Question: just need help answering question #5 and #6 ... CASE 12-2 BARCLAYS BONUS BANK: ROBBING PETER TO PAY PAUL Barclays is a London-based multinational banking

just need help answering question #5 and #6

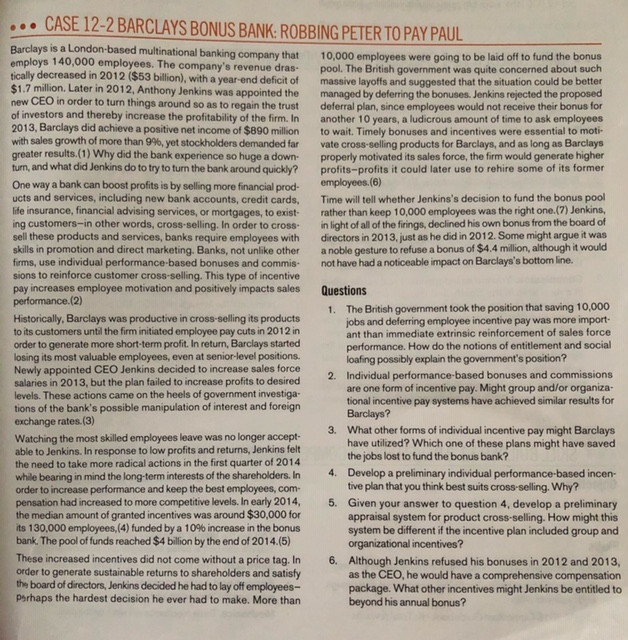

... CASE 12-2 BARCLAYS BONUS BANK: ROBBING PETER TO PAY PAUL Barclays is a London-based multinational banking company that 10.000 employees were going to be laid off to fund the bonus employs 140,000 employees. The company's revenue dras- pool. The British government was quite concerned about such tically decreased in 2012 ($53 billion), with a year-end deficit of massive layoffs and suggested that the situation could be better $1.7 million. Later in 2012, Anthony Jenkins was appointed the managed by deferring the bonuses. Jenkins rejected the proposed new CEO in order to turn things around so as to regain the trust deferral plan, since employees would not receive their bonus for of investors and thereby increase the profitability of the firm. In another 10 years, a ludicrous amount of time to ask employees 2013, Barclays did achieve a positive net income of $890 million to wait. Timely bonuses and incentives were essential to moti- with sales growth of more than 99, yet stockholders demanded far vate cross-selling products for Barclays, and as long as Barclays greater results. (1) Why did the bank experience so huge a down properly motivated its sales force, the firm would generate higher turn, and what did Jenkins do to try to turn the bank around quickly? profits-profits it could later use to rehire some of its former One way a bank can boost profits is by selling more financial prod e mployees (6) ucts and services, including new bank accounts, credit cards. Time will tell whether Jenkins's decision to fund the bonus pool mesurance, Tinancial advising services, or mortgages, to exist rather than keep 10,000 employees was the right one.(7Jenkins ing customers-in other words, cross-selling. In order to cross in light of all of the firings, declined his own bonus from the board of sell these products and services, banks require employees with directors in 2013. just as he did in 2012. Some might argue it was skills in promotion and direct marketing, Banks, not unlike other a noble gesture to refuse a bonus of $4.4 million, although it would firms, use individual performance-based bonuses and commis not have had a noticeable impact on Barclays's bottom line, sions to reinforce customer cross-selling. This type of incentive pay increases employee motivation and positively impacts sales Questions performance.(2) 1. The British government took the position that saving 10,000 Historically, Barclays was productive in cross-selling its products jobs and deferring employee incentive pay was more import- to its customers until the firm initiated employee pay cuts in 2012 in ant than immediate extrinsic reinforcement of sales force order to generate more short-term profit. In return, Barclays started performance. How do the notions of entitlement and social losing its most valuable employees, even at senior level positions. loafing possibly explain the government's position? Newly appointed CEO Jenkins decided to increase sales force 2. Individual performance-based bonuses and commissions salaries in 2013, but the plan failed to increase profits to desired levels. These actions came on the heels of government investiga- are one form of incentive pay. Might group and/or organiza tional incentive pay systems have achieved similar results for tions of the bank's possible manipulation of interest and foreign Barclays? exchange rates.(3) 3. What other forms of individual incentive pay might Barclays Watching the most skilled employees leave was no longer accept have utilized? Which one of these plans might have saved able to Jenkins. In response to low profits and returns, Jenkins felt the jobs lost to fund the bonus bank? the need to take more radical actions in the first quarter of 2014 while bearing in mind the long-term interests of the shareholders. In 4. Develop a preliminary individual performance-based incen order to increase performance and keep the best employees, com tive plan that you think best suits cross-selling. Why? pensation had increased to more competitive levels. In early 2014, 5. Given your answer to question 4, develop a preliminary the median amount of granted incentives was around $30,000 for appraisal system for product cross-selling. How might this its 130,000 employees, (4) funded by a 10% increase in the bonus system be different if the incentive plan included group and bank. The pool of funds reached $4 billion by the end of 2014.(5) organizational incentives? These increased incentives did not come without a price tag. In 6. Although Jenkins refused his bonuses in 2012 and 2013, order to generate sustainable returns to shareholders and satisfy as the CEO, he would have a comprehensive compensation the board of directors, Jenkins decided he had to lay off employees- package. What other incentives might Jenkins be entitled to Perhaps the hardest decision he ever had to make. More than beyond his annual bonusStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock