Question: JUST NEED OPTION no need explain NO need for explanation i will rate you Question 43 Not yet answered Marked out of 1.00 P Flag

JUST NEED OPTION

no need explain

NO need for explanation

i will rate you

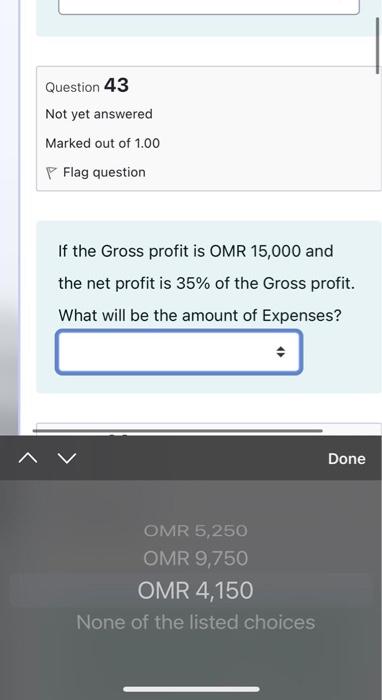

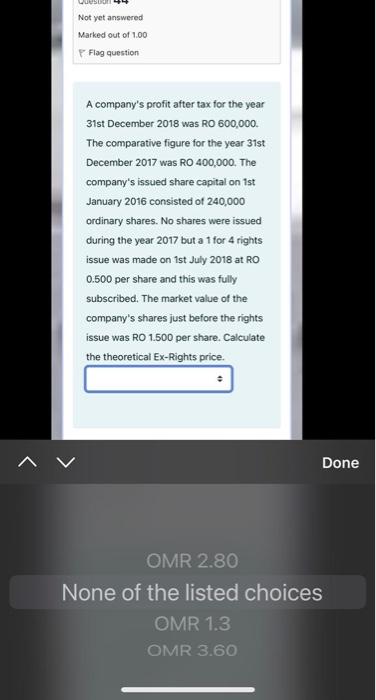

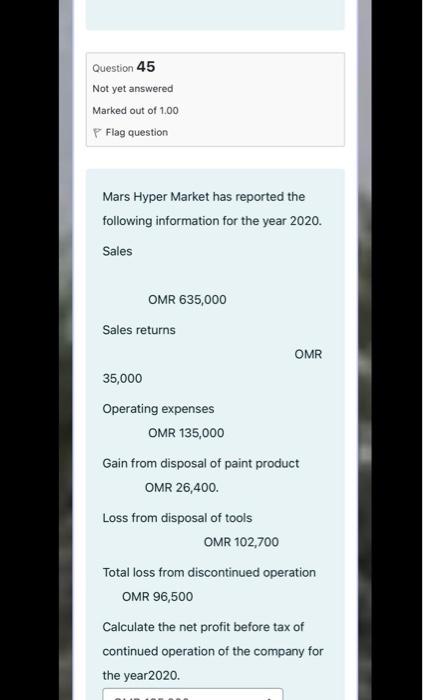

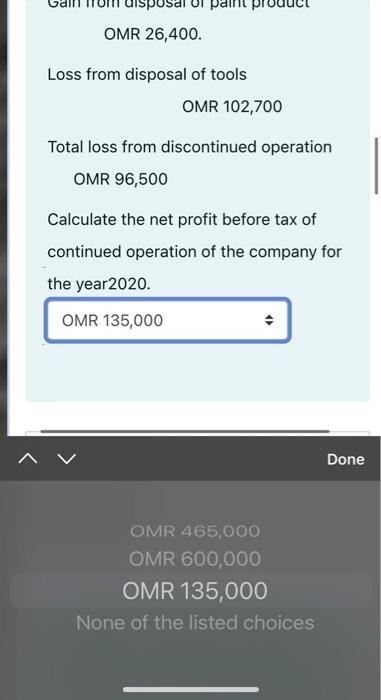

Question 43 Not yet answered Marked out of 1.00 P Flag question If the Gross profit is OMR 15,000 and the net profit is 35% of the Gross profit. What will be the amount of Expenses? Done OMR 5,250 OMR 9,750 OMR 4,150 None of the listed choices Not yet answered Marked out of 1.00 Flag question A company's profit after tax for the year 31st December 2018 was RO 600,000. The comparative figure for the year 31st December 2017 was RO 400,000. The company's issued share capital on 1st January 2016 consisted of 240,000 ordinary shares. No shares were issued during the year 2017 but a 1 for 4 rights issue was made on 1st July 2018 at RO 0.500 per share and this was fully subscribed. The market value of the company's shares just before the rights issue was RO 1.500 per share. Calculate the theoretical Ex-Rights price. Done OMR 2.80 None of the listed choices OMR 1.3 OMR 3.60 Question 45 Not yet answered Marked out of 1.00 P Flag question Mars Hyper Market has reported the following information for the year 2020. Sales OMR 635,000 Sales returns OMR 35,000 Operating expenses OMR 135,000 Gain from disposal of paint product OMR 26,400. Loss from disposal of tools OMR 102,700 Total loss from discontinued operation OMR 96,500 Calculate the net profit before tax of continued operation of the company for the year 2020. aint OMR 26,400. Loss from disposal of tools OMR 102,700 Total loss from discontinued operation OMR 96,500 Calculate the net profit before tax of continued operation of the company for the year2020. OMR 135,000 Done OMR 465,000 OMR 600,000 OMR 135,000 None of the listed choices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts