Question: ***JUST ANSWER QUESTION 2*** ***JUST ANSWER QUESTION 2*** Answer to Question 1: Reliable: Holding cost $ 1,250.00 Material cost $ 26,000,000.00 Cycle inventory 50 Annual

***JUST ANSWER QUESTION 2***

***JUST ANSWER QUESTION 2***

Answer to Question 1:

Reliable:

| Holding cost | $ 1,250.00 |

| Material cost | $ 26,000,000.00 |

| Cycle inventory | 50 |

| Annual holding cost | $ 62,500.00 |

| SDlead | 50.99019514 |

| Safey Stock (SS) | 83.87140741 |

| Material cost of SS | $ 419,357.04 |

| Annual holding cost of SS | $ 104,839.26 |

| Total Cost | $ 26,586,696.30 |

Value Electric:

| Holding cost | $ 1,200.00 |

| Material cost | $ 24,960,000.00 |

| Cycle inventory | 500 |

| Annual holding cost | $ 600,000.00 |

| SDlead | 415.3311931 |

| Safety Stock (SS) | 683.1590194 |

| Material cost of SS | $ 3,279,163.29 |

| Annual holding cost of SS | $ 819,790.82 |

| Total Cost | $ 29,658,954.12 |

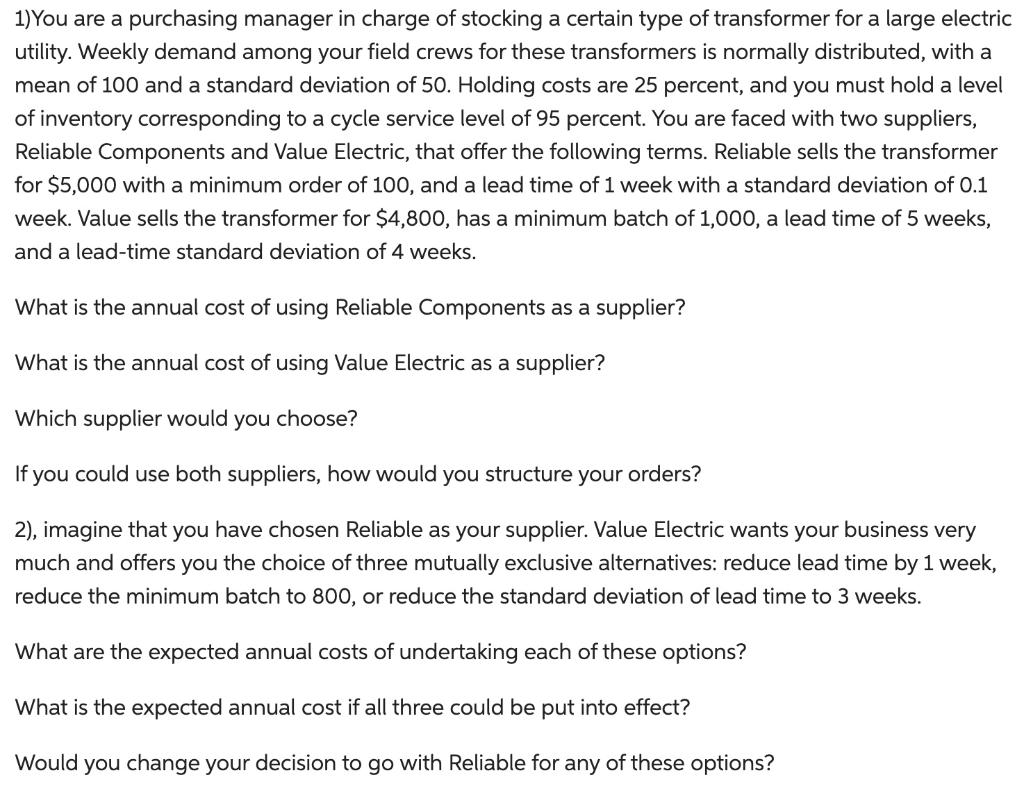

1)You are a purchasing manager in charge of stocking a certain type of transformer for a large electric utility. Weekly demand among your field crews for these transformers is normally distributed, with a mean of 100 and a standard deviation of 50 . Holding costs are 25 percent, and you must hold a level of inventory corresponding to a cycle service level of 95 percent. You are faced with two suppliers, Reliable Components and Value Electric, that offer the following terms. Reliable sells the transformer for $5,000 with a minimum order of 100 , and a lead time of 1 week with a standard deviation of 0.1 week. Value sells the transformer for $4,800, has a minimum batch of 1,000 , a lead time of 5 weeks, and a lead-time standard deviation of 4 weeks. What is the annual cost of using Reliable Components as a supplier? What is the annual cost of using Value Electric as a supplier? Which supplier would you choose? If you could use both suppliers, how would you structure your orders? 2), imagine that you have chosen Reliable as your supplier. Value Electric wants your business very much and offers you the choice of three mutually exclusive alternatives: reduce lead time by 1 week, reduce the minimum batch to 800 , or reduce the standard deviation of lead time to 3 weeks. What are the expected annual costs of undertaking each of these options? What is the expected annual cost if all three could be put into effect? Would you change your decision to go with Reliable for any of these options? 1)You are a purchasing manager in charge of stocking a certain type of transformer for a large electric utility. Weekly demand among your field crews for these transformers is normally distributed, with a mean of 100 and a standard deviation of 50 . Holding costs are 25 percent, and you must hold a level of inventory corresponding to a cycle service level of 95 percent. You are faced with two suppliers, Reliable Components and Value Electric, that offer the following terms. Reliable sells the transformer for $5,000 with a minimum order of 100 , and a lead time of 1 week with a standard deviation of 0.1 week. Value sells the transformer for $4,800, has a minimum batch of 1,000 , a lead time of 5 weeks, and a lead-time standard deviation of 4 weeks. What is the annual cost of using Reliable Components as a supplier? What is the annual cost of using Value Electric as a supplier? Which supplier would you choose? If you could use both suppliers, how would you structure your orders? 2), imagine that you have chosen Reliable as your supplier. Value Electric wants your business very much and offers you the choice of three mutually exclusive alternatives: reduce lead time by 1 week, reduce the minimum batch to 800 , or reduce the standard deviation of lead time to 3 weeks. What are the expected annual costs of undertaking each of these options? What is the expected annual cost if all three could be put into effect? Would you change your decision to go with Reliable for any of these options

Step by Step Solution

There are 3 Steps involved in it

To determine the expected annual costs of the given options we need to calculate the cost impact of ... View full answer

Get step-by-step solutions from verified subject matter experts