Question: just need to fill out blanks Current Attempt in Progress The chief financial officer (CFO) of Cullumber Company requested that the accounting department prepare a

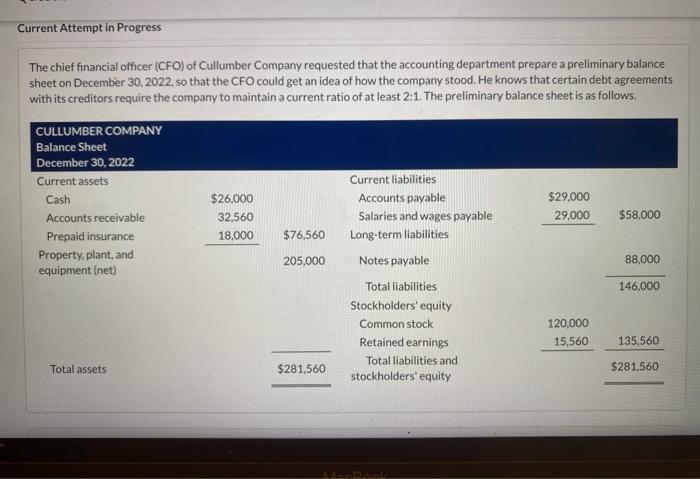

Current Attempt in Progress The chief financial officer (CFO) of Cullumber Company requested that the accounting department prepare a preliminary balance sheet on December 30, 2022, so that the CFO could get an idea of how the company stood. He knows that certain debt agreements with its creditors require the company to maintain a current ratio of at least 2:1. The preliminary balance sheet is as follows. CULLUMBER COMPANY Balance Sheet December 30, 2022 Current assets Cash $26.000 $29.000 29.000 $58,000 32,560 18.000 $76,560 Accounts receivable Prepaid insurance Property, plant, and equipment (net) 205,000 88,000 Current liabilities Accounts payable Salaries and wages payable Long-term liabilities Notes payable Total liabilities Stockholders' equity Common stock Retained earnings Total liabilities and stockholders' equity 146,000 120,000 15,560 135,560 Total assets $281,560 $281,560 (a) Calculate the current ratio and working capital based on the preliminary balance sheet. (Round current ratio to 2 decimal places, eg. 15.22) Current ratio :1 Working capital $ Save for Later Attempts: 0 of 1 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts