Question: Just need help with this part, please (originally was 3 parts, this is only 1 part that I need help on). Iron Man has been

Just need help with this part, please (originally was 3 parts, this is only 1 part that I need help on).

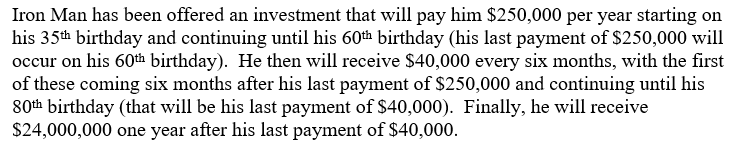

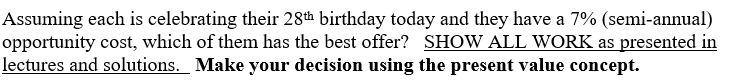

Iron Man has been offered an investment that will pay him $250,000 per year starting on his 35th birthday and continuing until his 60th birthday (his last payment of $250,000 will occur on his 60th birthday). He then will receive $40,000 every six months, with the first of these coming six months after his last payment of $250,000 and continuing until his 80th birthday (that will be his last payment of $40,000). Finally, he will receive $24,000,000 one year after his last payment of $40,000. Assuming each is celebrating their 28th birthday today and they have a 7% (semi-annual) opportunity cost, which of them has the best offer? SHOW ALL WORK as presented in lectures and solutions. Make your decision using the present value concept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts