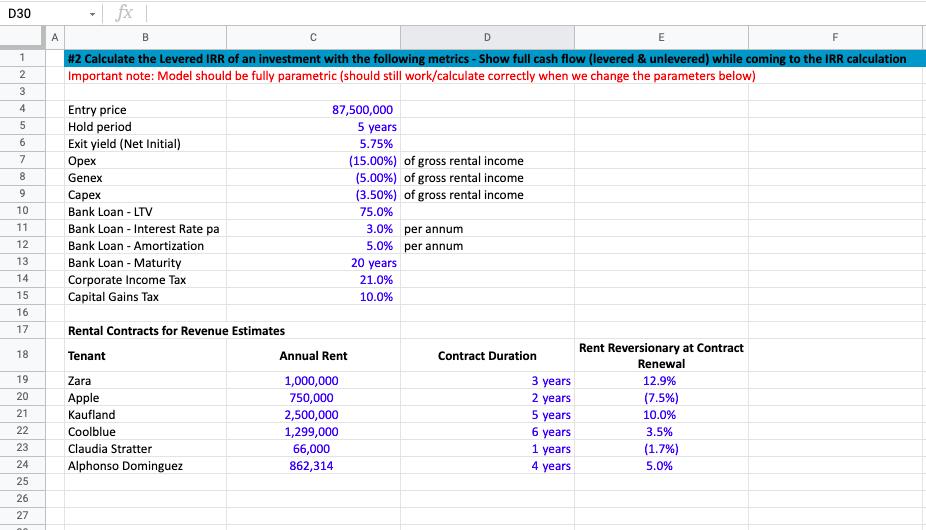

Question: Calculate the Levered IRR of an investment with the following metrics - | fx | D30 A B D F #2 Calculate the Levered IRR

Calculate the Levered IRR of an investment with the following metrics

- | fx | D30 A B D F #2 Calculate the Levered IRR of an investment with the following metrics - Show full cash flow (levered & unlevered) while coming to the IRR calculation Important note: Model should be fully parametric (should still work/calculate correctly when we change the parameters below) 1. 3. 4 Entry price Hold period 87,500,000 5 years 5.75% 6. Exit yield (Net Initial) (15.00%) of gross rental income (5.00%) of gross rental income (3.50%) of gross rental income 8. Genex 9. 10 Bank Loan - LTV 75.0% 11 Bank Loan - Interest Rate pa 3.0% per annum 12 Bank Loan - Amortization 5.0% per annum 13 Bank Loan - Maturity 20 years 14 Corporate Income Tax Capital Gains Tax 21.0% 15 10.0% 16 17 Rental Contracts for Revenue Estimates Rent Reversionary at Contract Renewal 18 Tenant Annual Rent Contract Duration 19 Zara 1,000,000 3 years 12.9% 20 Apple 750,000 (7.5%) 2 years 5 years 6 years 1 years 21 Kaufland 2,500,000 10.0% 22 Coolblue 1,299,000 3.5% 23 Claudia Stratter 66,000 (1.7%) 24 Alphonso Dominguez 862,314 4 years 5.0% 25 26 27

Step by Step Solution

There are 3 Steps involved in it

Unlevered free cash flows EBIT 1tax rate CAPEX add depreciation change in Working ... View full answer

Get step-by-step solutions from verified subject matter experts