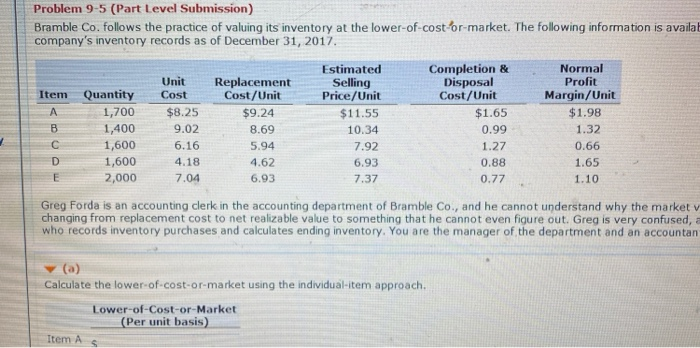

Question: Problem 9-5 (Part Level Submission) Bramble Co. follows the practice of valuing its inventory at the lower-of-cost-or-market. The following information is availab company's inventory records

Problem 9-5 (Part Level Submission) Bramble Co. follows the practice of valuing its inventory at the lower-of-cost-or-market. The following information is availab company's inventory records as of December 31, 2017. Item Quantity 1,700 1,400 1,600 1,600 2,000 Unit Cost $8.25 9.02 6.16 4.18 7.04 Replacement Cost/Unit $9.24 8.69 5.94 4.62 6.93 Estimated Selling Price/Unit $11.55 10.34 7.92 6.93 7.37 Completion & Disposal Cost/Unit $1.65 0.99 1.27 0.88 0.77 Normal Profit Margin/Unit $1.98 1.32 0.66 1.65 1.10 Greg Forda is an accounting clerk in the accounting department of Bramble Co., and he cannot understand why the market v changing from replacement cost to net realizable value to something that he cannot even figure out. Greg is very confused, a who records inventory purchases and calculates ending inventory. You are the manager of the department and an accountan (a) Calculate the lower-of-cost-or-market using the individual-item approach. Lower-of-Cost-or-Market (Per unit basis) Item AS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts