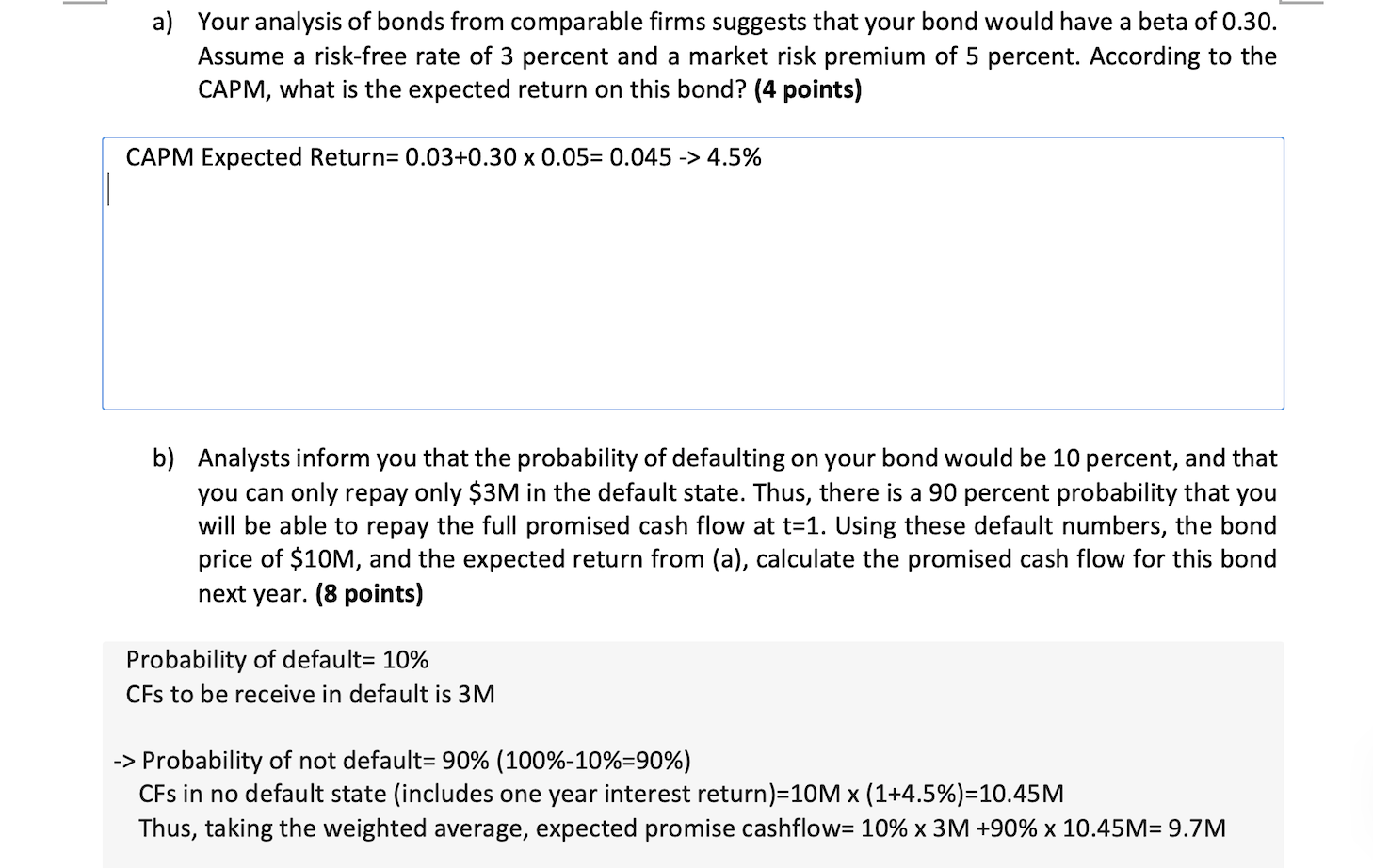

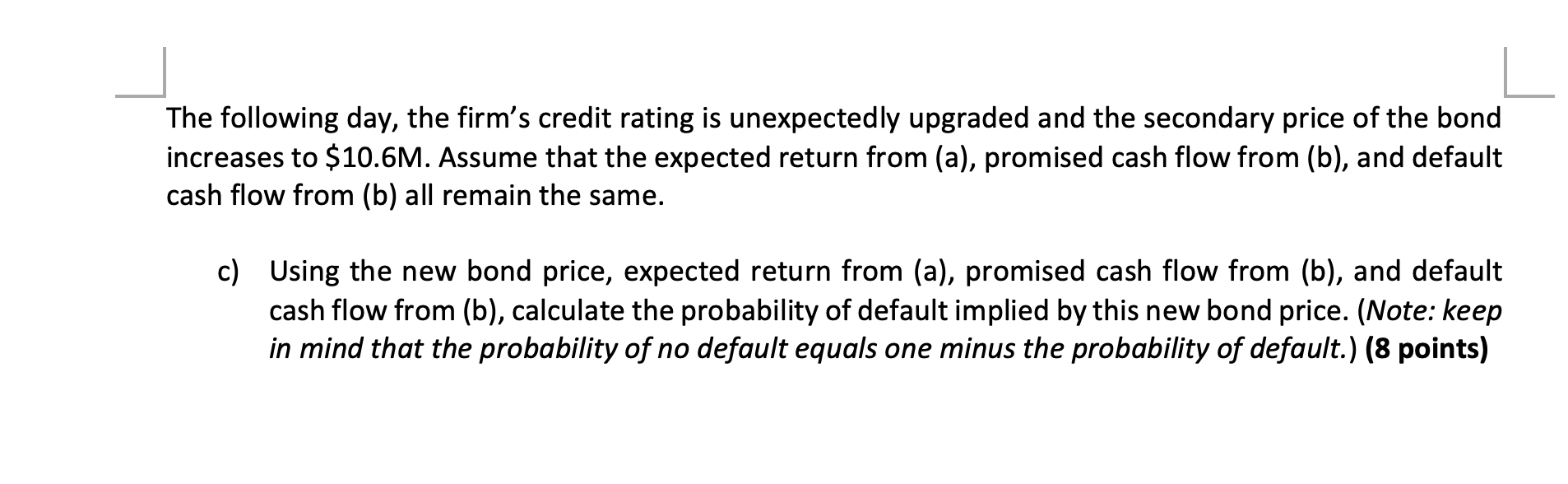

Question 6 (20 points) Your telecommunications firm is small but steadily growing. You have identified a profitable investment opportunity and need to raise $10M in cash to finance this investment. Your plan is to sell a single zero- coupon bond with a one-year maturity for $10M. You would first like to determine how much a potential lender will demand as promised repayment next year. a) Your analysis of bonds from comparable firms suggests that your bond would have a beta of 0.30. Assume a risk-free rate of 3 percent and a market risk premium of 5 percent. According to the CAPM, what is the expected return on this bond? (4 points) CAPM Expected Return=0.03+0.30 x 0.05= 0.045 -> 4.5% b) Analysts inform you that the probability of defaulting on your bond would be 10 percent, and that you can only repay only $3M in the default state. Thus, there is a 90 percent probability that you will be able to repay the full promised cash flow at t=1. Using these default numbers, the bond price of $10M, and the expected return from (a), calculate the promised cash flow for this bond next year. (8 points) Probability of default= 10% CFs to be receive in default is 3M -> Probability of not default= 90% (100%-10%=90%) CFs in no default state (includes one year interest return)=10M X (1+4.5%)=10.45M Thus, taking the weighted average, expected promise cashflow= 10% x 3M +90% x 10.45M=9.7M The following day, the firm's credit rating is unexpectedly upgraded and the secondary price of the bond increases to $10.6M. Assume that the expected return from (a), promised cash flow from (b), and default cash flow from (b) all remain the same. c) Using the new bond price, expected return from (a), promised cash flow from (b), and default cash flow from (b), calculate the probability of default implied by this new bond price. (Note: keep in mind that the probability of no default equals one minus the probability of default.) (8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts