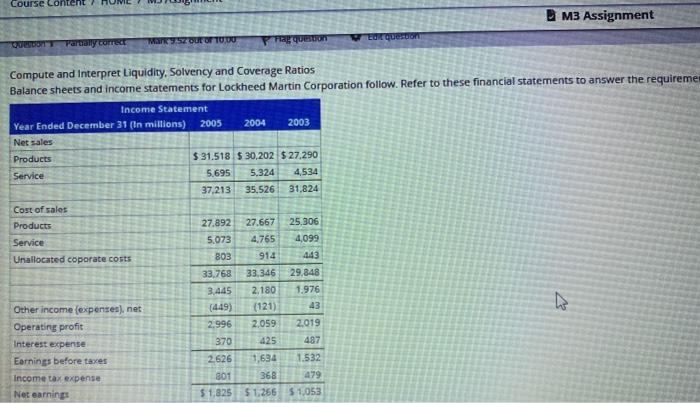

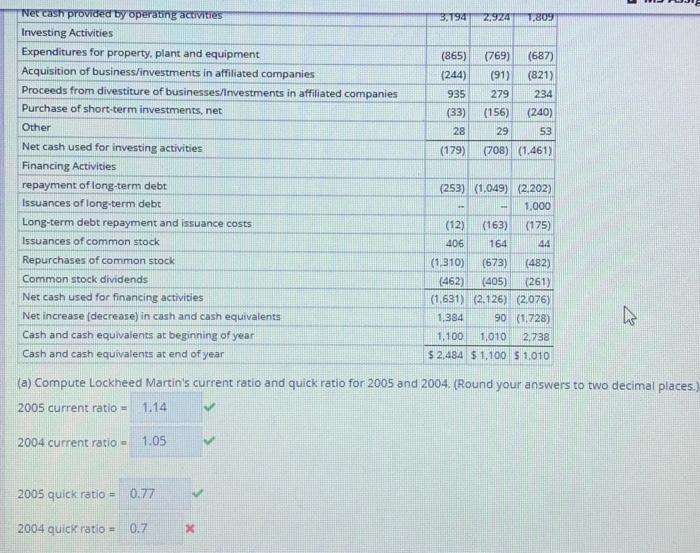

Question: Just need 2004 quick ratio please! thank you! Compute and Interpret Liquidity, Solvency and Coverage Ratios Balance sheets and incorne statements for Lockheed Martin Corporation

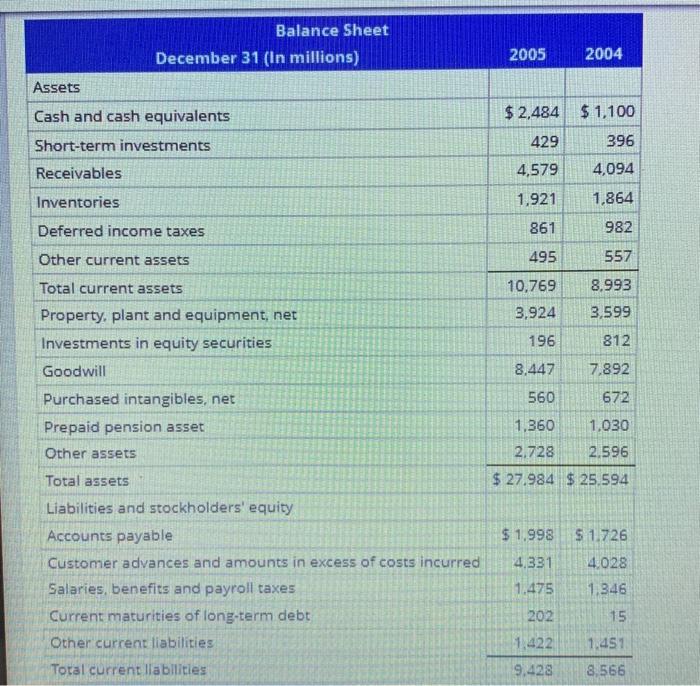

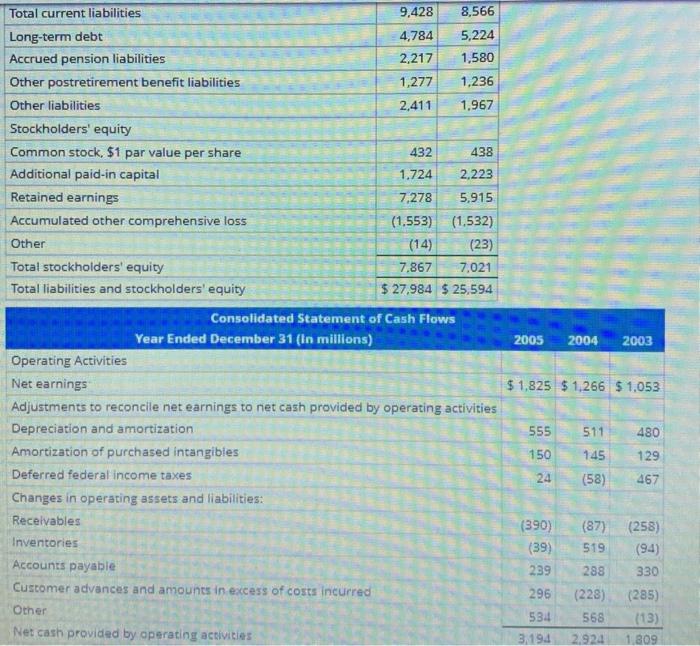

Compute and Interpret Liquidity, Solvency and Coverage Ratios Balance sheets and incorne statements for Lockheed Martin Corporation follow. Refer to these financial statements to answer the requireme \begin{tabular}{|l|r|r|} \hline Total current liabilities & 9,428 & 8,566 \\ \hline Long-term debt & 4,784 & 5,224 \\ \hline Accrued pension liabilities & 2,217 & 1,580 \\ \hline Other postretirement benefit liabilities & 1,277 & 1,236 \\ \hline Other liabilities & 2,411 & 1,967 \\ \hline Stockholders' equity & & \\ \hline Common stock, $1 par value per share & 432 & 438 \\ \hline Additional paid-in capital & 1,724 & 2,223 \\ \hline Retained earnings & 7,278 & 5,915 \\ \hline Accumulated other comprehensive loss & (1,553) & (1,532) \\ \hline Other & (14) & (23) \\ \hline Total stockholders' equity & $27,967 & 7,021 \\ \hline Total liabilities and stockholders' equity & $25,594 \\ \hline \end{tabular} (a) Compute Lockheed Martin's current ratio and quick ratio for 2005 and 2004 . (Round your answers to two decimal places.) 2005 current ratio = 2004 current ratio = 2005 quick ratio = 2004 quiek ratio =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts