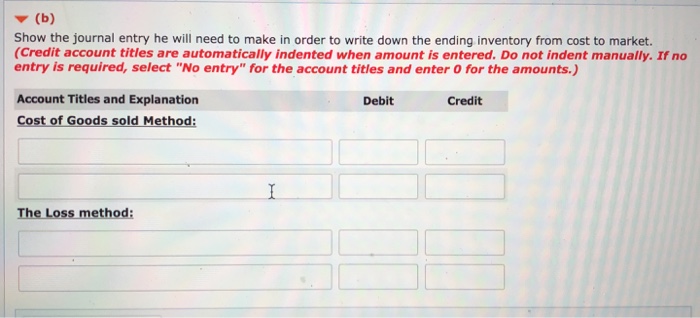

Question: Just Part B Problem 9-5 (Part Level Submission) Ivanhoe Co. follows the practice of valuing its inventory at the lower-of-cost-or-market. The following information is available

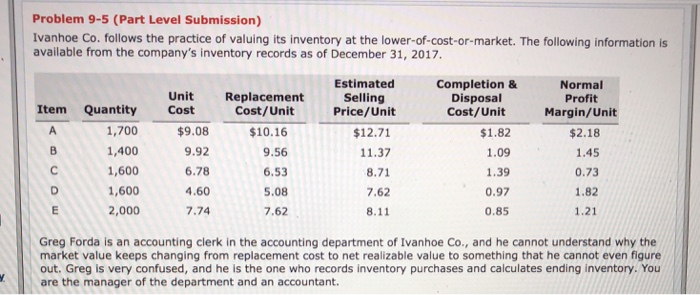

Problem 9-5 (Part Level Submission) Ivanhoe Co. follows the practice of valuing its inventory at the lower-of-cost-or-market. The following information is available from the company's inventory records as of December 31, 2017. Estimated Selling Completion & Disposal Cost/Unit Normal Profit Margin/Unit $2.18 1.45 0.73 1.82 1.21 Unit Cost Replacement Item Quantity 1,700 1,400 1,600 1,600 2,000 CS Cost/Unit Price/Unit $9.08 9.92 6.78 4.60 7.74 $10.16 9.56 6.53 5.08 7.62 $12.71 11.37 8.71 7.62 8.11 $1.82 1.09 1.39 0.97 0.85 Greg Forda is an accounting clerk in the accounting department of Ivanhoe Co., and he cannot understand why the market value keeps changing from replacement cost to net realizable value to something that he cannot even figure out. Greg is very confused, and he is the one who records inventory purchases and calculates ending inventory. You are the manager of the department and an accountant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts