Question: JUST NEED OPTION no need explain NO need for explanation i will rate you Lh30 de 40.000 Siding 000 00.000 m SOMR000 20000 Cash and

JUST NEED OPTION

no need explain

NO need for explanation

i will rate you

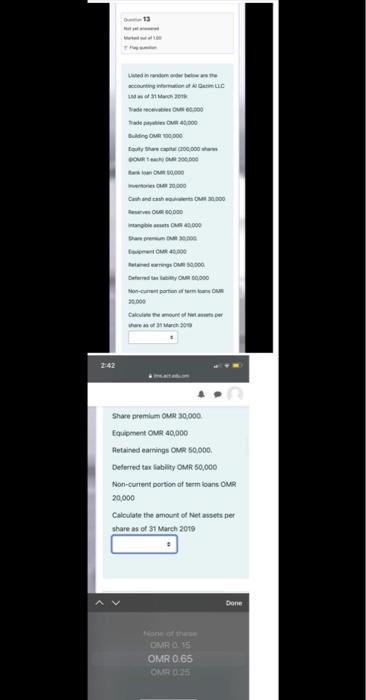

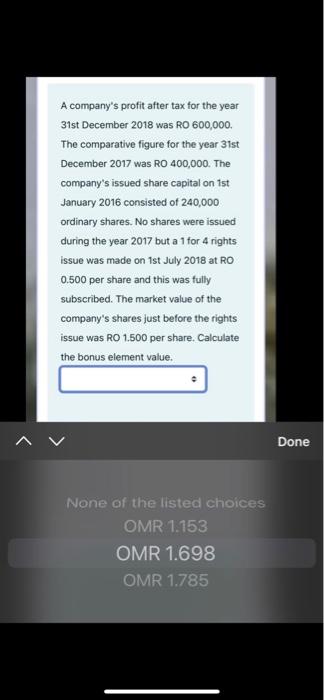

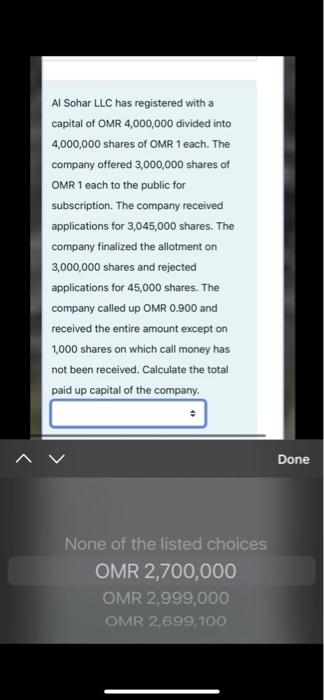

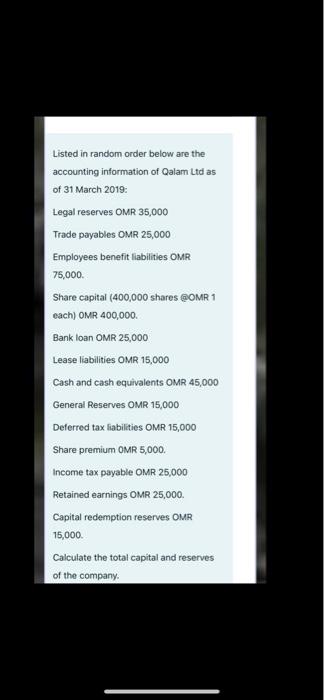

Lh30 de 40.000 Siding 000 00.000 m SOMR000 20000 Cash and 300 40.000 OM 3.000 NO.000 Deferred to 0.00 Non-comportant 20.000 2:42 Share premium OR 30,000 Equipment OMR 40,000 Retained earnings OMR 50,000 Deferred tax ability OMR 50,000 Non-current portion of term loans OMR 20,000 Calculate the amount of Net assets per share as of 31 March 2019 Done GMR 15 OMR 0.65 A company's profit after tax for the year 31st December 2018 was RO 600,000 The comparative figure for the year 31st December 2017 was RO 400,000. The company's issued share capital on 1st January 2016 consisted of 240,000 ordinary shares. No shares were issued during the year 2017 but a 1 for 4 rights issue was made on 1st July 2018 at RO 0.500 per share and this was fully Subscribed. The market value of the company's shares just before the rights issue was RO 1.500 per share. Calculate the bonus element value. Done None of the listed choices OMR 1.153 OMR 1.698 OMR 1.785 Al Sohar LLC has registered with a capital of OMR 4,000,000 divided into 4,000,000 shares of OMR 1 each. The company offered 3,000,000 shares of OMR 1 each to the public for subscription. The company received applications for 3,045,000 shares. The company finalized the allotment on 3,000,000 shares and rejected applications for 45,000 shares. The company called up OMR 0.900 and received the entire amount except on 1,000 shares on which call money has not been received. Calculate the total paid up capital of the company. Done None of the listed choices OMR 2,700,000 OMR 2,999,000 OMR 2,699,100 Listed in random order below are the accounting information of Qalam Ltd as of 31 March 2019: Legal reserves OMR 35,000 Trade payables OMR 25,000 Employees benefit liabilities OMR 75,000 Share capital (400,000 shares @OMR 1 each) OMR 400,000 Bank loan OMR 25,000 Lease liabilities OMR 15,000 Cash and cash equivalents OMR 45,000 General Reserves OMR 15,000 Deferred tax liabilities OMR 15,000 Share premium OMR 5,000 Income tax payable OMR 25,000 Retained earnings OMR 25,000 Capital redemption reserves OMR 15,000 Calculate the total capital and reserves of the company. None of the listed choices Done OMR 370,000 OMR 495,000 OMR 365,000 None of the listed choices Lh30 de 40.000 Siding 000 00.000 m SOMR000 20000 Cash and 300 40.000 OM 3.000 NO.000 Deferred to 0.00 Non-comportant 20.000 2:42 Share premium OR 30,000 Equipment OMR 40,000 Retained earnings OMR 50,000 Deferred tax ability OMR 50,000 Non-current portion of term loans OMR 20,000 Calculate the amount of Net assets per share as of 31 March 2019 Done GMR 15 OMR 0.65 A company's profit after tax for the year 31st December 2018 was RO 600,000 The comparative figure for the year 31st December 2017 was RO 400,000. The company's issued share capital on 1st January 2016 consisted of 240,000 ordinary shares. No shares were issued during the year 2017 but a 1 for 4 rights issue was made on 1st July 2018 at RO 0.500 per share and this was fully Subscribed. The market value of the company's shares just before the rights issue was RO 1.500 per share. Calculate the bonus element value. Done None of the listed choices OMR 1.153 OMR 1.698 OMR 1.785 Al Sohar LLC has registered with a capital of OMR 4,000,000 divided into 4,000,000 shares of OMR 1 each. The company offered 3,000,000 shares of OMR 1 each to the public for subscription. The company received applications for 3,045,000 shares. The company finalized the allotment on 3,000,000 shares and rejected applications for 45,000 shares. The company called up OMR 0.900 and received the entire amount except on 1,000 shares on which call money has not been received. Calculate the total paid up capital of the company. Done None of the listed choices OMR 2,700,000 OMR 2,999,000 OMR 2,699,100 Listed in random order below are the accounting information of Qalam Ltd as of 31 March 2019: Legal reserves OMR 35,000 Trade payables OMR 25,000 Employees benefit liabilities OMR 75,000 Share capital (400,000 shares @OMR 1 each) OMR 400,000 Bank loan OMR 25,000 Lease liabilities OMR 15,000 Cash and cash equivalents OMR 45,000 General Reserves OMR 15,000 Deferred tax liabilities OMR 15,000 Share premium OMR 5,000 Income tax payable OMR 25,000 Retained earnings OMR 25,000 Capital redemption reserves OMR 15,000 Calculate the total capital and reserves of the company. None of the listed choices Done OMR 370,000 OMR 495,000 OMR 365,000 None of the listed choices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts