Question: just need the answer for question # 14 in part 2 Finance Financial Statement Analysis - Mega Mouse Karate Schools, Inc.o Mary Fox Luquette, MBA,

just need the answer for question # 14 in part 2

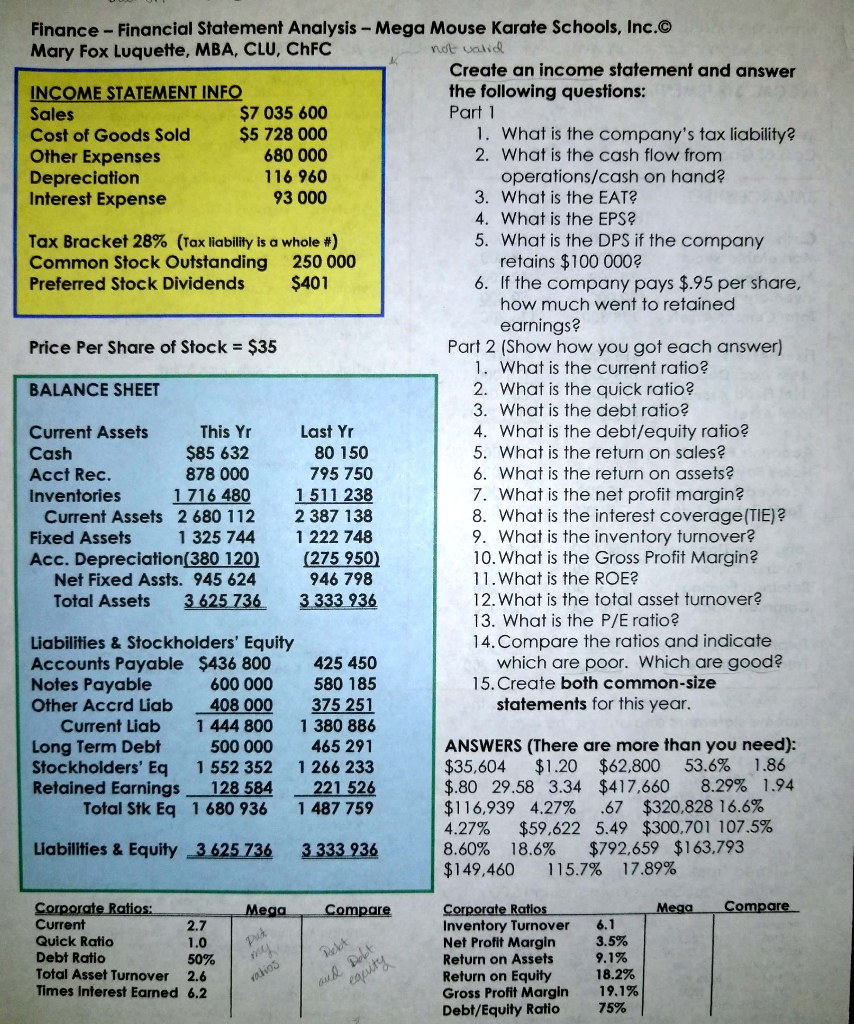

Finance Financial Statement Analysis - Mega Mouse Karate Schools, Inc.o Mary Fox Luquette, MBA, CLU, ChFC Create an income statement and answer the following questions: INCOME STATEMENT INFO Sales Cost of Goods Sold $5 728 000 Other Expenses Depreciation Interest Expens $7 035 600 1. What is the company's tax liabi 2. What is the cash flow from 680 000 116 960 operations/cash on hand? 3. What is the EAT? 4. What is the EPS? 5. What is the DPS if the company Tax Bracket 28% (Tax liability is a whole #) Common Stock Outstanding 250 000 Preferred Stock Dividends $401 retains $100 0002 6. If the company pays $.95 per share, how much went to retained earnings? Price Per Share of Stock $35 BALANCE SHEET Current Assets Acct Rec. Part 2 (Show how you got each answer) 1. What is the current ratio? 2. What is the quick ratio? 3. What is the debt ratio? 4. What is the debt/equity ratio? 5. What is the return on sales? 6. What is the return on assets? 7. What is the net profit margin? 8. What is the interest coverage(TIE)? 9. What is the inventory turnover? 10. What is the Gross Profit Margin 11.What is the ROE? 12.What is the total asset turnover 13. What is the P/E ratio? 14.Compare the ratios and indicate Last Y $85 632 Inventories 1 716 480 1511 238 Current Assets 2 680 112 2387 138 1325 744 1 222 748 Acc. Depreciation(380 120 (275 950) 946 798 Total Assets 3625 736 3333 936 Fixed Assets Net Fixed Assts. 945 624 Liabilities &Stockholders' Equity which are poor. Which are good Accounts Payable $436 800 425 450 600 000 580 185 Other Accrd Liab 408 000 375 251 Current Liab 1 444 800 1 380 886 500 000 465 291 Stockholders' Eq 1 552 352 1 266 233 Retained Earnings 128 584 221 526 Total Stk Eq 1 680 936 1 487 759 Notes Payable 15.Create both common-size statements for this year ANSWERS (There are more than you need): $35.604 $1.20 $62,800 53.6% 1.86 $.80 29.58 3.34 $417,660 8.29% 1.94 $116,939 4.27% .67 $320,828 16.6% 4.27% $59,622 5.49 $300,701 107.5% 8.60% 18.6% $792,659 $163,793 $149,460 115.7% 17.89% Long Term Debt Liabililties & Equity 3 625 736 3333 936 Corpor Inventory Turnover Net Profit Margin Return on Assets Return on Equity Gross Profit Margin Debt/Equity Ratio Me 6.1 3.5% Quick Ratio 50% Total Asset Turnover 2.6 Times Interest Earned 6.2 19.1% 75%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts