Question: JUST NEED HELP WITH PART D , DO NOT RECYCLE ALL ANSWERS FROM HERE CAUSE THERE ARE WRONG. ALSO, $ 2 , 2 5 0

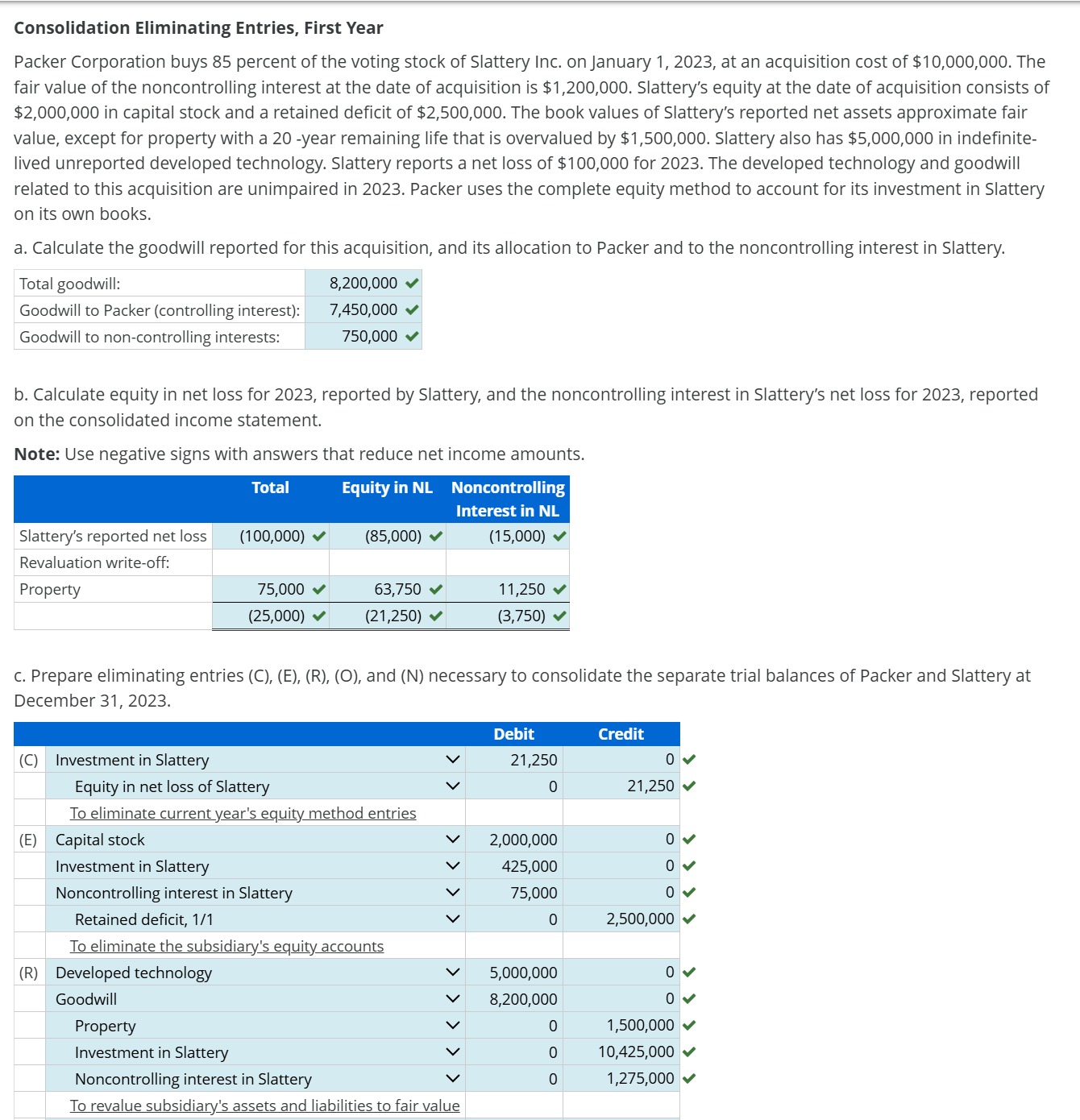

JUST NEED HELP WITH PART D DO NOT RECYCLE ALL ANSWERS FROM HERE CAUSE THERE ARE WRONG. ALSO, $ IS WRONG... Consolidation Eliminating Entries, First Year Packer Corporation buys percent of the voting stock of Slattery Inc. on January at an acquisition cost of $ The fair value of the noncontrolling interest at the date of acquisition is $ Slattery's equity at the date of acquisition consists of $ in capital stock and a retained deficit of $ The book values of Slattery's reported net assets approximate fair value, except for property with a year remaining life that is overvalued by $ Slattery also has $ in indefinitelived unreported developed technology. Slattery reports a net loss of $ for The developed technology and goodwill related to this acquisition are unimpaired in Packer uses the complete equity method to account for its investment in Slattery on its own books. a Calculate the goodwill reported for this acquisition, and its allocation to Packer and to the noncontrolling interest in Slattery. b Calculate equity in net loss for reported by Slattery, and the noncontrolling interest in Slattery's net loss for reported on the consolidated income statement. Note: Use negative signs with answers that reduce net income amounts. c Prepare eliminating entries CERO and N necessary to consolidate the separate trial balances of Packer and Slattery at December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock