Question: just need assistance with question 3 just need help with #3. here's what i got also for 1&2 for a reference. Question 2: Initrode Inc

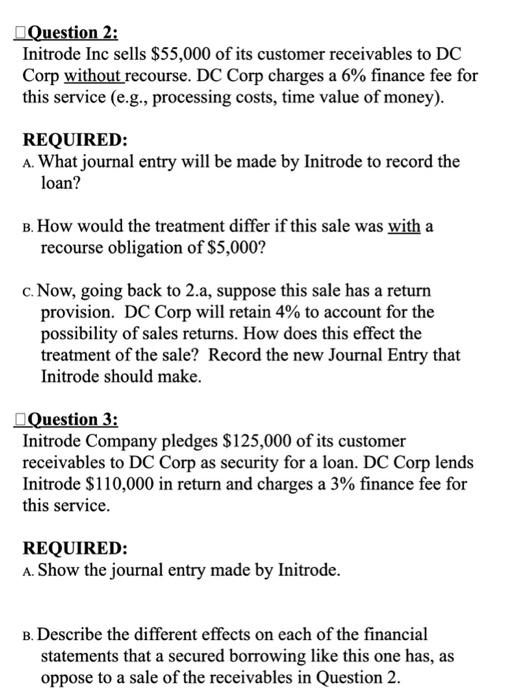

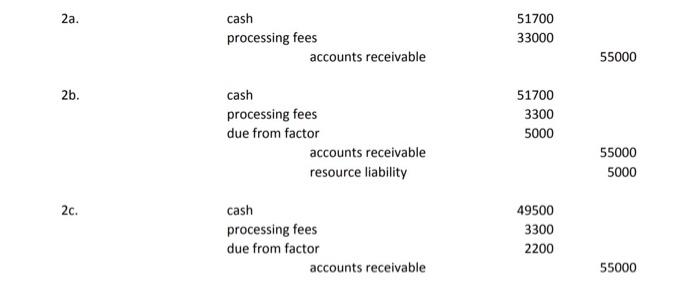

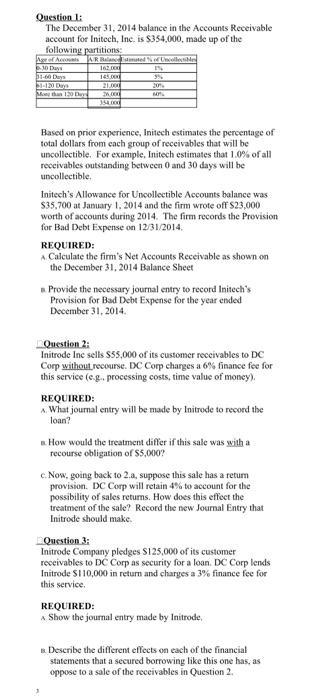

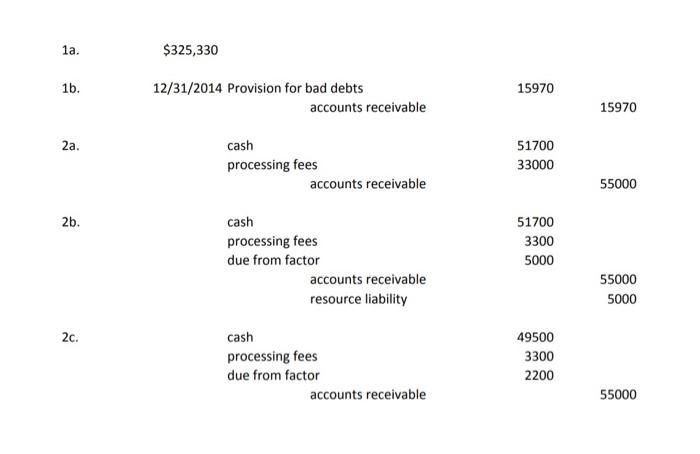

Question 2: Initrode Inc sells $55,000 of its customer receivables to DC Corp without recourse. DC Corp charges a 6% finance fee for this service (e.g., processing costs, time value of money). REQUIRED: A. What journal entry will be made by Initrode to record the loan? . How would the treatment differ if this sale was with a recourse obligation of $5,000 ? c. Now, going back to 2 .a, suppose this sale has a return provision. DC Corp will retain 4% to account for the possibility of sales returns. How does this effect the treatment of the sale? Record the new Journal Entry that Initrode should make. Question 3: Initrode Company pledges $125,000 of its customer receivables to DC Corp as security for a loan. DC Corp lends Initrode $110,000 in return and charges a 3% finance fee for this service. REQUIRED: A. Show the journal entry made by Initrode. . Describe the different effects on each of the financial statements that a secured borrowing like this one has, as oppose to a sale of the receivables in Question 2. 2a. 2b. processingfeesduefromfactoraccountsreceivable5170033005000550005000 2c. cashprocessingfeesduefromfactor4950033002200 accounts receivable 55000 Question L: The December 31, 2014 balance in the Accounts Receivable account for Initech, Inc. is $354,000, made up of the followino mertitione Based on prior experience, Initech estimates the percentage of total dollars from each group of receivables that will be uncollectible. For example, Initech estimates that 1.0% of all receivables outstanding between 0 and 30 days will be uncollectible. Initech's Allowance for Uncollectible Accounts balance was $35,700 at Jasuary 1, 2014 and the firm wrote off $23,000 worth of accounts during 2014. The firm records the Provision for Bad Debt Expense on 12/31/2014. REQUIRED: A. Calculate the firm's Net Accounts Receivable as shown on the December 31, 2014 Balance Sheet a Provide the necessary journal entry to record lnitech's Provision for Bad Debe Expense for the year ended December 31, 2014. Questien 2. Initrode Ine sells $55,000 of its customer receivables to DC Corp without recourse. DC Corp charges a 6% finance foe for this service (e.g. processing costs, time value of moncy). REQUIRED: A. What joumal entry will be made by lnitrode to record the loan? E. How would the treatment differ if this sale was with a recourse obligation of $5,000 ? c. Now, going back to 2.a, suppose this sale has a retum provision. DC Corp will retain 4% to account for the possibility of sales retums. How does this effect the treatment of the sale? Record the new Joumal Entry that Initrode should make. Qacstion 3: Initrode Company pledges $125,000 of its customer reseivables to DC Corp as security for a loan. DC Corp lends Initrode $110,000 in return and charges a 3% finance fee for this service. REQUIRED: \& Show the journal entry made by Initrode, B Deseribe the differen effects on each of the financial statements that a secured borrowing like this one has, as oppose to a sale of the receivables in Question 2. 1a. $325,330 1b. 12/31/2014 Provision for bad debts 15970 accounts receivable 15970 2a. cashprocessingfeesaccountsreceivable517003300055000 2b. processingfeesduefromfactoraccountsreceivable5170033005000550005000 2c. cashprocessingfeesduefromfactor4950033002200 accounts receivable 55000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts