Question: just need help on the multiple choice questions Group Exercise: A copy machine acquired with a cost of $1,410 has an estimated useful life of

just need help on the multiple choice questions

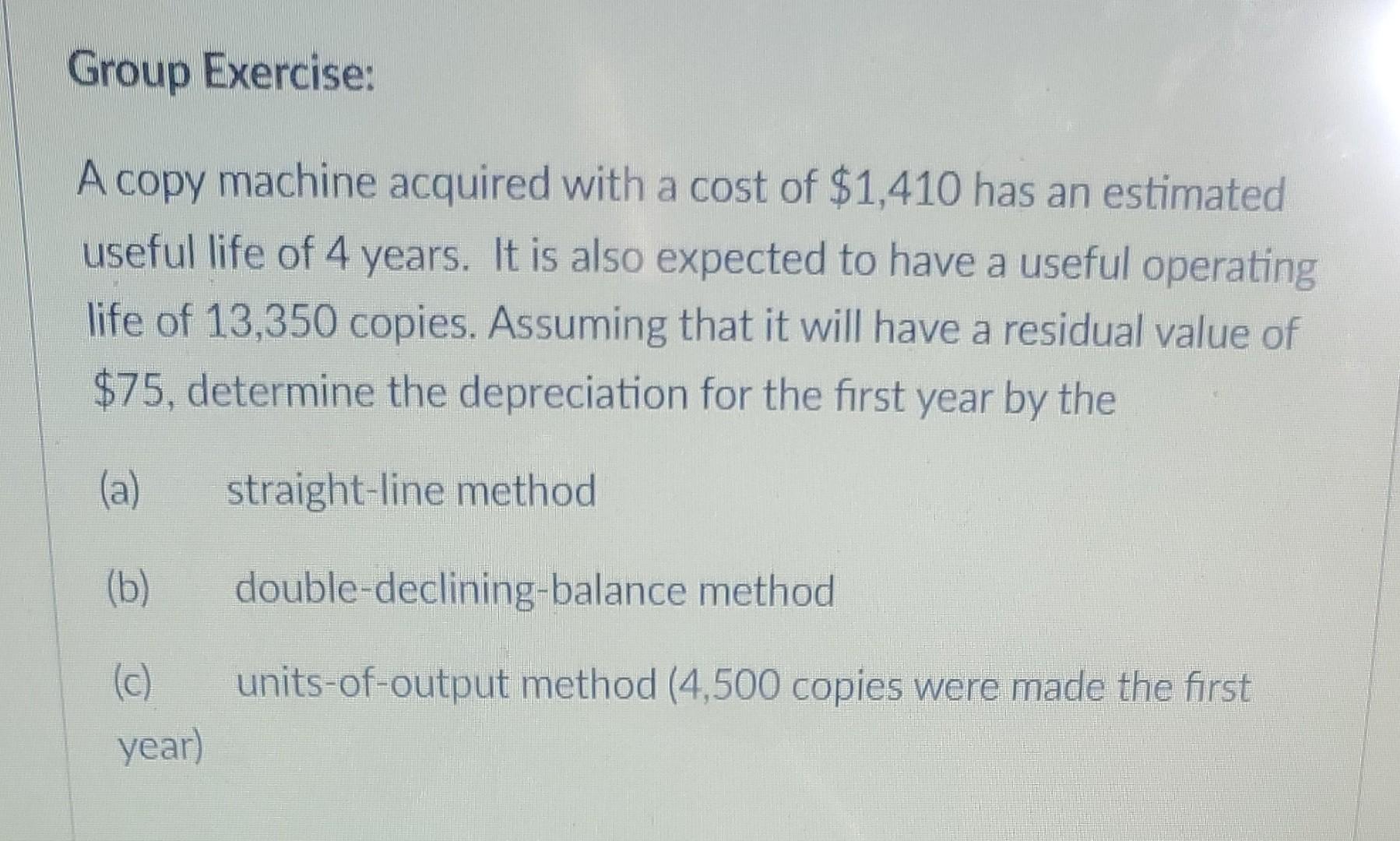

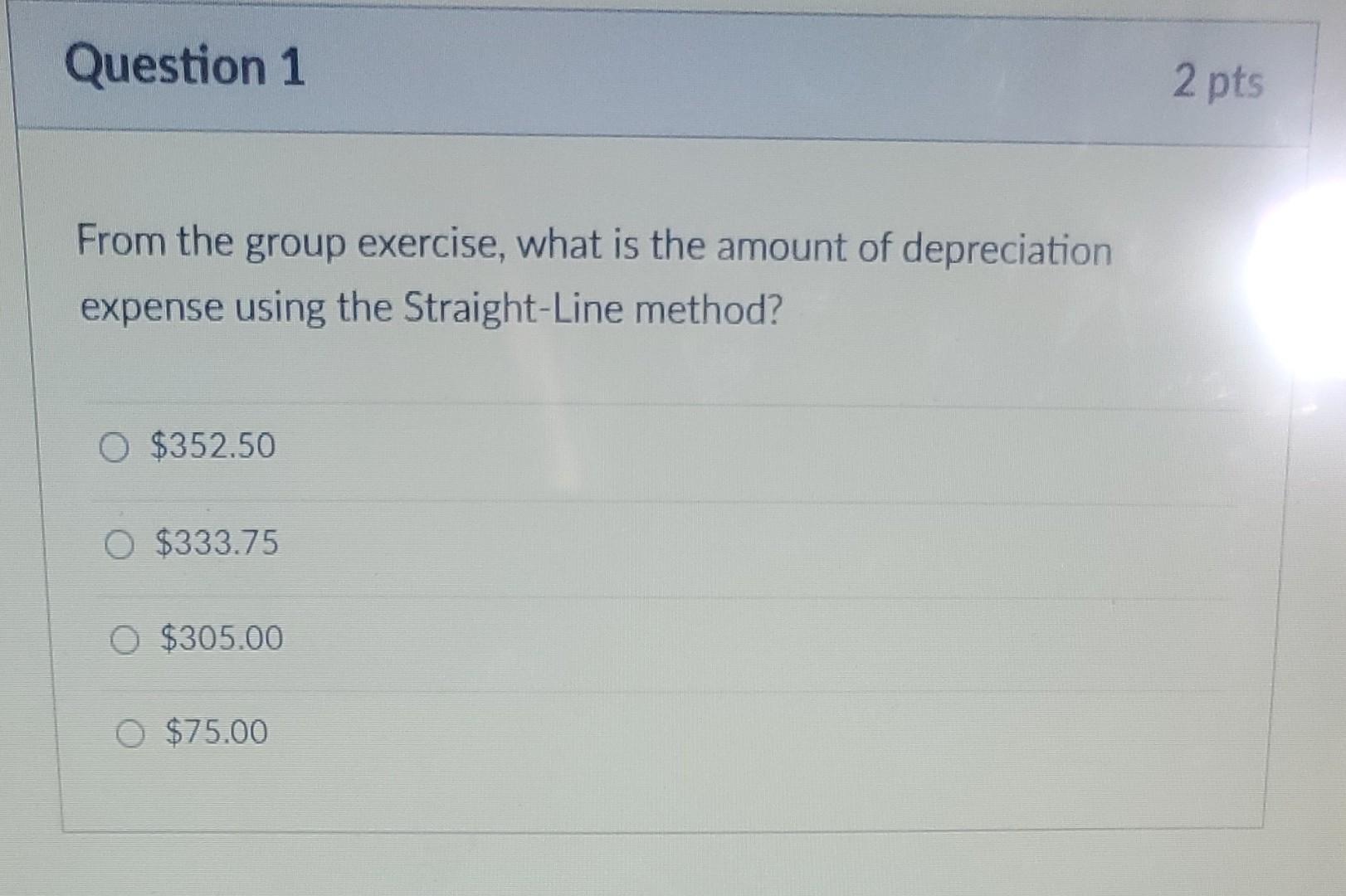

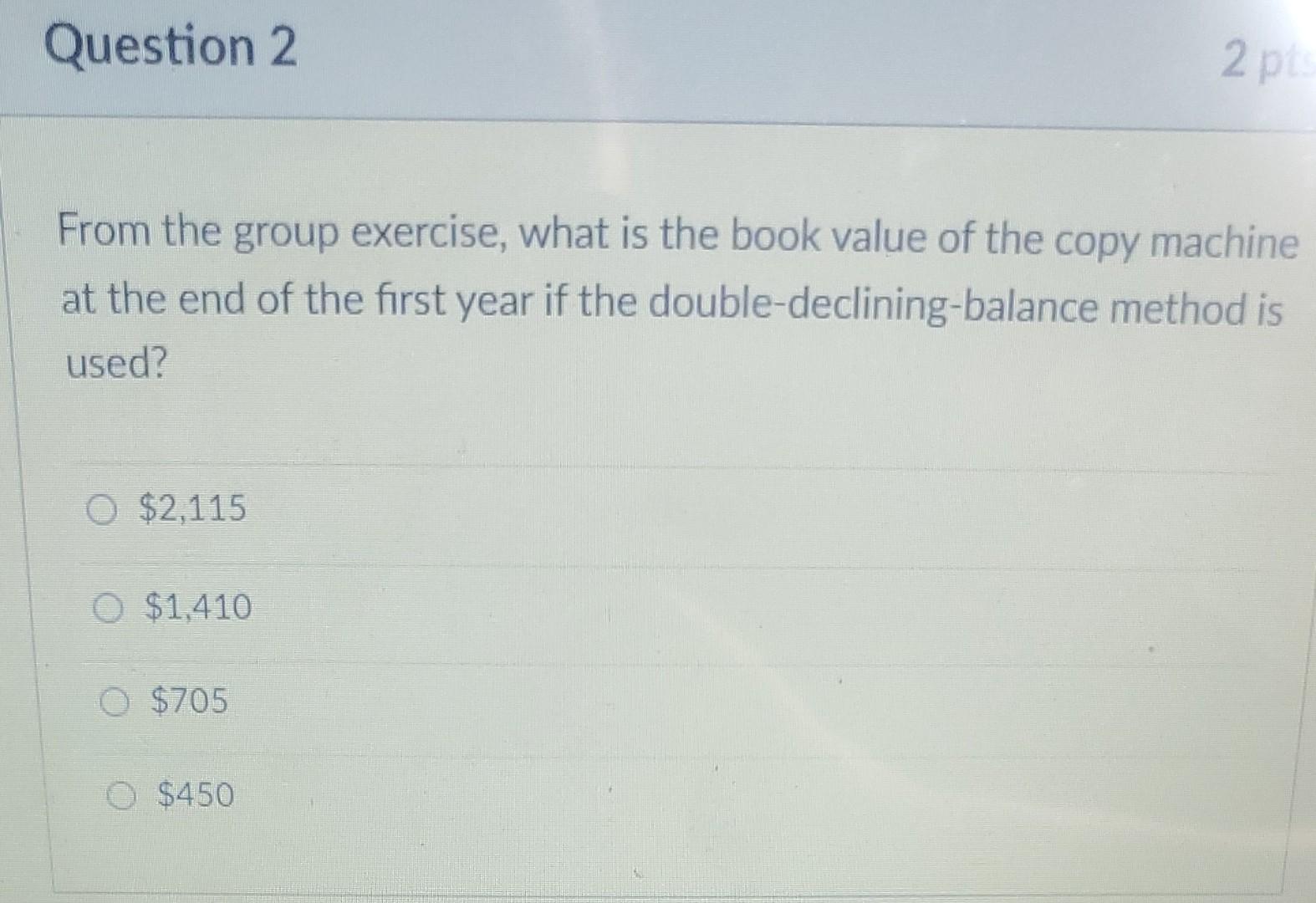

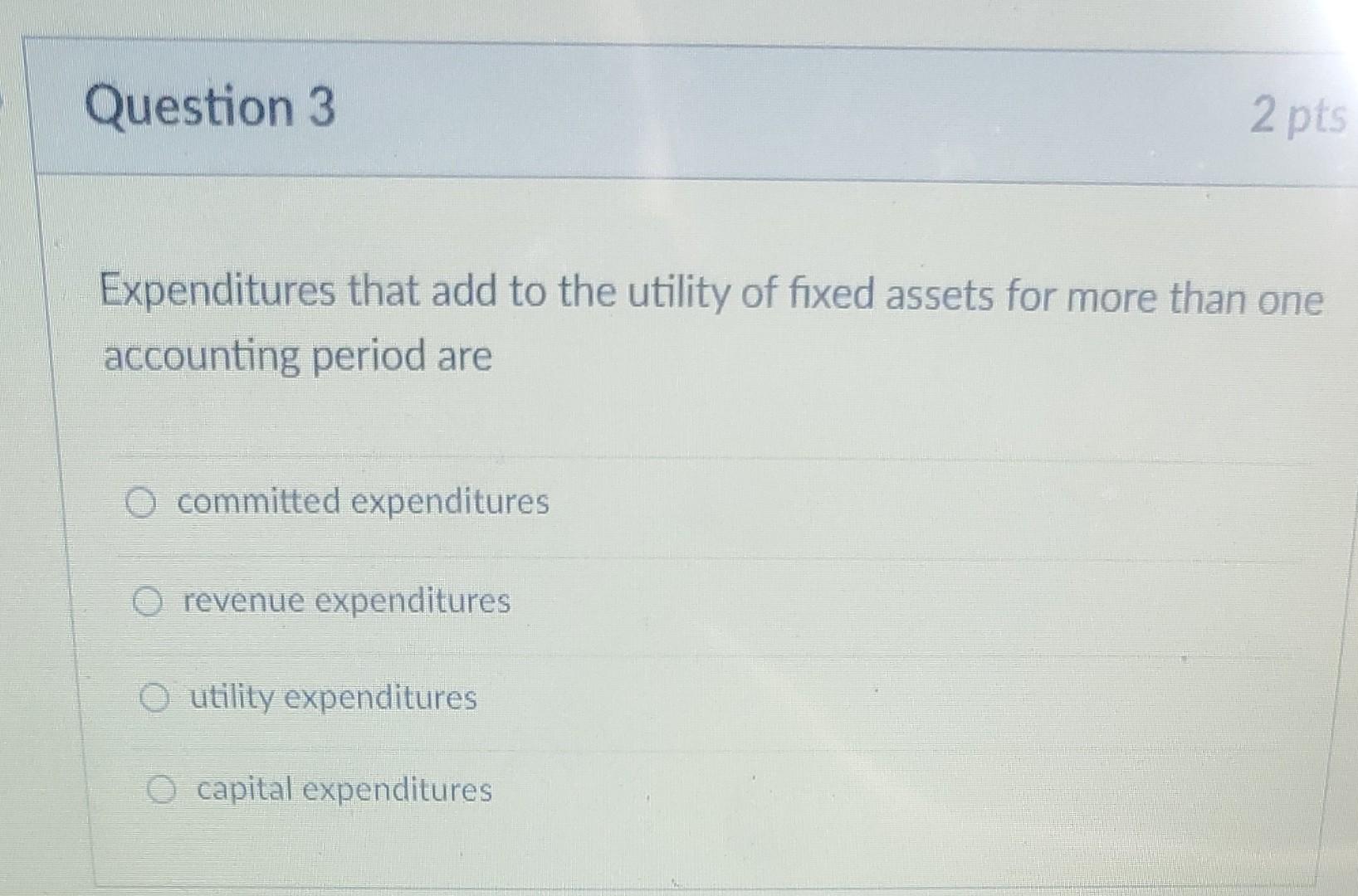

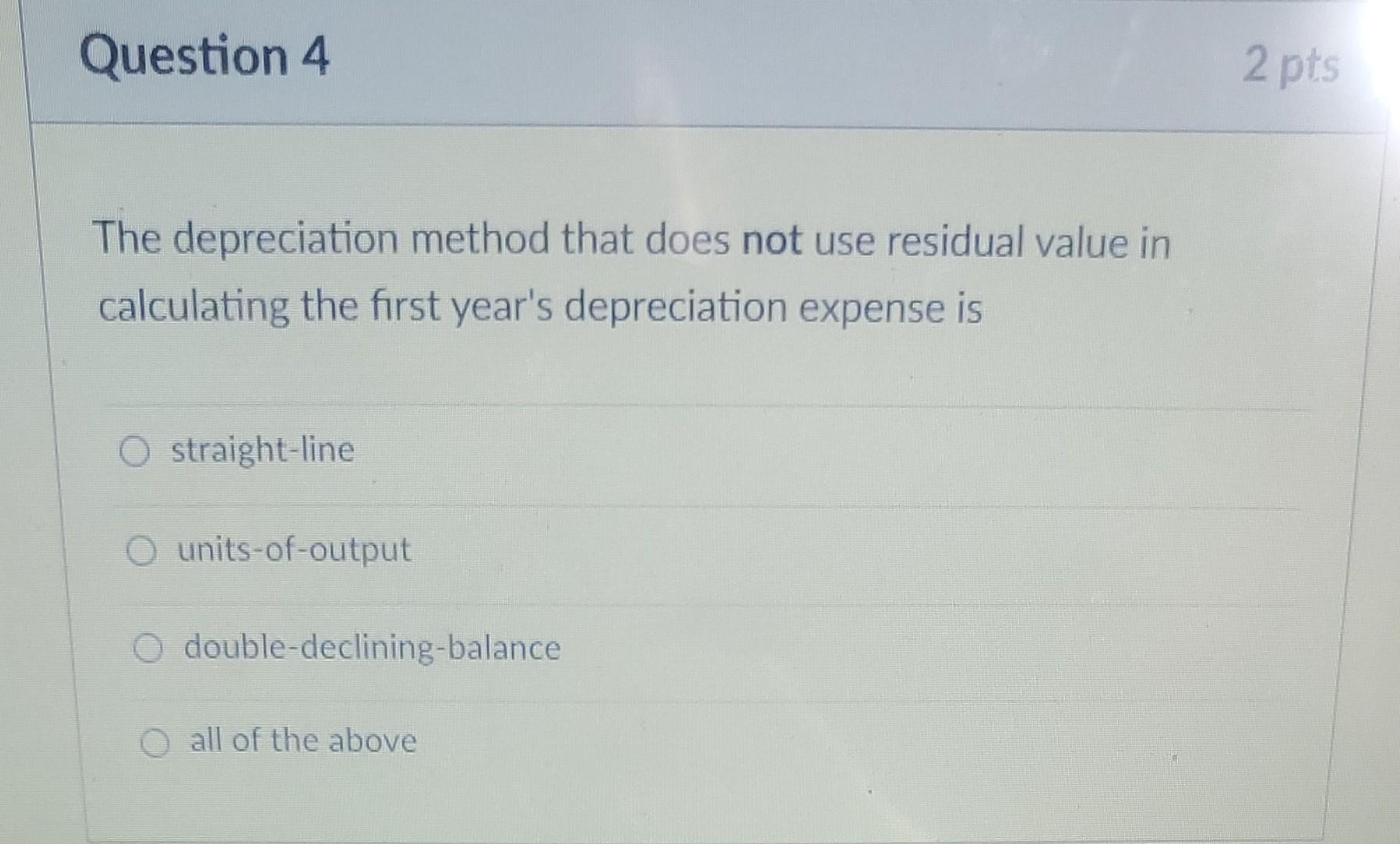

Group Exercise: A copy machine acquired with a cost of $1,410 has an estimated useful life of 4 years. It is also expected to have a useful operating life of 13,350 copies. Assuming that it will have a residual value of $75, determine the depreciation for the first year by the (a) straight-line method (b) double-declining-balance method units-of-output method (4,500 copies were made the first (c) year) Question 1 2 pts From the group exercise, what is the amount of depreciation expense using the Straight-Line method? O $352.50 O $333.75 O $305.00 0 $75.00 Question 2 2 pts From the group exercise, what is the book value of the copy machine at the end of the first year if the double-declining-balance method is used? $2,115 $1,410 $705 O $450 Question 3 2 pts Expenditures that add to the utility of fixed assets for more than one accounting period are committed expenditures o revenue expenditures utility expenditures capital expenditures Question 4 2 pts The depreciation method that does not use residual value in calculating the first year's depreciation expense is O straight-line O units-of-output O double-declining-balance all of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts