Question: just need help with these 3 problems question 1 question 2 question 3 Gonzales Corporation generated free cash flow of $86 million this year. For

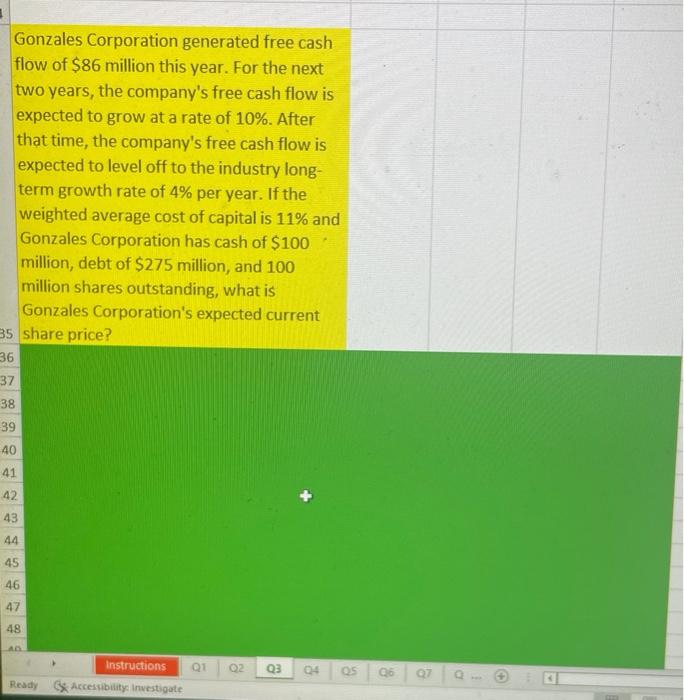

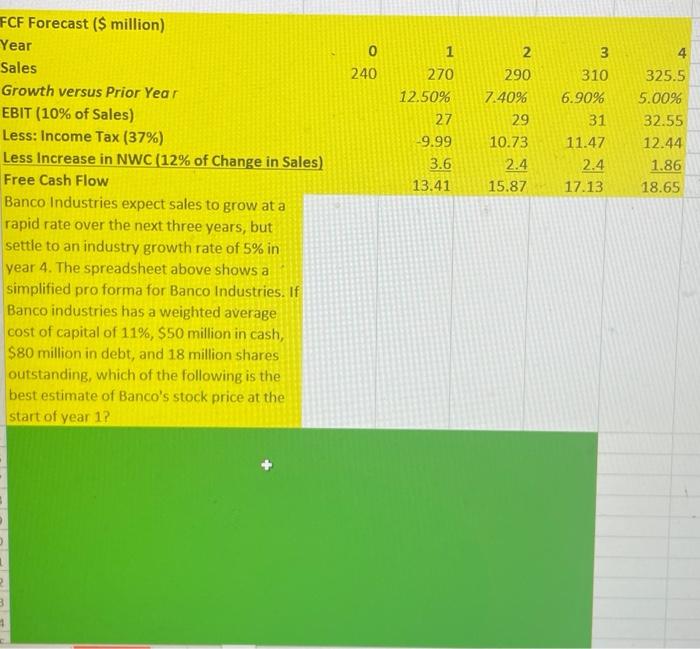

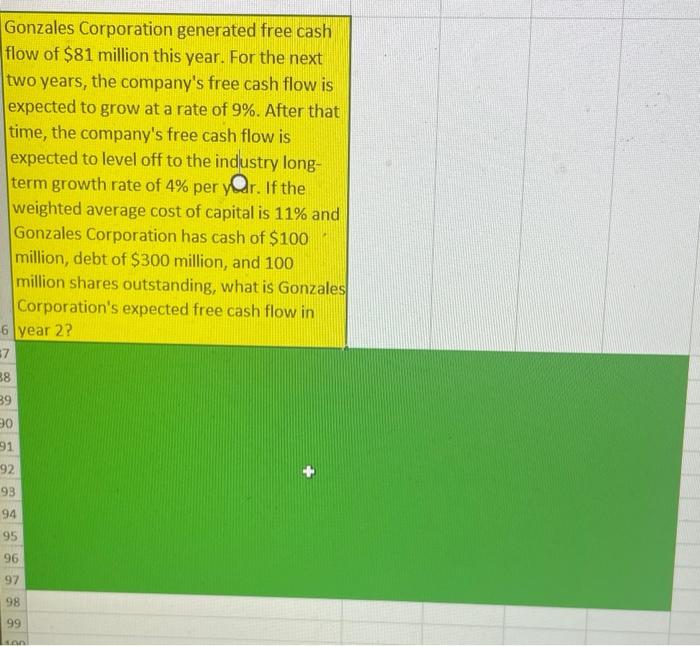

Gonzales Corporation generated free cash flow of $86 million this year. For the next two years, the company's free cash flow is expected to grow at a rate of 10%. After that time, the company's free cash flow is expected to level off to the industry longterm growth rate of 4% per year. If the weighted average cost of capital is 11% and Gonzales Corporation has cash of $100 million, debt of $275 million, and 100 million shares outstanding, what is Gonzales Corporation's expected current share price? \begin{tabular}{l|r|r|r|r|r|} \hline CF Forecast (\$ million) & & & & \\ Year & 0 & 1 & 2 & 3 & 4 \\ Sales & 240 & 270 & 290 & 310 & 325.5 \\ Growth versus Prior Year & & 12.50% & 7.40% & 6.90% & 5.00% \\ EBIT (10\% of Sales) & 27 & 29 & 31 & 32.55 \\ Less: Income Tax (37\%) & 9.99 & 10.73 & 11.47 & 12.44 \\ Less Increase in NWC (12\% of Change in Sales) & 3.6 & 2.4 & 2.4 & 1.86 \\ \hline Free Cash Flow & 13.41 & 15.87 & 17.13 & 18.65 \\ \hline \end{tabular} Banco Industries expect sales to grow at a rapid rate over the next three years, but settle to an industry growth rate of 5% in year 4. The spreadsheet above shows a simplified pro forma for Banco Industries. If Banco industries has a weighted average cost of capital of 11%,$50 million in cash, $80 million in debt, and 18 million shares outstanding, which of the following is the best estimate of Banco's stock price at the start of year 1 ? Gonzales Corporation generated free cash flow of $81 million this year. For the next two years, the company's free cash flow is expected to grow at a rate of 9%. After that time, the company's free cash flow is expected to level off to the industry longterm growth rate of 4% per yer. If the weighted average cost of capital is 11% and Gonzales Corporation has cash of $100 million, debt of $300 million, and 100 million shares outstanding, what is Gonzales Corporation's expected free cash flow in year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts