Question: just do problem 2 and 3 Problem 1. (3 points) Two alternatives have been proposed to pretreat the waste acid stream from the rylates Unit

just do problem 2 and 3

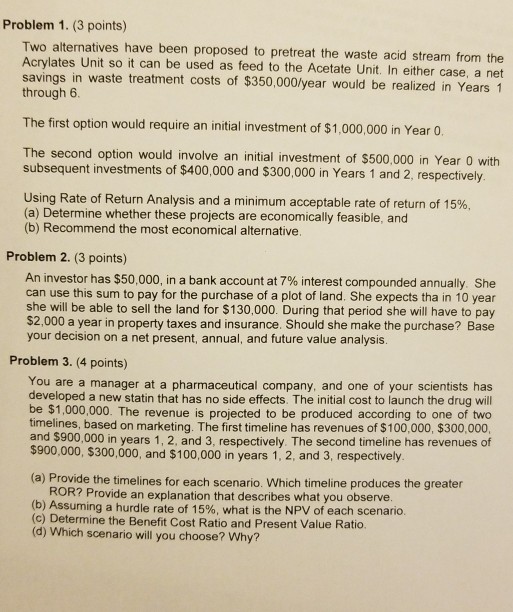

Problem 1. (3 points) Two alternatives have been proposed to pretreat the waste acid stream from the rylates Unit so it can be used as feed to the Acetate Unit. In either case, a net savings in waste treatment costs of $350,000lyear would be realized in Years1 through 6 The first option would require an initial investment of $1,000,000 in Year 0 The second option would involve an initial investment of $500,000 in Year 0 with subsequent investments of $400,000 and $300,000 in Years 1 and 2, respectively using Rate of Return Analysis and a minimum acceptable rate of return of 15% (a) Determine whether these projects are economically feasible, a (b) Recommend the most economical alternative Problem 2. (3 points) An investor has $50,000, in a bank account at 7% interest compounded annually. She can use this sum to pay for the purchase of a plot of land. She expects tha in 10 year she will be able to sell the land for $130,000. During that period she will have to pay $2,000 a year in property taxes and insurance. Should she make the purchase? Base your decision on a net present, annual, and future value analysis. Problem 3. (4 points) ou are a manager at a pharmaceutical company, and one of your scientists has eveloped a new statin that has no side effects. The initial cost to launch the drug will be $1,00 0,000. The revenue is projected to be produced according to one of two timelines, based on marketing. The first timeline has revenues of $100,000, $300,000 and $800.00 $900,000, $300,000, and $100,000 in years 1, 2, and 3, respectively 0 in years 1, 2, and 3, respectively. The second timeline has revenues of (a) Provide the timelines for each scenario. Which timeline produces the greater ROR? Provide an explanation that describes what you observe. (b) Assuming a hurdle rate of 15% (c) Determine the Benefit Cost Ratio and Present Value Ratio (d) Which scenario will you choose? Why? , what is the NPV of each scenario

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts