Question: JUST NEED OPTION no need explain NO need for explanation i will rate you The following balances were extracted from the books of Al Mualdha

JUST NEED OPTION

no need explain

NO need for explanation

i will rate you

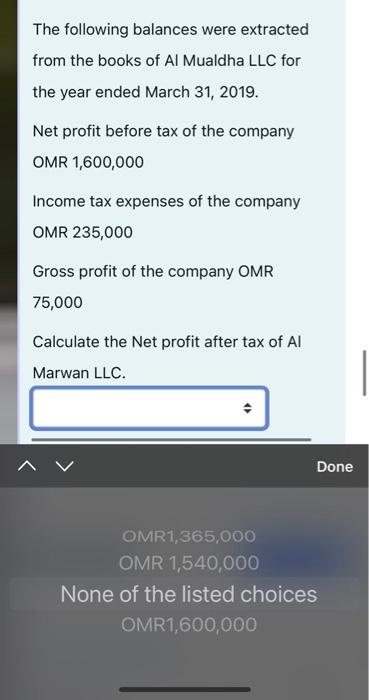

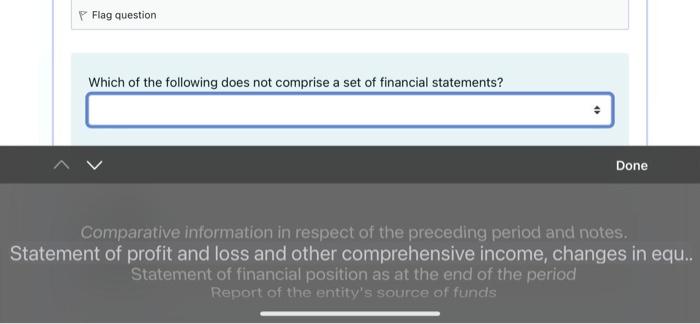

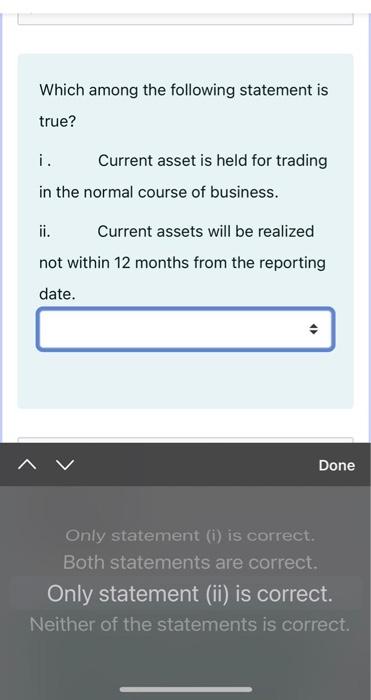

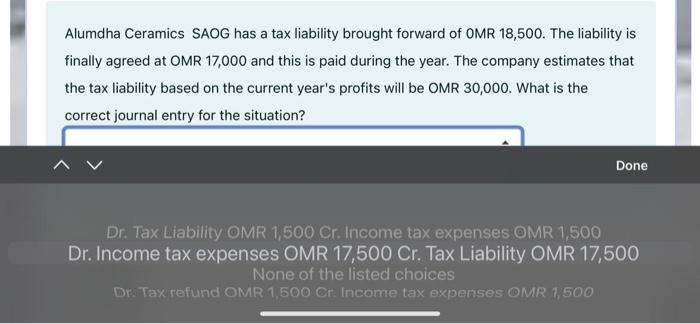

The following balances were extracted from the books of Al Mualdha LLC for the year ended March 31, 2019. Net profit before tax of the company OMR 1,600,000 Income tax expenses of the company OMR 235,000 Gross profit of the company OMR 75,000 Calculate the Net profit after tax of Al Marwan LLC Done OMR1,365,000 OMR 1,540,000 None of the listed choices OMR1,600,000 Flag question Which of the following does not comprise a set of financial statements? Done Comparative information in respect of the preceding period and notes. Statement of profit and loss and other comprehensive income, changes in equ.. Statement of financial position as at the end of the period Report of the entity's source of funds Which among the following statement is true? i. Current asset is held for trading in the normal course of business. ii. Current assets will be realized not within 12 months from the reporting date. Done Only statement (i) is correct. Both statements are correct. Only statement (ii) is correct. Neither of the statements is correct. Alumdha Ceramics SAOG has a tax liability brought forward of OMR 18,500. The liability is finally agreed at OMR 17,000 and this is paid during the year. The company estimates that the tax liability based on the current year's profits will be OMR 30,000. What is the correct journal entry for the situation? Done Dr. Tax Liability OMR 1,500 Cr. Income tax expenses OMR 1,500 Dr. Income tax expenses OMR 17,500 Cr. Tax Liability OMR 17,500 None of the listed choices Dr. Tax refund OMR 1,500 Ct. Income tax expenses OMR 1,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts