Question: just give me the answer no need to explain how you got it Jiminy's Cricket Farm issued a 25-year, 5.5 percent semiannual bond 4 years

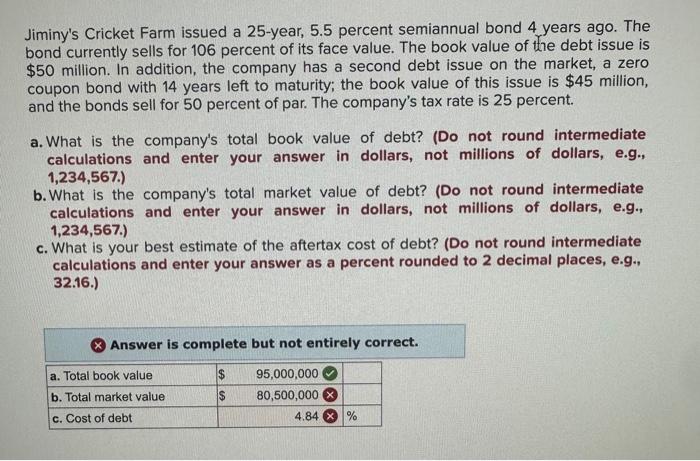

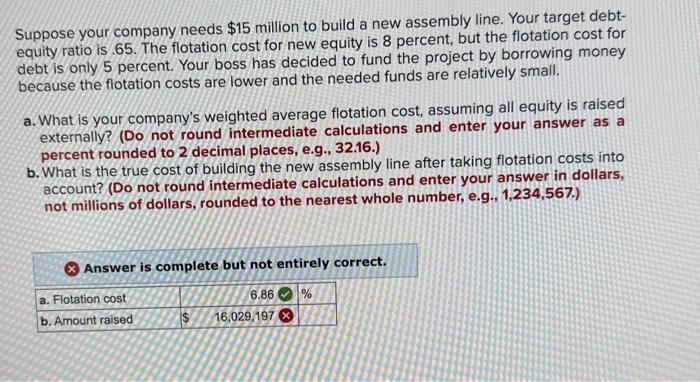

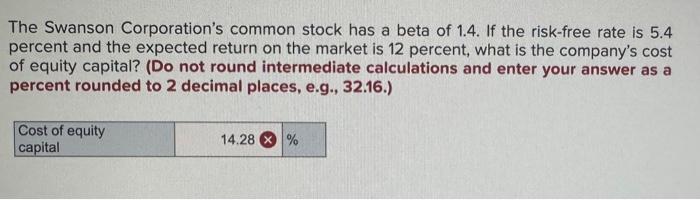

Jiminy's Cricket Farm issued a 25-year, 5.5 percent semiannual bond 4 years ago. The bond currently sells for 106 percent of its face value. The book value of the debt issue is $50 million. In addition, the company has a second debt issue on the market, a zero coupon bond with 14 years left to maturity; the book value of this issue is $45 million, and the bonds sell for 50 percent of par. The company's tax rate is 25 percent. a. What is the company's total book value of debt? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) b. What is the company's total market value of debt? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567. c. What is your best estimate of the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Suppose your company needs $15 million to build a new assembly line. Your target debtequity ratio is 65 . The flotation cost for new equity is 8 percent, but the flotation cost for debt is only 5 percent. Your boss has decided to fund the project by borrowing money because the flotation costs are lower and the needed funds are relatively small. a. What is your company's weighted average flotation cost, assuming all equity is raised externally? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the true cost of building the new assembly line after taking flotation costs into account? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g.. 1,234,567.) Answer is complete but not entirely correct. The Swanson Corporation's common stock has a beta of 1.4 . If the risk-free rate is 5.4 percent and the expected return on the market is 12 percent, what is the company's cost of equity capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts