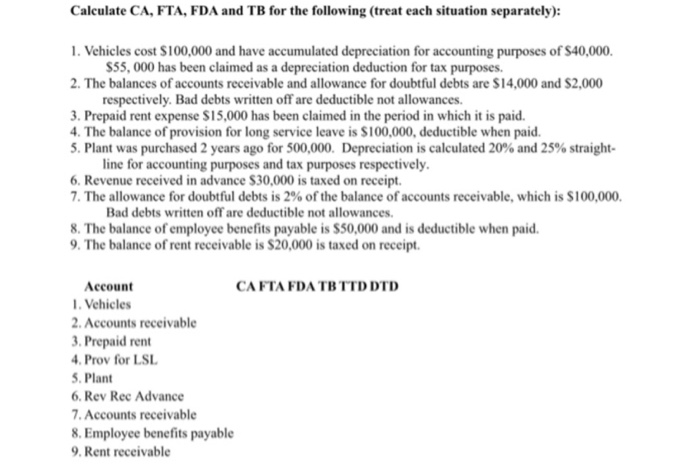

Question: Just for the plant section please. Please write down explaination(eg.why is this amount) and formulas Calculate CA, FTA, FDA and TB for the following (treat

Calculate CA, FTA, FDA and TB for the following (treat each situation separately): 1. Vehicles cost S100,000 and have accumulated depreciation for accounting purposes of S40,000. S55,000 has been claimed as a depreciation deduction for tax purposes. 2. The balances of accounts receivable and allowance for doubtful debts areSI4,000 and S2,000 respectively. Bad debts written off are deductible not allowances. 3. Prepaid rent expense S15,000 has been claimed in the period in which it is paid. 4. The balance of provision for long service leave is S100,000, deductible when paid. 5. Plant was purchased 2 years ago for 500,000. Depreciation is calculated 20% and 25% straight- line for accounting purposes and tax purposes respectively. 6. Revenue received in advance S30,000 is taxed on receipt. 7. The allowance for doubtful debts is 2% of the balance of accounts receivable, which is S100,000. Bad debts written off are deductible not allowances. 8. The balance of employee benefits payable is S50,000 and is deductible when paid. 9. The balance of rent receivable is S20,000 is taxed on receipt. Account CAFTA, FDA TBTTD DTD 1,Vehicles 2 Accounts receivable 3. Prepaid rent 4, Prov for LSL 5. Plant 6. Rev Rec Advance 7,Accounts receivable 8. Employee benefits payable 9, Rent receivable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts