Question: Just need the answer to part e please Growth Company's current share price is $20.30, and it is expected to pay a $1.00 dividend per

Just need the answer to part e please

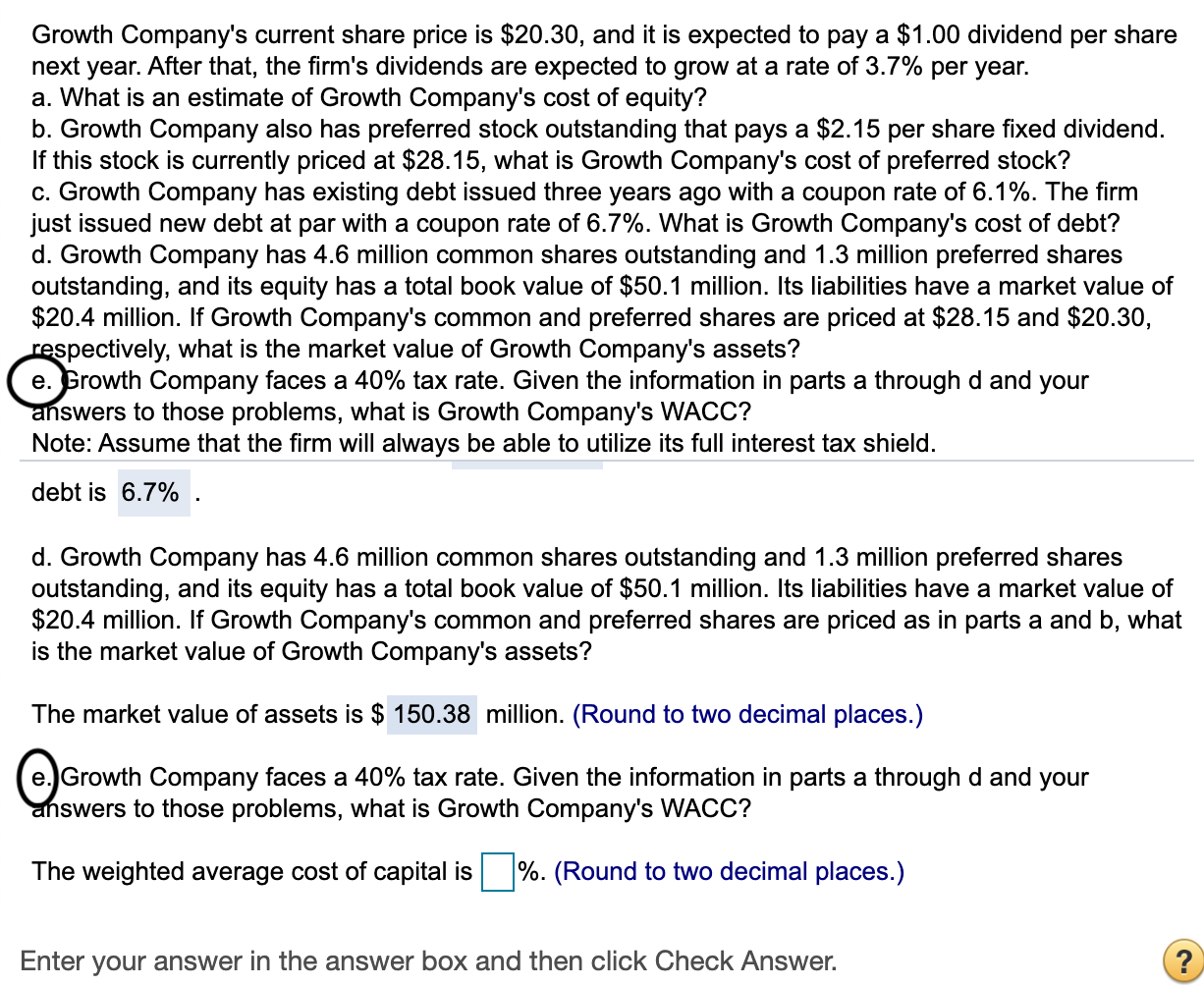

Growth Company's current share price is $20.30, and it is expected to pay a $1.00 dividend per share next year. After that, the firm's dividends are expected to grow at a rate of 3.7% per year. a. What is an estimate of Growth Company's cost of equity? b. Growth Company also has preferred stock outstanding that pays a $2.15 per share fixed dividend. If this stock is currently priced at $28.15, what is Growth Company's cost of preferred stock? c. Growth Company has existing debt issued three years ago with a coupon rate of 6.1%. The firm just issued new debt at par with a coupon rate of 6.7%. What is Growth Company's cost of debt? d. Growth Company has 4.6 million common shares outstanding and 1.3 million preferred shares outstanding, and its equity has a total book value of $50.1 million. Its liabilities have a market value of $20.4 million. If Growth Company's common and preferred shares are priced at $28.15 and $20.30, respectively, what is the market value of Growth Company's assets? e. Growth Company faces a 40% tax rate. Given the information in parts a through d and your answers to those problems, what is Growth Company's WACC? Note: Assume that the firm will always be able to utilize its full interest tax shield. debt is 6.7% . d. Growth Company has 4.6 million common shares outstanding and 1.3 million preferred shares outstanding, and its equity has a total book value of $50.1 million. Its liabilities have a market value of $20.4 million. If Growth Company's common and preferred shares are priced as in parts a and b, what is the market value of Growth Company's assets? The market value of assets is $ 150.38 million. (Round to two decimal places.) e. Growth Company faces a 40% tax rate. Given the information in parts a through d and your answers to those problems, what is Growth Company's WACC? The weighted average cost of capital is %. (Round to two decimal places.) Enter your answer in the answer box and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts