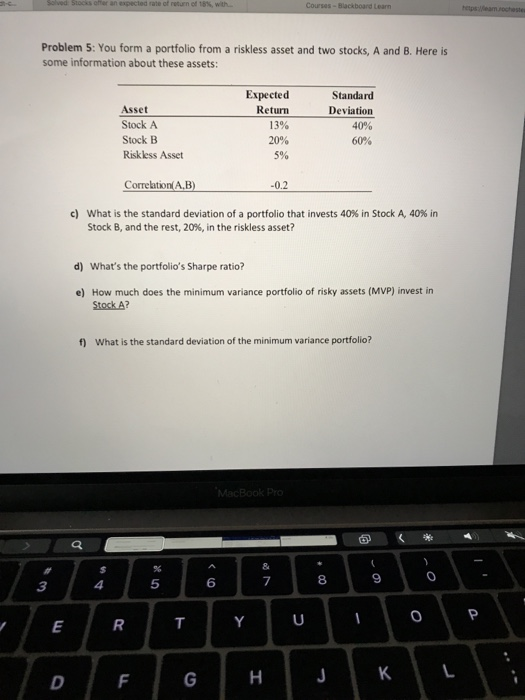

Question: Just need e and f Problem 5: You form a portfolio from a riskless asset and two stocks, A and B. Here is some information

Problem 5: You form a portfolio from a riskless asset and two stocks, A and B. Here is some information about these assets: Expected Return 13% 20% 5% Standard Deviation Asset Stock A Stock B Riskless Asset CorrelationA,B) -0.2 c) what is the standard deviation of a portfolio that invests 40% in Stock A, 40% in Stock B, and the rest, 20%, in the riskless asset? d) What's the portfolio's Sharpe ratio? e) How much does the minimum variance portfolio of risky assets (MVP) invest in Stock A? f) What is the standard deviation of the minimum variance portfolio? 5 6 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts