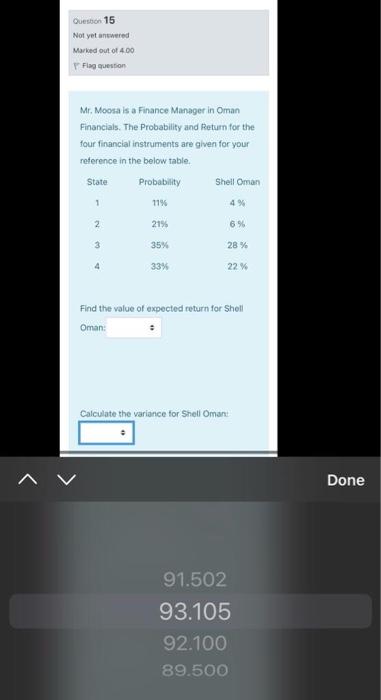

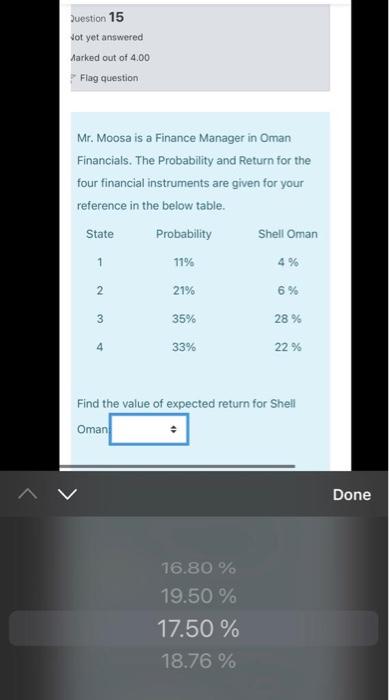

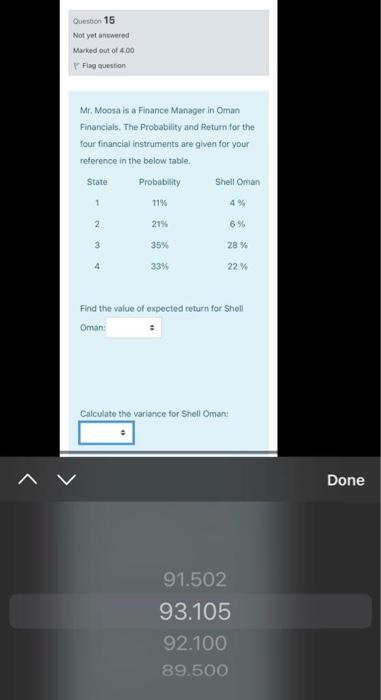

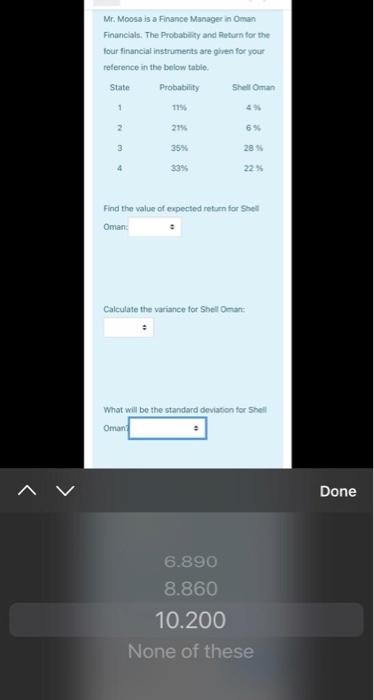

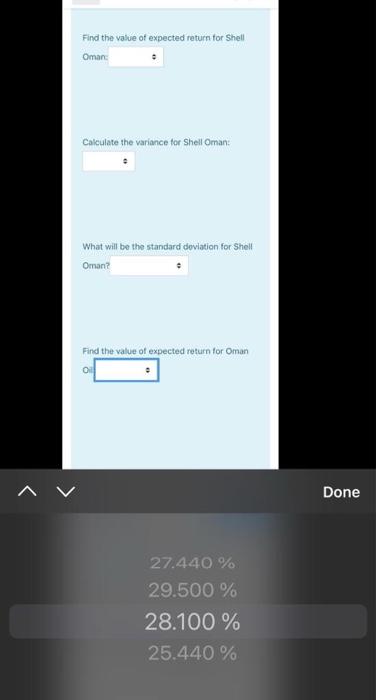

Question: JUST NEED OPTION no need explain NO need for explanation i will rate you Question 15 Not yet antwered Marked out of 400 Flag question

JUST NEED OPTION

no need explain

NO need for explanation

i will rate you

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock