Question: Just need to know what Im doing wrong with finding the average tax rate Hunt Taxidermy, Inc. is concerned about the taxes paid by the

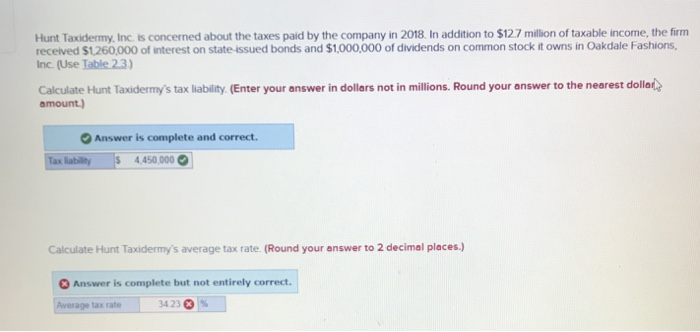

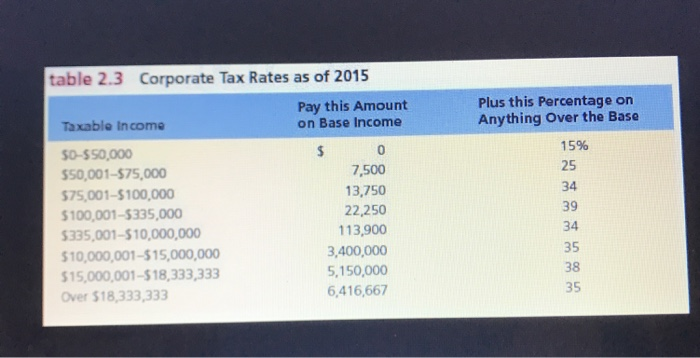

Hunt Taxidermy, Inc. is concerned about the taxes paid by the company in 2018. In addition to $12.7 million of taxable income, the firm received $1260,000 of interest on state-issued bonds and $1,000,000 of dividends on common stock it owns in Oakdale Fashions, Inc. (Use Table 2.3) Calculate Hunt Taxidermy's tax liability. (Enter your answer in dollars not in millions. Round your answer to the nearest dollar amount.) Answer is complete and correct. Tax labilty4450 000 0 Calculate Hunt Taxidermy's average tax rate. (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. tax rate table 2.3 Corporate Tax Rates as of 2015 Pay this Amount on Base Income Plus this Percentage on Anything Over the Base Taxable Income S0-$50,000 50,001-575,000 75,001-$100,000 100,001-$335,000 335,001-$10,000,000 10,000,001-$15,000,000 15,000,001-$18,333,333 Over $18,333,333 0 7,500 13,750 22,250 13,900 3,400,000 5,150,000 6,416,667 15% 25 34 39 34 35 38 35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts