Question: Just need the incorrect answer at the bottom.. Cullumber Corp. has 18-year bonds outstanding. These bonds, which pay interest semiannually, have a coupon rate of

Just need the incorrect answer at the bottom..

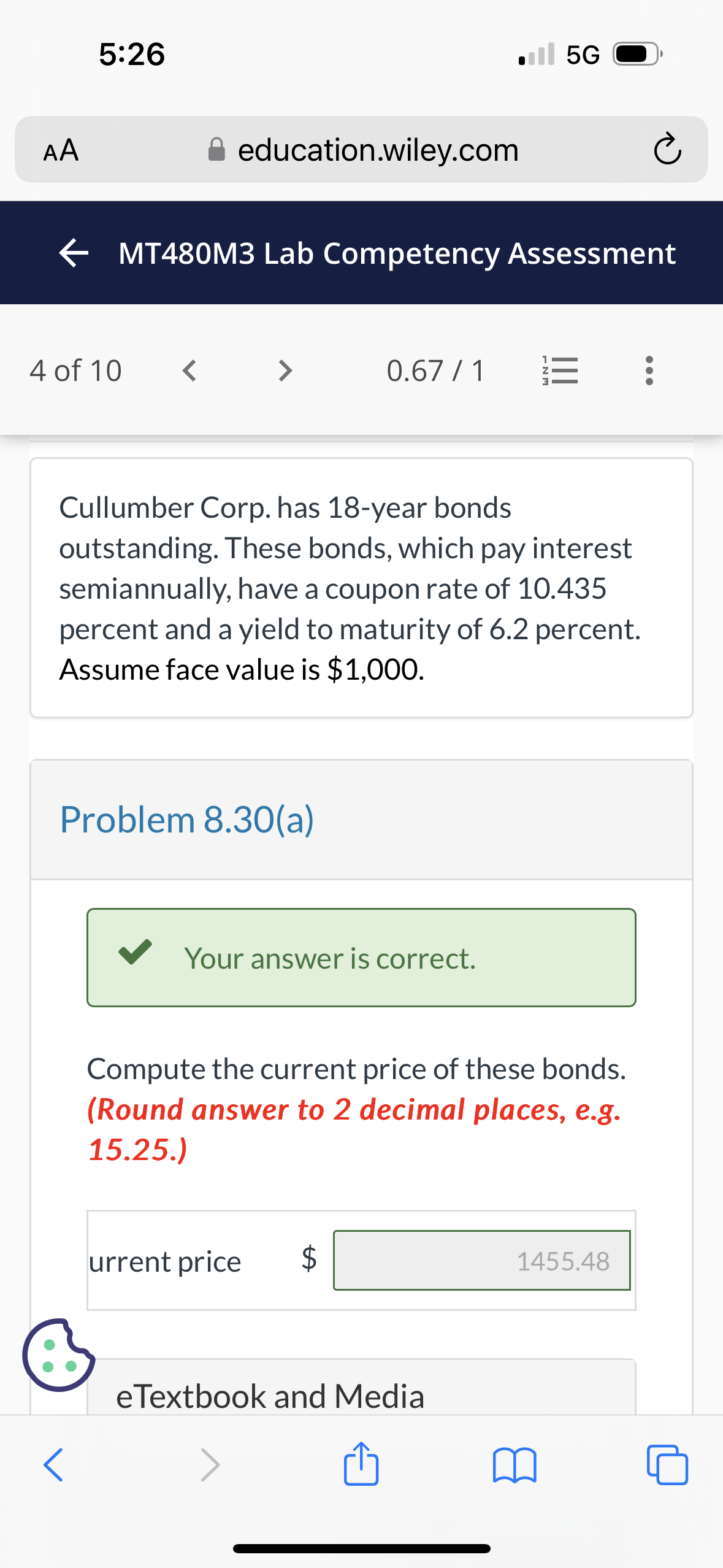

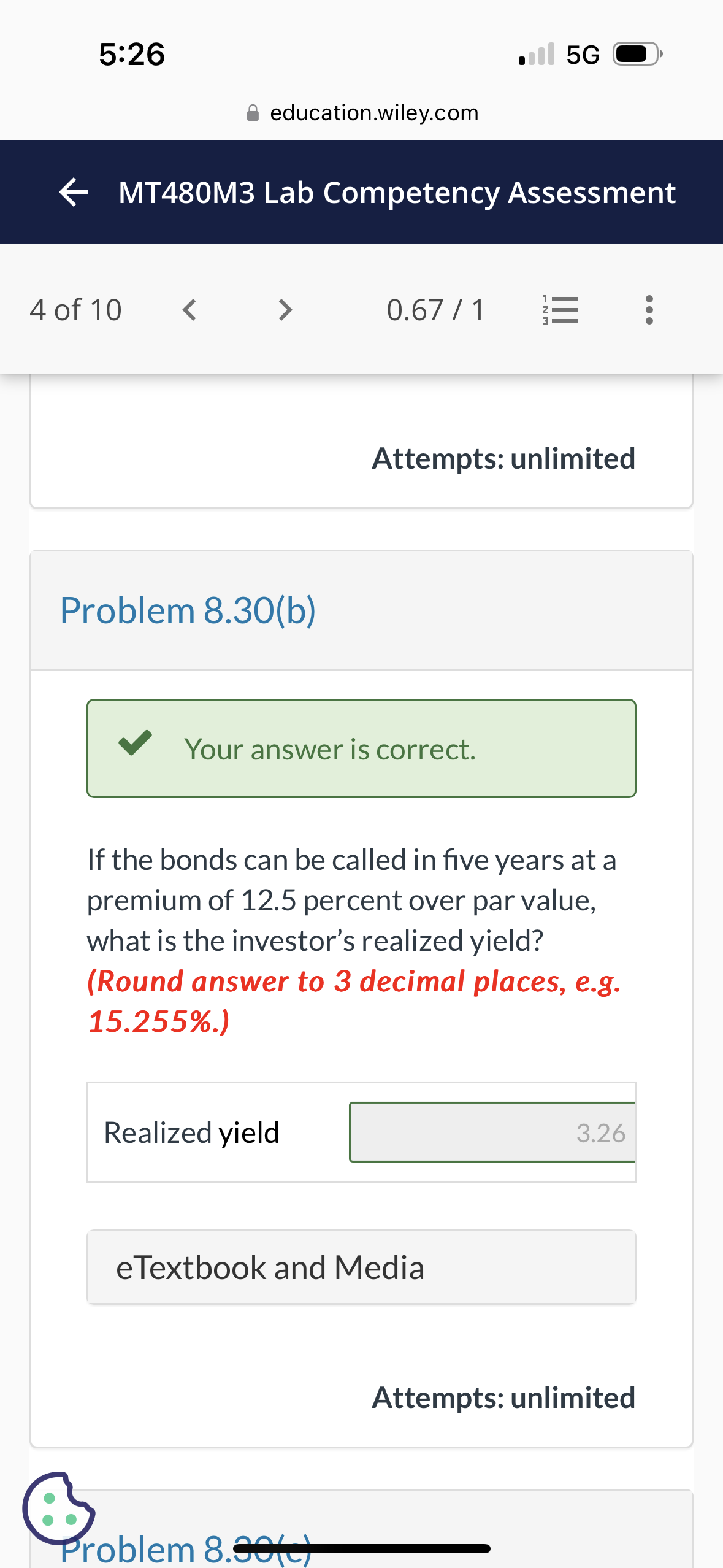

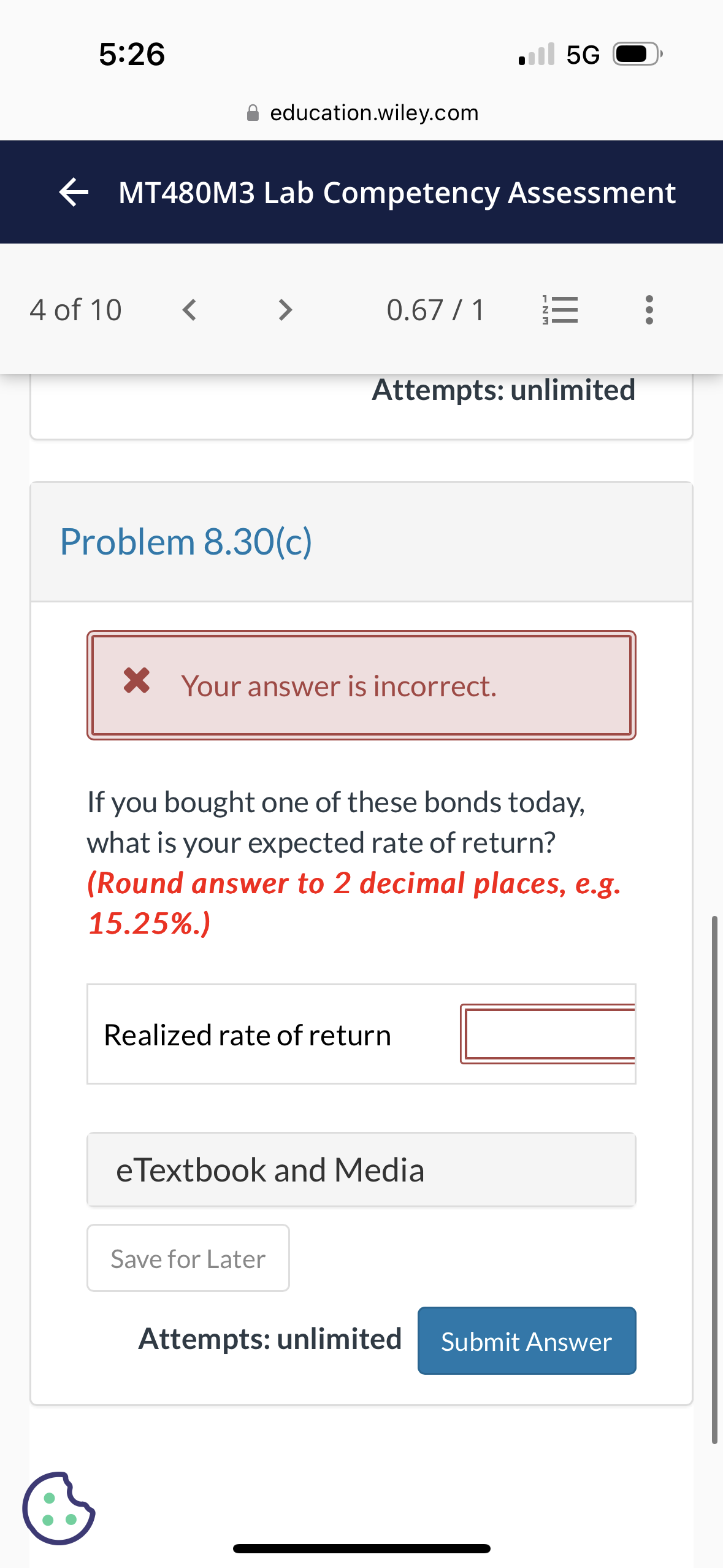

Cullumber Corp. has 18-year bonds outstanding. These bonds, which pay interest semiannually, have a coupon rate of 10.435 percent and a yield to maturity of 6.2 percent. Assume face value is $1,000. Problem 8.30(a) Compute the current price of these bonds. (Round answer to 2 decimal places, e.g. 15.25.) MT480M3 Lab Competency Assessment 4 of 100.67/1 : Attempts: unlimited Problem 8.30(b) Your answer is correct. If the bonds can be called in five years at a premium of 12.5 percent over par value, what is the investor's realized yield? (Round answer to 3 decimal places, e.g. 15.255\%.) Realized yield Attempts: unlimited MT480M3 Lab Competency Assessment 4 of 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts