Question: just do the second question i included the first one You have been hired as a Financial Analyst for hip-hop artist, Jay-T. Select financial information

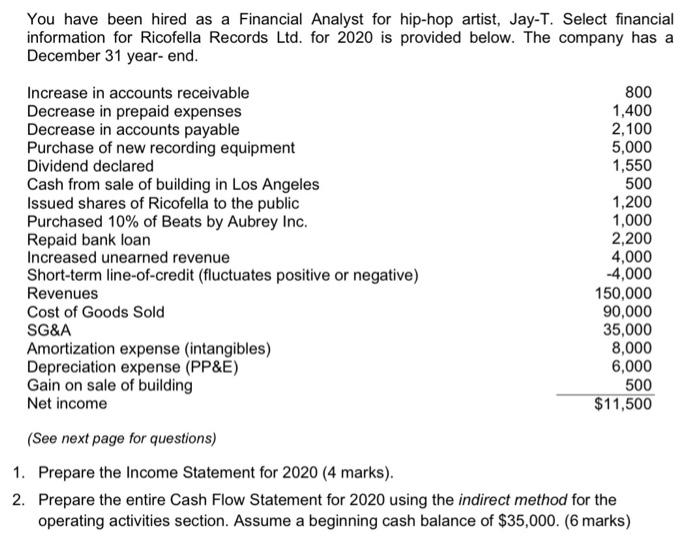

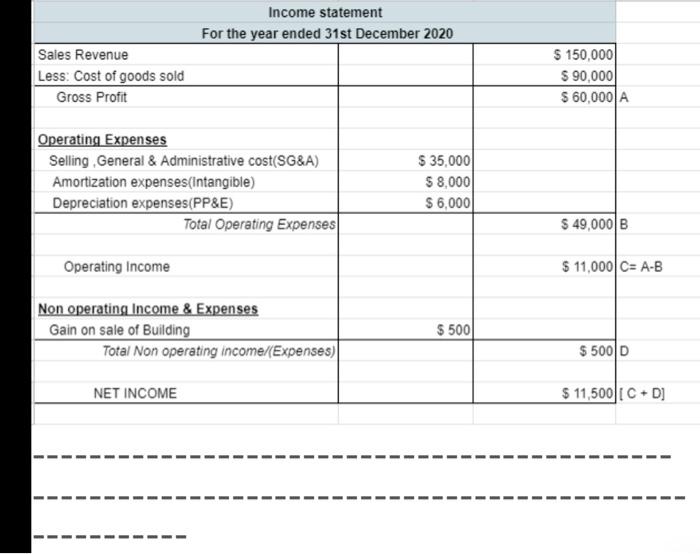

You have been hired as a Financial Analyst for hip-hop artist, Jay-T. Select financial information for Ricofella Records Ltd. for 2020 is provided below. The company has a December 31 year-end. Increase in accounts receivable 800 Decrease in prepaid expenses 1,400 Decrease in accounts payable 2,100 Purchase of new recording equipment 5,000 Dividend declared 1,550 Cash from sale of building in Los Angeles 500 Issued shares of Ricofella to the public 1,200 Purchased 10% of Beats by Aubrey Inc. 1,000 Repaid bank loan 2,200 Increased unearned revenue 4,000 Short-term line-of-credit (fluctuates positive or negative) -4,000 Revenues 150,000 Cost of Goods Sold 90,000 SG&A 35,000 Amortization expense intangibles) 8,000 Depreciation expense (PP&E) 6,000 Gain on sale of building 500 Net income $11,500 (See next page for questions) 1. Prepare the Income Statement for 2020 (4 marks). 2. Prepare the entire Cash Flow Statement for 2020 using the indirect method for the operating activities section. Assume a beginning cash balance of $35,000. (6 marks) Income statement For the year ended 31st December 2020 Sales Revenue Less: Cost of goods sold Gross Profit $ 150,000 $ 90,000 $ 60,000 A Operating Expenses Selling, General & Administrative cost(SG&A) Amortization expenses(Intangible) Depreciation expenses(PP&E) Total Operating Expenses $ 35,000 $ 8,000 $ 6,000 $ 49,000 B Operating Income $ 11,000 C= A-B Non operating Income & Expenses Gain on sale of Building Total Non operating income (Expenses) $ 500 $ 500 D NET INCOME $ 11,5001 C +D]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts