Question: Use a resource based perspective base to explain the success of capitec bank? PART 2 CASE STUDY Peet Venter Absa's planned resurgence: Turbulence ahead for

Use a resource based perspective base to explain the success of capitec bank?

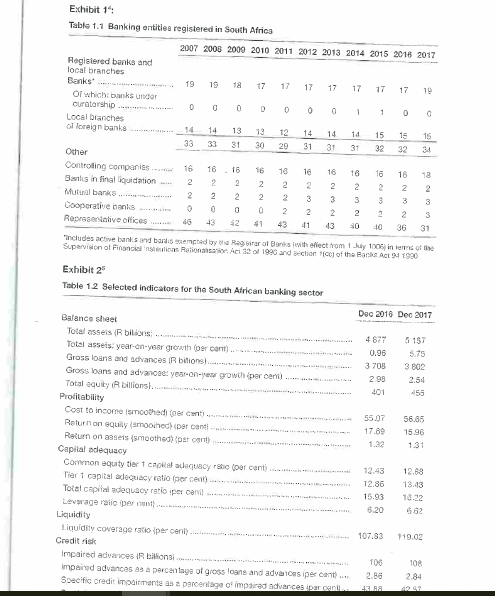

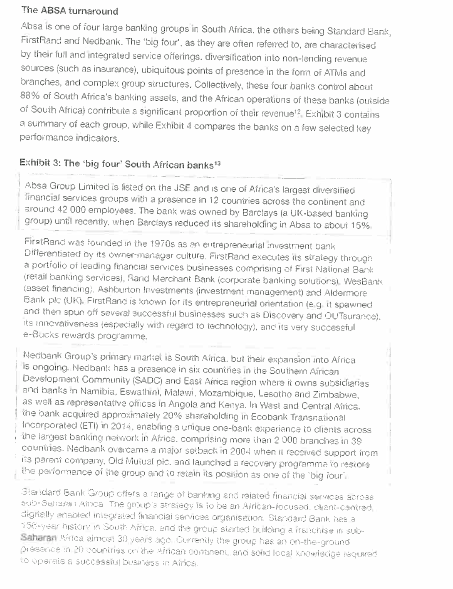

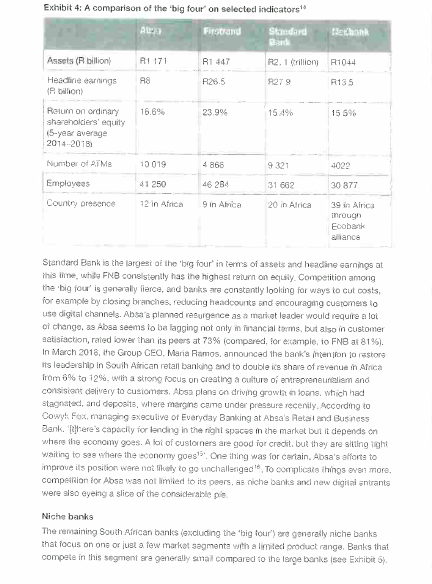

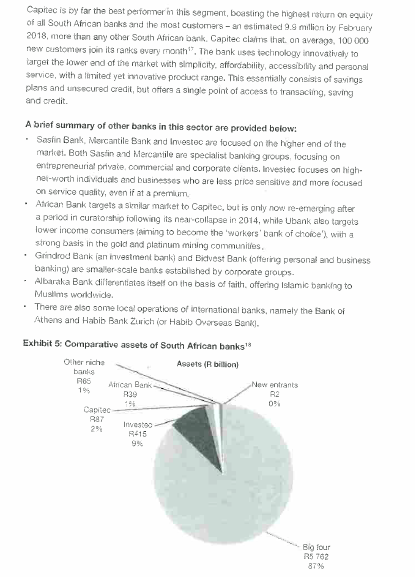

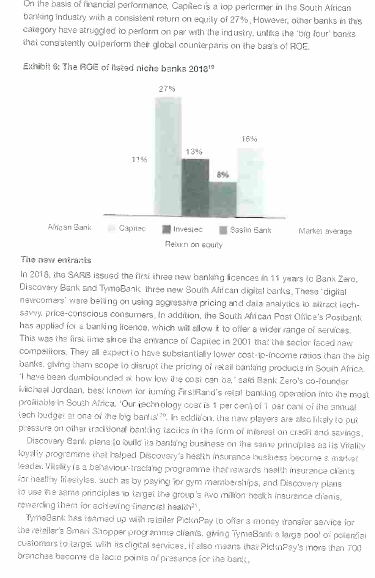

PART 2 CASE STUDY Peet Venter Absa's planned resurgence: Turbulence ahead for the South African retail banking industry? Background The fight for cominance of South Africa's retail-banking segment hots up. Absa, once the nation's biggest consumer lender is considering a change in tactics to boost revenue and to regain its former leadership in the retail-banking industry. In March 2018, the Group CEO Maria Ramos, announced the bank's intention to restore its leadership in South Airican retail banking and to double its share of revenue in Alrica from 8% to 12%. She also said the Group would begin to build a culture oi antrepreneurialism and consistent delivery to customers. However, regaining its position as market leader will not be easy. and the bank is facing a number of challenges. Overview of the South Airican banking industry Despite South Africa's status as a developing economy, it has a sophisticated and stable barking system, comparable to those of most developed countries. This, along with the advanced risk management practices applied by South Ainican banks, meant that, unlike in many other countries, no banking crisis occurred in South Airica after the 2008 global financial crisis Despite this stability, banks have faced a tough tow yoors, and things are starting to shake up as the South African Reserve Bank (SARB) has issued its first banking licences for new entrants in 11 years. In 2017, there were 19 registered South African banks, and a number of other national and international players in the industry. However, as reported by the SARB (300 Exhibit 1, this number has been very stable over the lasi decade, and the lasi tienes ne banking licence was issued was when Capliec entered the industry in 2001 Although there has been some stability in the sector, the average cosito income ratio of banks has risen steadily, while return on equity has been decining at a similar pace. This suggests a relative increase in the average cosi base of banks (see Exhibit 2) most likely due to the challenging conditions currently facing South African banks The banking sector is particularly vulnerable to low economic growth, and the slump in South Africa's GDP has resulted in banking revenues growing at their slowest rate since the global financial crisis. Plummeting oil and commodity prices in 2014 and 2015 have sent various commodity-dependent sectors into turmoil, from which they have been slow to recover. As a result of poor economic conditions, lending fell across the board, while samnings remained stagnant. Another result of these tough conclitions is that advances grew at a higher rate than deposits, prompting banks to raise interest rates in order to ensure revenues 1 co 14 Exhibit 1": Table 1.1 Banking antities registered in South Africa 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Registered banks and local branches 19 19 17 17 17 17 17 17 19 of which banks under curatarship... 0 D 0 0 1 D Local branches of foreign banks 14 13 12 14 14 15 15 15 33 33 31 30 29 31 31 31 32 32 34 Other Controlling companies 16 16 16 16 18 1e 16 16 16 16 18 Banks in finaliquidation 2 2 2 2 2 2 2 2 2 Mutual banks 2 2 2 2 3 3 3 3 3 Cooperative banks 0 0 0 2 2 2 2 2 2 3 Representative offices 46 43 41 43 41 43 30 40 36 31 includes active banks and banlis empted by the Registrar of Banks with effect from 1 July 1005) in lens of the Supervision of Financial Rational Act 32 of 1990 and chance of the Bank Act 1990 Exhibit 26 Table 12 Selected indicators for the South African banking sector Dec 2016 Dec 2017 4877 0.96 6 157 5.75 3708 2 98 401 2.54 -455 55.07 17.69 56.85 1596 131 Balance sheet Total assets IR bilions Total assets year-cn-year growth cont Gross loans and advances IR bilions! Gross loans and advancee year-en-yes growth percent Total quity billions Profitability Cost to income smootheder Return on equily smooche per cent Return on anses smoothed) per con Capital adequacy Common equity tier chokladequacy (per canti Tier 1 capital adequacy ratio force Total capital adequacy ratio percent Leverage ratio per Liquidity Liquidity coverage ratio per cent Credit risk Impaired advances i billions impaired advances as a percentage of gross loans and advances per conti Specific credit indiments as parcentage of implicaddvarcas para 12.68 12.43 12.86 15.93 13:43 18.22 6.62 107.83 119.02 TOG 2.88 108 2.84 1202 538 Part Things are not looking up as the financial sector is facing global challenges of digital disruption and other threatening regulatory restrictions aiming to counter the rise in cyber-attacks. Just as banks were starting to get to grips with the Financial intelligence Centre Act 38 of 2001 (FICAM and the National Consumer Protection Act, they had to consider the impact of General Data Protection Regulation (GDPR) and the Protection of Personal Information (POPIA on their operations and systems. In addition banks are preparing for the implementation of the Bass IV package, which is focused on reducing the variability of risk-weighted assets and enhancing the credibility of the risk-based regulatory capital iramework for banks' by 2022 Note: This iable presents an overview of the financial and risk information, compiled by mans of ine aggregation of data submitted during 2016 and 2017 from individual South African-registered banks including domestic branches of international banks but exclucing offshore branches and subsidiaries of Souih African banks, mutual banks and cooperative banks. Information represents aggregated bank-sola Information Smoothed refers to calculations based on a 12-monch moving average. Iniormation is subject to change without notice Banking sector dale is available at http://www.resbank.co.za (refer to Prudential Authority link! The South Adrian Reserve Bank The SARS is the oversear of the banking industry, ensuring that banks adhere to their strict licensing requirements. Despite its cantral role in monetary policy, the SARS is not owned by the government but privately owned by about 650 shareholders. The functions oi the SARS include inter alia! Formutaling and implementing South African monetary policy Managing the money supply, for example by issuing banknoras and coin Supervising the Souih Ainican banking system Ensuring the aifective functioning of the national payment system (NPS) Managing the country's oficial gold and foreign exchange reserves Acling as bancario the govemman Administering the country's loraign exchange and ching as lender oilasi rason in exceptional circumstances Rocenily.calls from within the ruling party to nationalise the SARS a va resulted in s national desie, with soms com manilors claiming at the marginal loss of transparency due to the loss of private shareholding could increase is long-termisko more eogresave or more politically sie policy interventions The ABSA turnaround Absa is one of our large banking groups in South Africa, the others being Standard Bank, Firstand and Nedbank. The big four', as they are often referred to, are characterised by their full and integrated service offerings, diversification into non-londing revenue sources (such as insurance), ubiquitous points of presence in the fom of ATMs and branches, and complex group structures. Collectively, these four banks control about 88% of South Africa's banking assets, and the African operations of these banks outside of South Africa) contribute a significant proportion of their revenue Exhibit 3 contains a summary of each group, while Exhibits compares the banks on a few selected key performance indicators Exhibit 3: The big four' South African banks Absa Group Limited is listed on the JSE and is one of Africa's largest diversified financial services groups with a presence in 12 countries across the continent and sround 42 000 employees. The bank was owned by Barclays la UK-based banking group) until recently, when Barclays reduced its shareholding in Abss to sboui 15% Firstand was tounded in the 1970s as an entrepreneurial investment bank Differentiated by its owner manager culture. First Rand executes its surategy througn a portfolio of leading financial services businesses comprising of First National Bank (retail banking services, Rand Merchant Bank corporate banking solutions WesBank (asset financing Ashburton Investments investment management and Aldermore Bank Plc (Uk. First and is known for its ontrepreneurial orientation (eg i spawned and then spun of several successful businesses such as Discovery and OU Tourance) its innovativenees especially with regard to technology), and is very successful e-Bucks rewards progamme. Nedbank Group's primary martelis South Ainca, but their expansion into Africa is ongoing. Nedbank has a presence in six countries in the Southern Aincan Development Community (SADC) and East Africa region where it owns subsichiaries and banks in Namibia. Eswathi, Malawi, Mozambique, Lesotho and Zimbabwe, as well as representative ohicas in Angola and Kanya. In West and Central Africa, the bank acquired approximately 20% shareholding in Ecobank Transnational Incorporated (ETI) in 2014, enabling a unique one-bank experience to clients across the largest banking notwork in Africa, comprising more than 2000 branches in 39 countries. Nedbank ovcame a major se back in 2004 when it raced support from 13 parent company, Old Mutual pic and launched a recovery programma vo lesio the pavimence of the group and retain its position as one of the bigiour Slacard Bank Group Chiers a range of bartryg end related financial or 07038 Sub Sulic The X egy isio be an Mirican-locusad chat.cat digrally need internancial Service Onison Sted Bank see a 150 ya hisirin sout inca and the group sa buong dischise in Saharan a aims 3: Ourrently the group has an on-the-ground Price in 2 counse incan combinan and send local ledige per a SUCCESS B5 in Ainics Exhibit 4: A comparison of the big four' on selected indicators! Firstrand Standard chon Assets (R billion R! 171 R1347 R2.1 Grillioni 1044 Headine earnings Rihon) 28 R26.5 R279 R135 16.6% 23.9% 15.4% 15 596 Return on ordinary shareholders' equily 15-year everage 2014-2015 Number of ATMs 10019 4866 9.321 1022 Employees 41 250 46284 31 662 30 877 Country presence 12 in Africa 9 in Alice 20 in Africa 39 in Ainica inrough Eobank Bilance Standard Bank is the largest of the big four' in terms of assets and headine sarnings at This time, who FNB consistently has the highest return on culy. Competition among the big fou' is generally flerce, and banks are constantly looking for ways to cut costs, for example by closing branches, reducing headcounts and encouraging customers to use digital channels, Absa's planned resurgence as a market leader would require a lot of change, as Absa seems lo ba lagging not only in financial oms, but also in customer satisiaction, rated lower than its peers at 73% (compared, for example, to FNB at 81%). In March 2018, the Group CEO, Maria Ramos, announced the bank's intenfon for store its leadership in South African retail banking and to double its share of revenue in Ainca from 6% to 12%, with a strong focus on creating a culture of entrepreneurialiem and consistant delivery to cusiomers. Absa plana on driving grown Soans, which had stagnated, and deposits, where margins came under pressure recenily. According to Cowy Fox, managing sxecutive of Everyday Banking at Absa's Aata and Business Bank. There's capacity for lending in the night spaces in the market but it depends on where the economy goes. A lot of customers are good for credit but they are sitting light waiting to see where the economy goes! One thing was for certain. Absa's efforts to improve its position were not likely to go unchallenged' To complicate things even more, competion for Absa was not limied to its poors, as niche banks and new digital entrants were also eyeing a slice of the considerable po Niche banks The remaining South African banks (excluding the 'big four') are generally niche banks that focus on one or just a few market segments with a limited product range. Banks that compete in this segment are generally sinal compared to the large banks see Exhibit) Capitec is by far the best performer in this segment, boasting the highest return on equity of all South African banks and the most customers - an estimated 9.9 million by February 2018, more than any other South African bank. Capitec claims that on average, 100 000 new customers join its ranks every month. The bank uses technology innovatively to target the lower end of the market with simplicity, affordability, accessibility and paraonal Service, with a fonited yet inovative product range. This essentially consists of savings plans and unsecured credit, but after a single point of access to transacing, saving and credit. A brief summary of other banks in this sector are provided below: Sashin Bank, Mercantile Bank and Investec are focused on the higher end of the market. Both Sastin and Mercantile are specialist bancing groups, focusing on entrepreneurial private commercial and corporate clients. Investec focuses on high- nei-worth individuals and businesses who are less price sensitive and more focused on service quality, even if at a premium African Bank targets a Skrilar martiet to Capitec, but is only now re-emerging after a period in curatorship following its near collapse in 2014, while Ubank also targets lower income consumers timing to become the 'workers' bank of choice') with a strong basis in the gold and platinum mining communities Grindrod Bank (an investment bank and Bidvest Bank offering personal and business banking) are smaller scale banks established by corporate groups. Albaraka Bank differentiates itself on the basis of faith, offering Islamic banking to Muslims worklide. There are also some local operations of international banks, namely the Bank of Athene and Habib Bank Zurich (or Habib Overseas Bank). Exhibit : Comparative assets of South African banks Other riche Assets (R billion banks ROS Atrcan Bank New entrants 199 R39 R2 195 09. Capitec 287 29 Investos 2415 Biolour R$ 762 87% On the basis olencial performance, Capitec is a lop performer in the South African banting industry with a consistent return on equily of 27%. However, other banks in this category have struggled to perform on par with the industry, untia ihe 'big four banks theicona stently ou perform the global counier paris on the basis of ROE Exhab : The ROE of listed niche banka 2013 13% 115 Ancan Bank Inwesiec Sasiin bank Markeverage hen on our The new entrants In 2018, the SARS issued the first three new banlang icences in 15 years to Bank Zwo Discovery Bank and TymoBank ihre now South Aircan digital arts. These digital newcomers' ware being on using aggressive pricing and cal analytics to skract lech- Savvy price-conscious consumers. In addition, the South Mhican Post Once's Posibani has applied icra banling licence, which will allow to oller a wide range of services This was the first time since ihe erance of Capitec in 2001 that the socior facad now competitors. They all expecto have substantially lower cost-income ratios than the big bale, ghing tham scope lo disrupt the pricing of rail banlong products in South Africa I have been dumblounded how low cost can asal Bank Zero's co-founder wichel Jordaan, best known for luming firsirand's reial banking operation into the most prolable in South Africa. Our chology COBE 1 percorl of 1 or cani oi dhe annual lech Iudge at one of the big barlah sedion, the law players are also likely to put pessure on oiharraconabang sciics in the form of interest once and savings, Discovery Bank plena to build its bentong businese on the same principles aalis Vitality loyalty programme that helped Discovery's health insurance less become matot Seades. Visby is a bereviou-tractang programme that nowards 19h neurance clients for healing festyles, such as by paying for gym membership, and Discovery plans to she same principles to target in groups o million hoch insurance dianis. rewering that for cheving financial healicy" Two and hestamed up with sil PekaPay to offer a money transfer service for che /eiler's Sinal Shopper programe clienis, ging maganda larga poolopolencia customers to largel Win is digital services. It also means that Pick n Pay's more than 700 bronchas become de lac.e points of presence or the banks TymeBank is also believed io basoeking partnerships will retirement funds firm Alexander Forbes and insurance giant Santam, Panners lilce these could offer Tyme Bank further access to polonial cusiomers and data Bank Zero is aiming to use technology to drive down it costs and offer banking services at much lower rates ihon incumbents, especially in Ousiness banking, CEO Michael Jordaan said that their goal is to challenge banking fees Jodas added that ther aim is to iackle Igh business fees especially related to the extremely high lees that businesses have to pay forced transactions and a locuronic Banking tees! The new entanisl nibally focus on South Ainca, but may consider other marging matters in due course and given that strong ICT platforms and digital aiurs they may And Healier (o expand globally. However, in South Africa banlong sarvices have a high role ol martel penetration (> 3095) and the challenge in the newcomers is gong to be breaking into a very competitive mate where customers are iraditionally reluctanero switch banks Fintechs While mancial technology businesses tinch) war originally perceived to be a big thres i incumbent banks. They are generally ihning by forming partnerships with incurrbants in the banking and insurance industries rather than by competing head-on with then, Finiechs generally focus on providing solutions to customer cr boncing poin points such as fraud and KYO - how your customer') habanics struggle to address Combining the innovative thinking and technology of inlechs with the large, established Oslomares, distribution networt and capital investment of incumbenia produces a powariul customer value proposition. Fintechs can also help to service mariet segments that are traditionally difficult or un appealing for banks to service, such as the SME sector. For example, iba Finance. InvoiceWorx and vierchent Capital parinaning with Standard Bank offer inovalve finance offerings for SMEs, who often sinuggle loger inancing from the big banks, Growing confidens in new schnologies auch sa ardilloin ntelligence (91) will drive a spate si new applications for the mousty, such as chatbois, which ease the process of customer interaction will inancial services companies and Guiomated wealih advisors. These applications can connue to banks and insurans Offering more innovative vices and batter customer Service The Sun for A636? While there is some snity in banking boardrooms about the new animis in the barting in dugby. Abesseeme alive concemed. Cowy Fox said that they are able to aasily compie with digital banks. He went on to say that despite the better price oifer, ise cosi base of a lagyan.com is one of a low contages that they have over the digital compartiossa Asasins to retais acaricienia by oilaning better prices loisys clients, responding lasier toer needs and proactively managing the accounts. The new lady will allow Absato lalis on more risk tar London-based Barclays CURS former controlling investown is below 15%. Mosa a cubes were generally upbear about cha Barclays withdrawal. sugesting that decision making could now retum to exacullves on the ground, and that they will lace less bureaucracy in general, Absa stems confident thai, going forward, the new strategy will be shielded from new competitors, which will in their view. be capital light and mors transactional in nature. In contrast, Ansa's drive to increase their assets like home loans will according to them) provide a strong basis to offer more transactional banking, Conclusion While incumbent banks may not relish new competition, consumers are likely to benellt ihrough more innovative offerings, more competitive pricing and higher interest rates on Savings accounts. The question is: who will be the winners and who wil lose in the new Danking landscape? Questions 1. What are the key opportunities and threats facing South African banks? 2. Would you regard the South African banking industry as an attractive industry to invest in? 3. Would you regard intechs as competitors or complementors in the ndustry? 4. Conduct a strategic group analysis of the South Alrican banking hdustry. Clearly idently the mobility barriers between strategic groups. 5. Use a resource-based perspective to explain the success of Capitec BankStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock