Question: JUST NEED OPTION no need explain NO need for explanation i will rate you The following balances were extracted from the books of Al Musanna

JUST NEED OPTION

no need explain

NO need for explanation

i will rate you

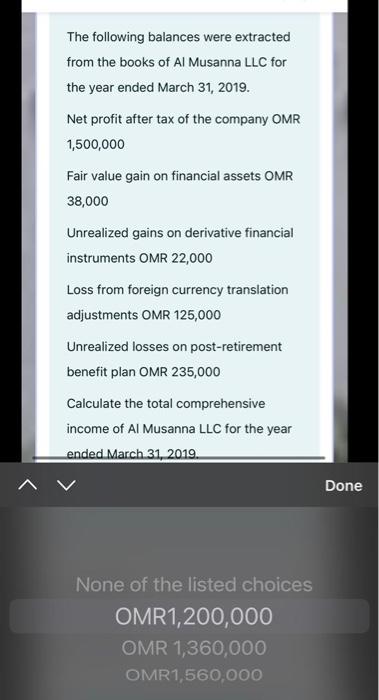

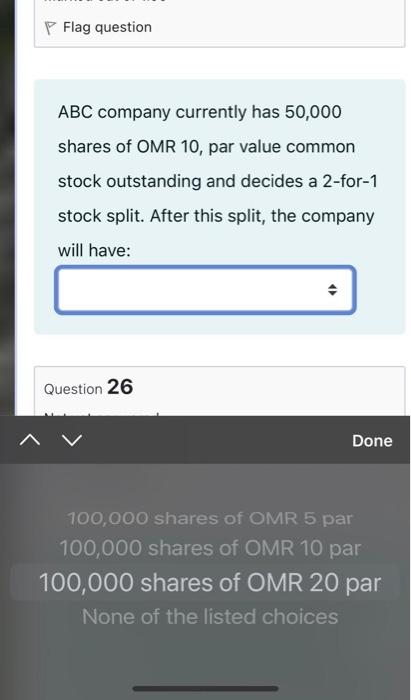

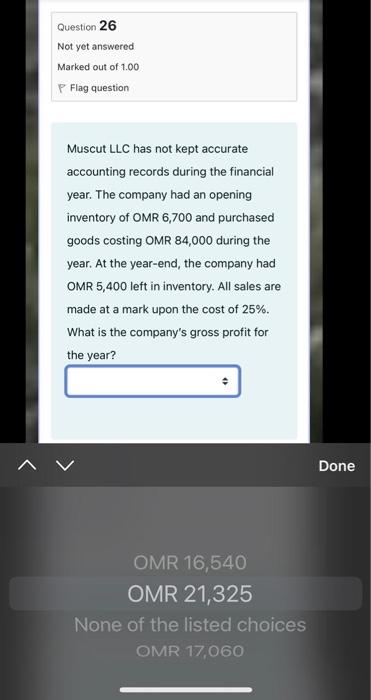

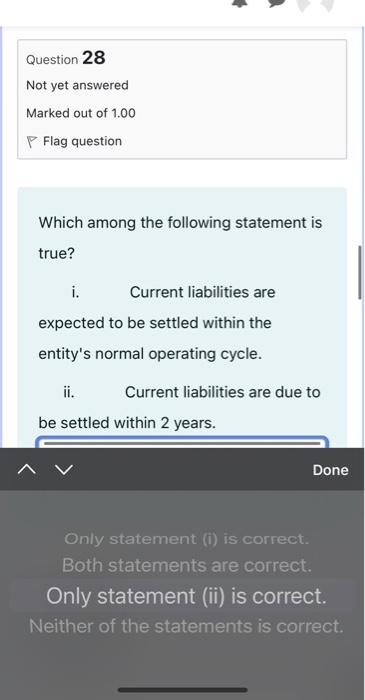

The following balances were extracted from the books of Al Musanna LLC for the year ended March 31, 2019. Net profit after tax of the company OMR 1,500,000 Fair value gain on financial assets OMR 38,000 Unrealized gains on derivative financial instruments OMR 22,000 Loss from foreign currency translation adjustments OMR 125,000 Unrealized losses on post-retirement benefit plan OMR 235,000 Calculate the total comprehensive income of Al Musanna LLC for the year ended March 31, 2019. Done None of the listed choices OMR1,200,000 OMR 1,360,000 OMR1,560,000 P Flag question ABC company currently has 50,000 shares of OMR 10, par value common stock outstanding and decides a 2-for-1 stock split. After this split, the company will have: Question 26 Done 100,000 shares of OMR 5 par 100,000 shares of OMR 10 par 100,000 shares of OMR 20 par None of the listed choices Question 26 Not yet answered Marked out of 1.00 Flag question Muscut LLC has not kept accurate accounting records during the financial year. The company had an opening inventory of OMR 6,700 and purchased goods costing OMR 84,000 during the year. At the year-end, the company had OMR 5,400 left in inventory. All sales are made at a mark upon the cost of 25%. What is the company's gross profit for the year? Done OMR 16,540 OMR 21,325 None of the listed choices OMR 17,060 Question 28 Not yet answered Marked out of 1.00 P Flag question Which among the following statement is true? i. Current liabilities are expected to be settled within the entity's normal operating cycle. ii. Current liabilities are due to be settled within 2 years. Done Only statement (i) is correct. Both statements are correct. Only statement (ii) is correct. Neither of the statements is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts