Question: just need help with journal entries in the notes. journal entries are within notes 1-4 im blind as a bat and can read the pics

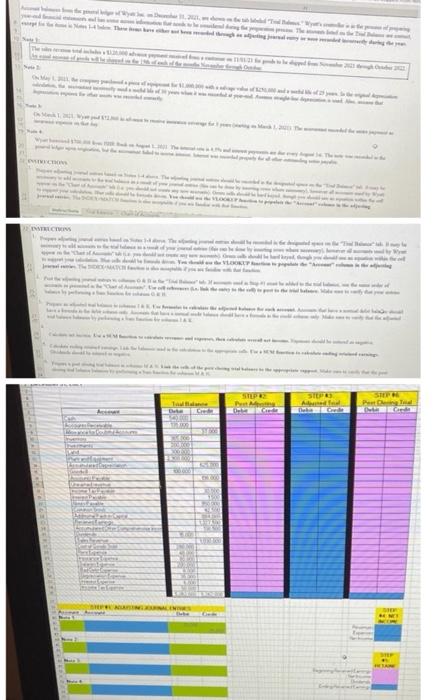

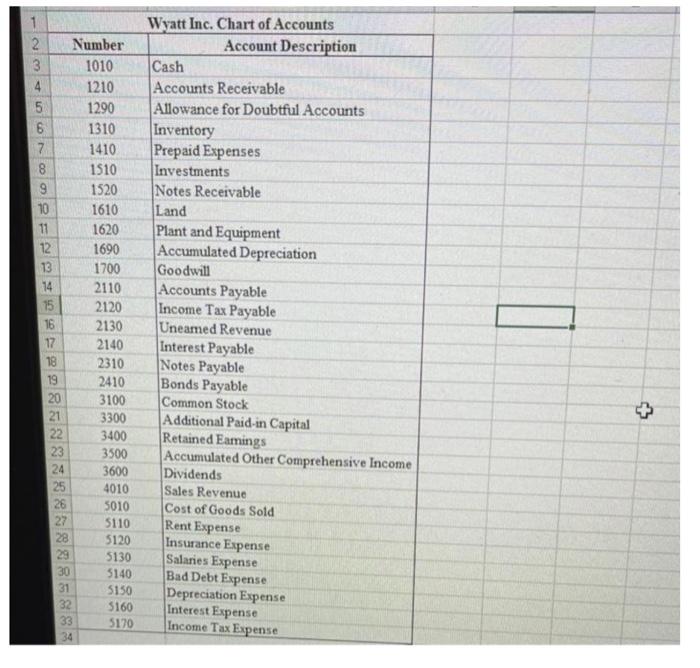

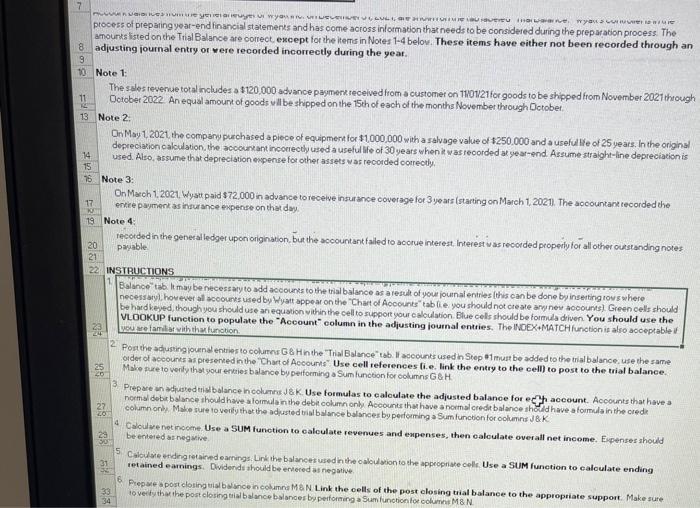

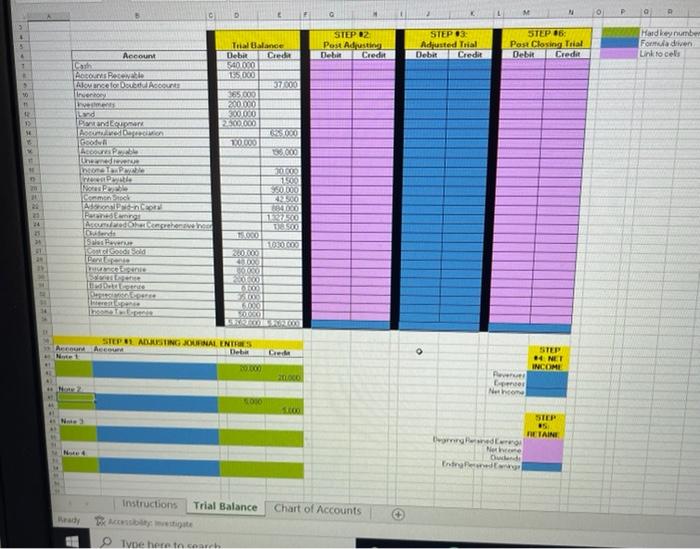

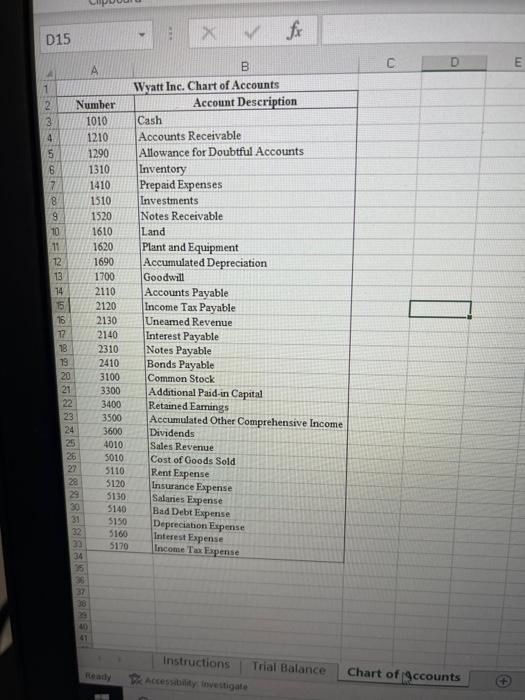

Sele t prosess of preparing year-end financial statements and has come across information that needs to be considered during the preparation process. The anounts isted on the Trial Balance are correct, except for the items in Notes 14 below. These items have either not been recorded through an adjusting journal entry or were recorded incorrectly during the geat. Note 1: The sales tevenue total includes a 1120,000 advance pamerk received from a customer on 1101/21 for goods to be shipped from Nowember 2021 through Dotober 2022 . An equal amount of goods vilbe shipped on the 15 th of each of the months November through Detobet. Note 2: OnMay 1,2021 the company purchased a piece of equipment for $1,000,000 with a salvage value of $250.000 and a usefullre of 25 years. In the originsl depreciationcalculation, the accounkant incorecthy used a usefulffe of 30 years when ik was reoorded at gear-pnd. Assume straight-line depreciation is used. Also, assume that depreciation eppense for other assets was recorded oorrectly. Mote 3: On Mach 1,2021, Wyat paid $72,000 in advance to recelve insurance coverage for 3 years (starting on March 1, 20211 . The accountank recorded the entie paymentas insurance expense on that day. 19 Note 4: recoided in the generalledger upon origination, but the accountant faled ro acorue interest, interest was recorded propeify for all other oustanding notes 20 payable 22 INSTRUCTIONS 17 Ealanoe" tab limay benecessary to add accounks to the thal balance as a result of you foumal enitres (this can be done by insetting rous where necessaryi, hovever al acoouns used by kyat appear on the "Chart or Acocunts" tab fie you should not creste ary new acoournst. Green cells should be hard kejed, thoughyou should use an equation vithin the cell to support your caloulation. Elue cels should be formala diven You should use the VLOOKUP function to populate the "Aceount" column in the adjusting journal entries. The WOEX+MATCH funotion if also aoceptable if wouse familat viththarfunction. 2. Porthe adusting jound entrier to colurne 68 Hinthe Trial Balance " wb. If acoounts used in Stop 01 must be added to the trial balance. use che same aider of accounts as presened in the Chart of Accourns' Use cell references fi.e. link the entry to the cell) to post to the trial balance. Malro ture to verly that your entier balance by performing Sum function for columns G&H. 25 Prepare an adiusted trisbolance hcolumne 18K Use formulas to calculate the adjusted balance for ecul aceunt. Accounts thar have a 27 Columnonis. Make sure to verify that the adjusted trial balance balances by performing a Sum functon for oclumns J&K 4 Caculve netinocene Use a SUM function to calculate revenues and enpences, then ealculate overall net income. Eypenser should 29 be entred as negurive 31. Tetained eamings. Duidends ahould be enered as negative. 6 . Ficpac a post closing tial balsnce ncolumna M N Link the oells of the post olosing twal balance to the appropriate support. Make sure \begin{tabular}{|l|l|l|l|} \hline \multicolumn{1}{l|l|l|}{} \\ \hline 15 & & & \end{tabular} Sele t prosess of preparing year-end financial statements and has come across information that needs to be considered during the preparation process. The anounts isted on the Trial Balance are correct, except for the items in Notes 14 below. These items have either not been recorded through an adjusting journal entry or were recorded incorrectly during the geat. Note 1: The sales tevenue total includes a 1120,000 advance pamerk received from a customer on 1101/21 for goods to be shipped from Nowember 2021 through Dotober 2022 . An equal amount of goods vilbe shipped on the 15 th of each of the months November through Detobet. Note 2: OnMay 1,2021 the company purchased a piece of equipment for $1,000,000 with a salvage value of $250.000 and a usefullre of 25 years. In the originsl depreciationcalculation, the accounkant incorecthy used a usefulffe of 30 years when ik was reoorded at gear-pnd. Assume straight-line depreciation is used. Also, assume that depreciation eppense for other assets was recorded oorrectly. Mote 3: On Mach 1,2021, Wyat paid $72,000 in advance to recelve insurance coverage for 3 years (starting on March 1, 20211 . The accountank recorded the entie paymentas insurance expense on that day. 19 Note 4: recoided in the generalledger upon origination, but the accountant faled ro acorue interest, interest was recorded propeify for all other oustanding notes 20 payable 22 INSTRUCTIONS 17 Ealanoe" tab limay benecessary to add accounks to the thal balance as a result of you foumal enitres (this can be done by insetting rous where necessaryi, hovever al acoouns used by kyat appear on the "Chart or Acocunts" tab fie you should not creste ary new acoournst. Green cells should be hard kejed, thoughyou should use an equation vithin the cell to support your caloulation. Elue cels should be formala diven You should use the VLOOKUP function to populate the "Aceount" column in the adjusting journal entries. The WOEX+MATCH funotion if also aoceptable if wouse familat viththarfunction. 2. Porthe adusting jound entrier to colurne 68 Hinthe Trial Balance " wb. If acoounts used in Stop 01 must be added to the trial balance. use che same aider of accounts as presened in the Chart of Accourns' Use cell references fi.e. link the entry to the cell) to post to the trial balance. Malro ture to verly that your entier balance by performing Sum function for columns G&H. 25 Prepare an adiusted trisbolance hcolumne 18K Use formulas to calculate the adjusted balance for ecul aceunt. Accounts thar have a 27 Columnonis. Make sure to verify that the adjusted trial balance balances by performing a Sum functon for oclumns J&K 4 Caculve netinocene Use a SUM function to calculate revenues and enpences, then ealculate overall net income. Eypenser should 29 be entred as negurive 31. Tetained eamings. Duidends ahould be enered as negative. 6 . Ficpac a post closing tial balsnce ncolumna M N Link the oells of the post olosing twal balance to the appropriate support. Make sure \begin{tabular}{|l|l|l|l|} \hline \multicolumn{1}{l|l|l|}{} \\ \hline 15 & & & \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts