Question: Just need answers for Quetion 2 Part A and B please 1 Portfolio Allocation Consider a portfolio allocation problem that is a special case of

Just need answers for Quetion 2 Part A and B please

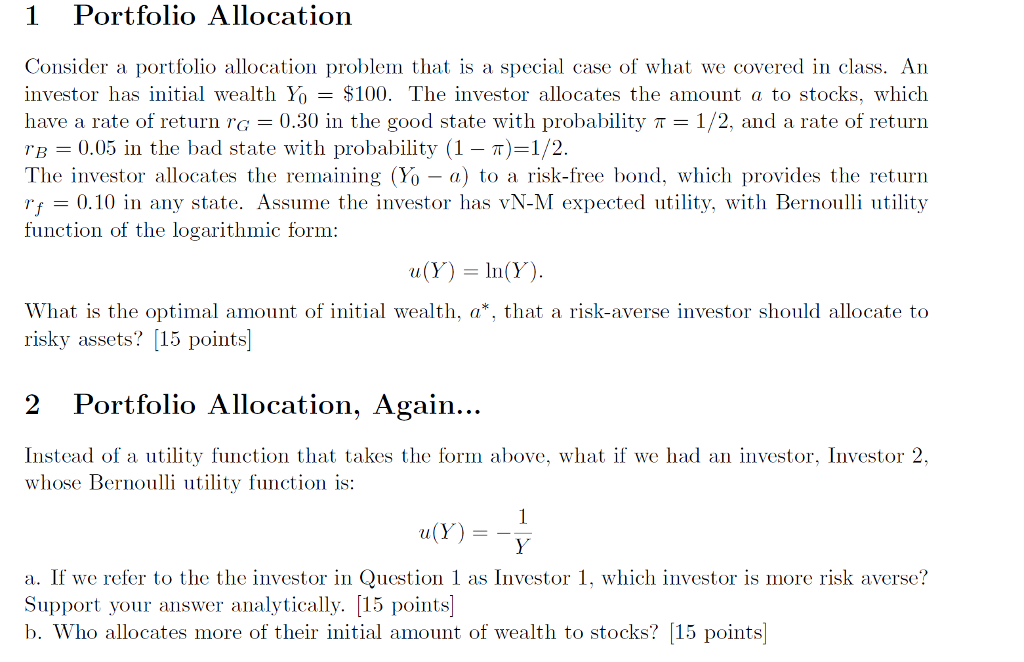

1 Portfolio Allocation Consider a portfolio allocation problem that is a special case of what we covered in class. An investor has initial wealth Yo- $100. The investor allocates the amount a to stocks, which have a rate of return r0.30 in the good state with probability T-1/2, and a rate of return rB 0.05 in the bad state with probability (1-)-1/2. The investor allocates the remaining (Yo -a) to a risk-free bond, which provides the return rf 0.10 in any state. Assume the investor has vN-M expected utility, with Bernoulli utility function of the logarithmic form: a(Y) = ln(Y). What is the optimal amount of initial wealth, a*, that a risk-averse investor should allocate to risky assets? [15 points] 2 Portfolio Allocation, Again. Instead of a utility function that takes the form above, what if we had an investor, Investor 2, whose Bernoulli utility function is: a(Y) = T a. If we refer to the the investor in Question 1 as Investor 1, which investor is more risk averse? Support your answer analytically. 15 points b. Who allocates more of their initial amount of wealth to stocks? 15 points 1 Portfolio Allocation Consider a portfolio allocation problem that is a special case of what we covered in class. An investor has initial wealth Yo- $100. The investor allocates the amount a to stocks, which have a rate of return r0.30 in the good state with probability T-1/2, and a rate of return rB 0.05 in the bad state with probability (1-)-1/2. The investor allocates the remaining (Yo -a) to a risk-free bond, which provides the return rf 0.10 in any state. Assume the investor has vN-M expected utility, with Bernoulli utility function of the logarithmic form: a(Y) = ln(Y). What is the optimal amount of initial wealth, a*, that a risk-averse investor should allocate to risky assets? [15 points] 2 Portfolio Allocation, Again. Instead of a utility function that takes the form above, what if we had an investor, Investor 2, whose Bernoulli utility function is: a(Y) = T a. If we refer to the the investor in Question 1 as Investor 1, which investor is more risk averse? Support your answer analytically. 15 points b. Who allocates more of their initial amount of wealth to stocks? 15 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts