Question: just need the correct info for b-2 Ghost, Inc., has no debt outstanding and a total market value of $356,900. Earnings before interest and taxes,

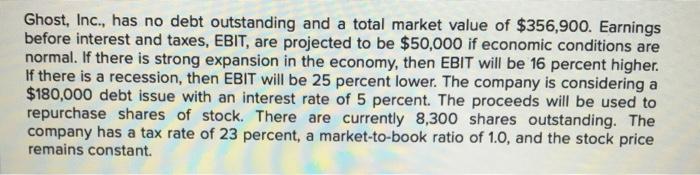

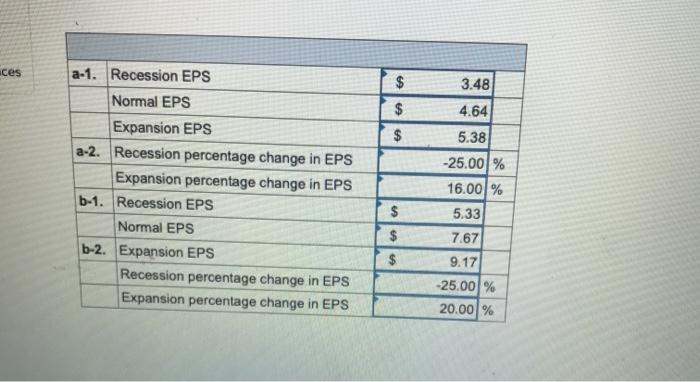

Ghost, Inc., has no debt outstanding and a total market value of $356,900. Earnings before interest and taxes, EBIT, are projected to be $50,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 16 percent higher. If there is a recession, then EBIT will be 25 percent lower. The company is considering a $180,000 debt issue with an interest rate of 5 percent. The proceeds will be used to repurchase shares of stock. There are currently 8,300 shares outstanding. The company has a tax rate of 23 percent, a market-to-book ratio of 1.0, and the stock price remains constant. aces 3.48 $ $ $ $ a-1. Recession EPS Normal EPS Expansion EPS a-2. Recession percentage change in EPS Expansion percentage change in EPS b-1. Recession EPS Normal EPS b-2. Expansion EPS Recession percentage change in EPS Expansion percentage change in EPS $ 4.64 5.38 -25.00% 16.00% 5.33 7.67 9.17 -25.00% 20.00% $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts