Question: SECTION A Answer ALL the questions in this section. Study the statement of cash flows of Mantis Limited for the year ended 31 December

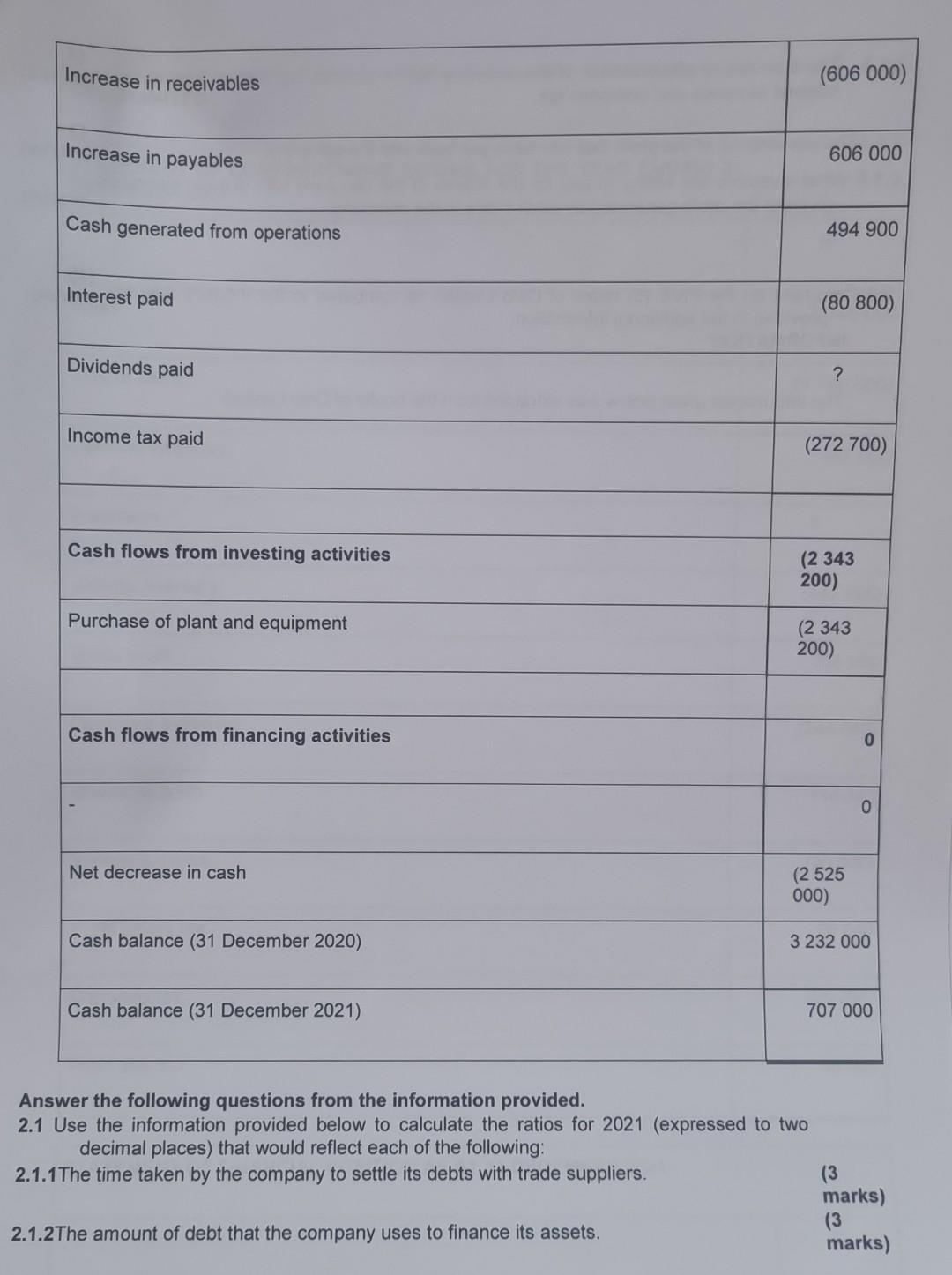

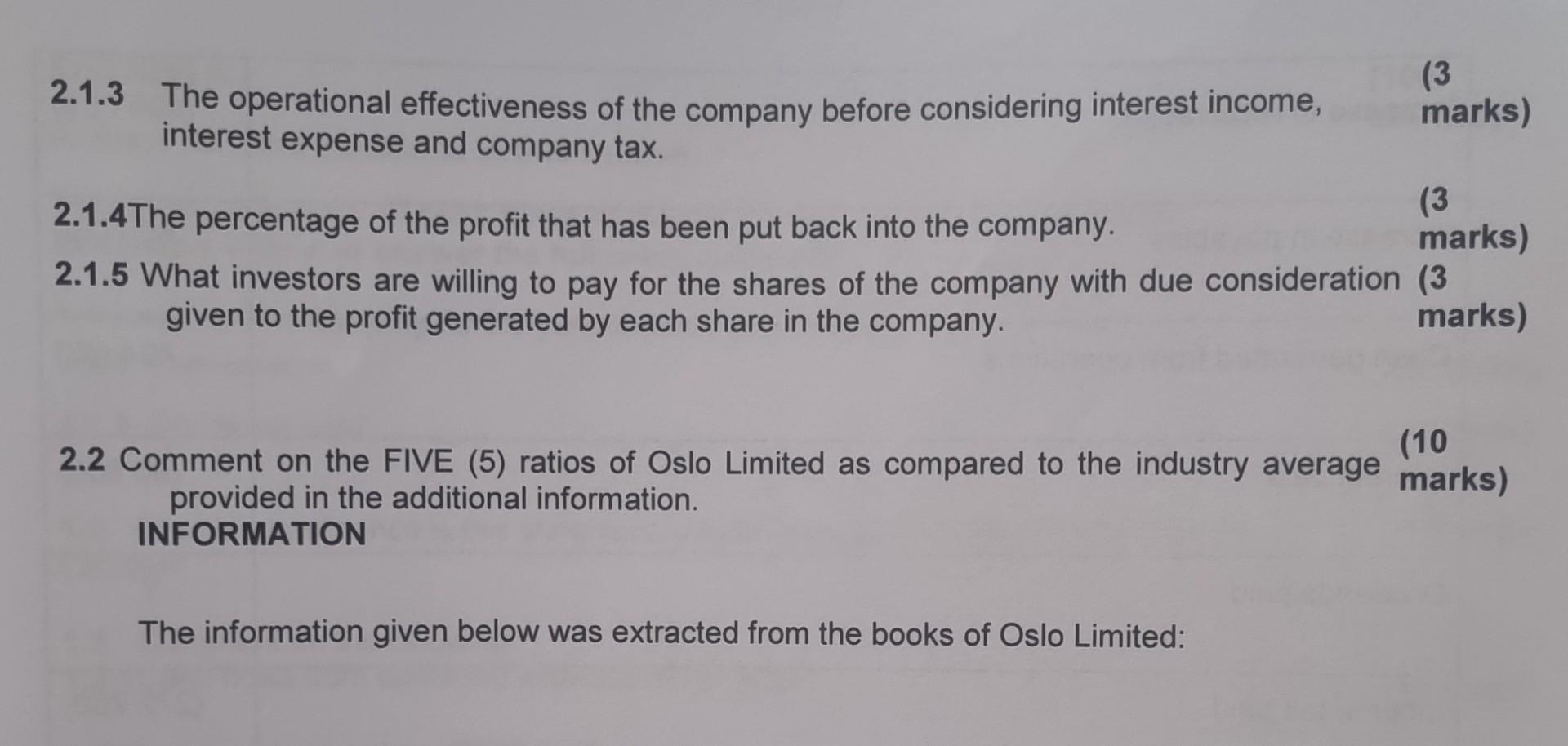

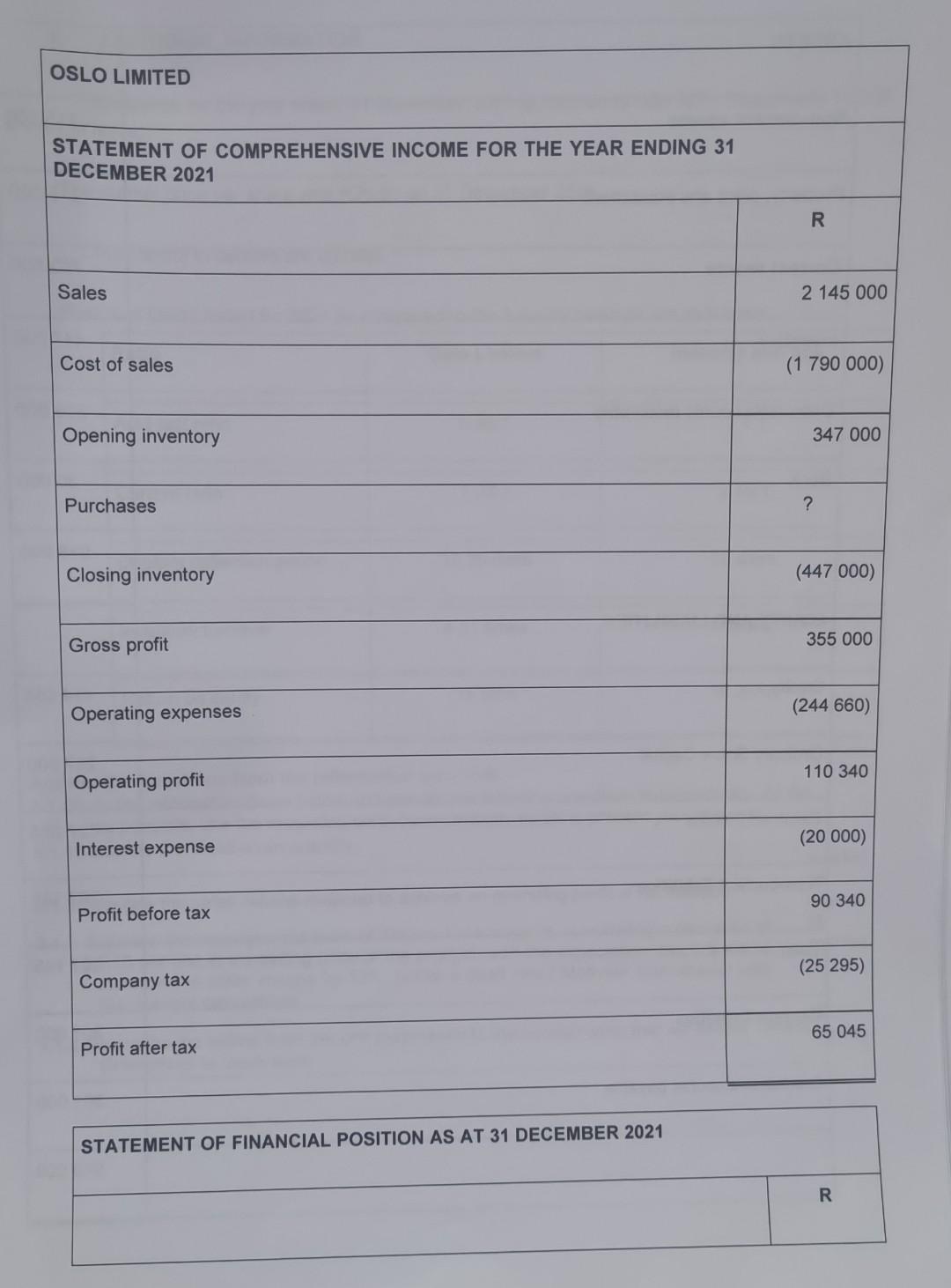

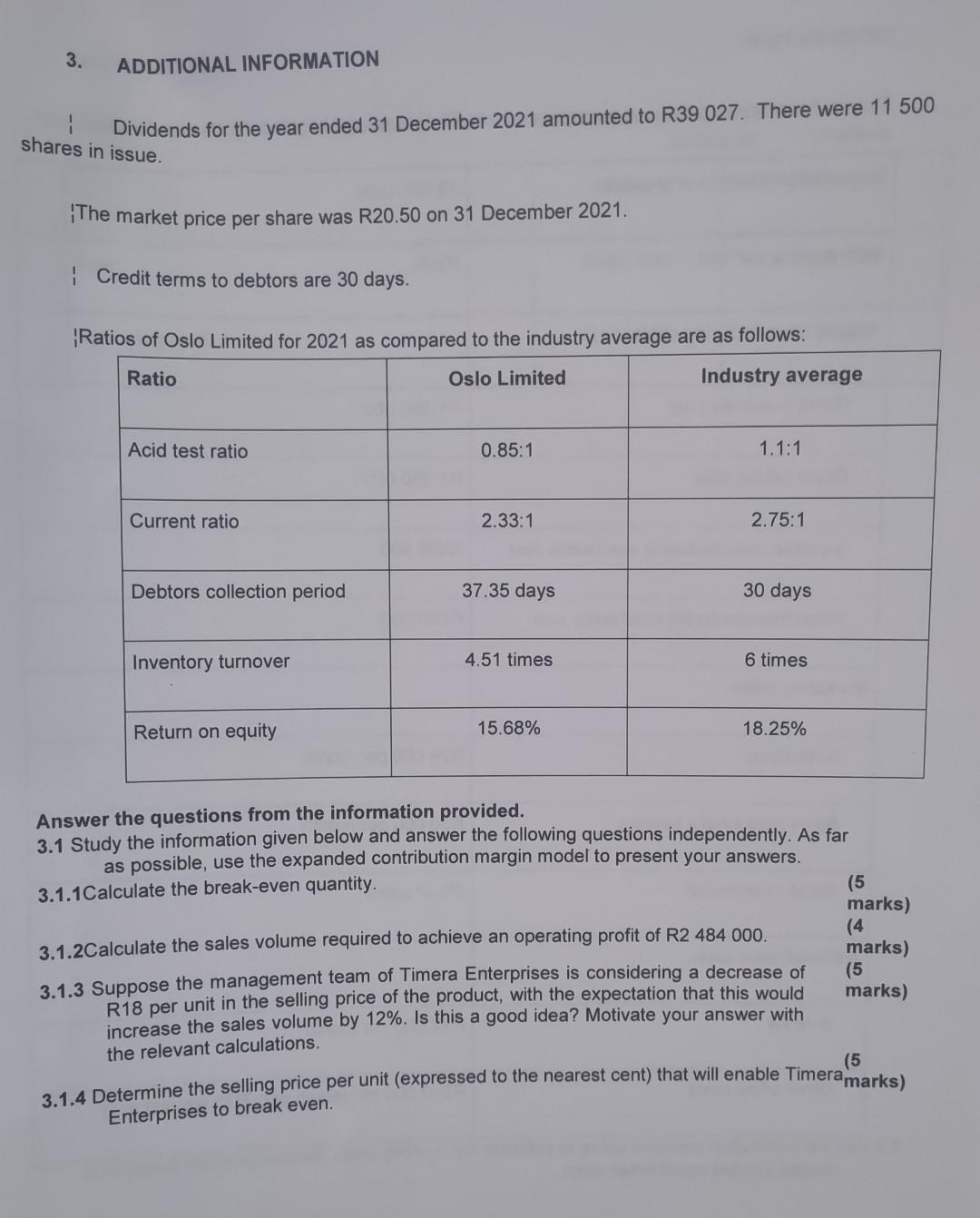

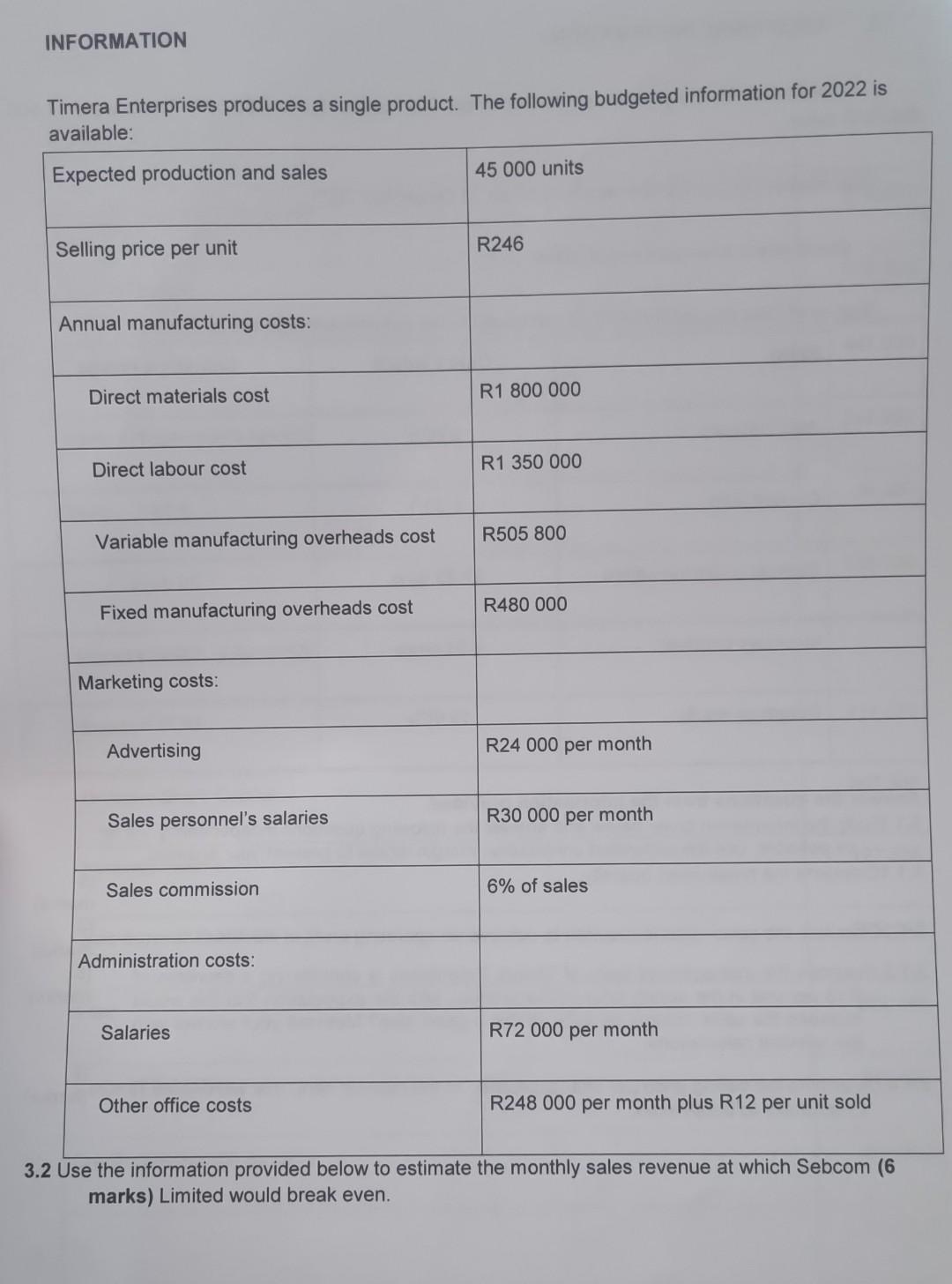

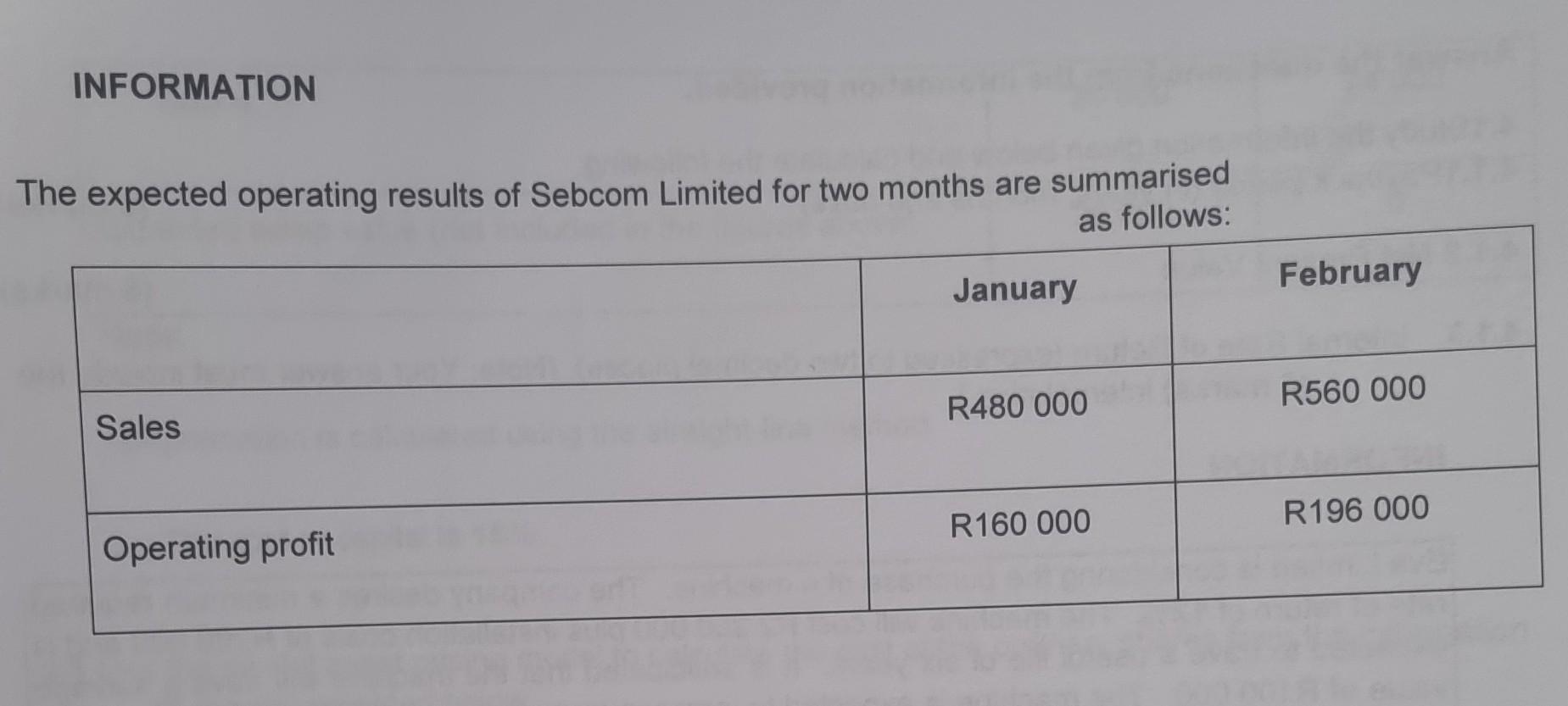

SECTION A Answer ALL the questions in this section. Study the statement of cash flows of Mantis Limited for the year ended 31 December 2021 and answer the following questions: 1.1Calculate the following for the year ended 31 December 2021: 1.1.1 Depreciation 1.1.2 Dividends paid 1.2 Of what significance is this statement of cash flows to the shareholders of Mantis Limited? 1.3 Comment on the following: 1.3.1Cash flows from operating activities (R181 800) 1.3.2Increase in inventory (R808 000) 1.3.3Increase in receivables (R606 000) 1.3.4 Interest paid (R80 800) 1.3.5Cash flows from investing activities (R2 343 200) INFORMATION MANTIS LIMITED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 DECEMBER 2021 Cash flows from operating activities Operating profit Depreciation Profit before working capital changes Working capital changes Increase in inventory [100 MARKS] marks) (2 marks) (1 marks) (4 marks) (4 marks) (4 marks) (4 marks) (4 marks) R (181 800) 979 700 ? ? (808 000) (808 000) Increase in receivables Increase in payables Cash generated from operations Interest paid Dividends paid Income tax paid Cash flows from investing activities Purchase of plant and equipment Cash flows from financing activities Net decrease in cash Cash balance (31 December 2020) Cash balance (31 December 2021) 2.1.2The amount of debt that the company uses to finance its assets. (606 000) 606 000 494 900 (80 800) ? (272 700) Answer the following questions from the information provided. 2.1 Use the information provided below to calculate the ratios for 2021 (expressed to two decimal places) that would reflect each of the following: 2.1.1 The time taken by the company to settle its debts with trade suppliers. (2 343 200) (2 343 200) (2 525 000) 0 0 3 232 000 707 000 (3 marks) (3 marks) 2.1.3 The operational effectiveness of the company before considering interest income, interest expense and company tax. (3 marks) 2.1.4The percentage of the profit that has been put back into the company. (3 marks) 2.1.5 What investors are willing to pay for the shares of the company with due consideration (3 given to the profit generated by each share in the company. marks) (10 2.2 Comment on the FIVE (5) ratios of Oslo Limited as compared to the industry average marks) provided in the additional information. INFORMATION The information given below was extracted from the books of Oslo Limited: OSLO LIMITED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDING 31 DECEMBER 2021 Sales Cost of sales Opening inventory Purchases Closing inventory Gross profit Operating expenses Operating profit Interest expense Profit before tax Company tax Profit after tax STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2021 R 2 145 000 (1 790 000) 347 000 ? (447 000) 355 000 (244 660) 110 340 (20 000) 90 340 (25 295) 65 045 R ASSETS Non-current assets Property, plant and equipment Current assets Inventory Debtors/Accounts receivable Bank EQUITY AND LIABILITIES Equity Ordinary Share Capital Retained Income Non-current liabilities Loan Current liabilities Creditors/Accounts payable 215 500 215 500 702 500 447 000 219 500 36 000 918 000 414 855 287 500 127 355 202 145 202 145 301 000 301 000 918 000 3. ADDITIONAL INFORMATION Dividends for the year ended 31 December 2021 amounted to R39 027. There were 11 500 shares in issue. The market price per share was R20.50 on 31 December 2021. Credit terms to debtors are 30 days. Ratios of Oslo Limited for 2021 as compared to the industry average are as follows: Ratio Oslo Limited Industry average Acid test ratio Current ratio Debtors collection period Inventory turnover Return on equity 0.85:1 2.33:1 37.35 days 4.51 times 15.68% 1.1:1 2.75:1 30 days 6 times 18.25% Answer the questions from the information provided. 3.1 Study the information given below and answer the following questions independently. As far as possible, use the expanded contribution margin model to present your answers. 3.1.1 Calculate the break-even quantity. 3.1.2Calculate the sales volume required to achieve an operating profit of R2 484 000. 3.1.3 Suppose the management team of Timera Enterprises is considering a decrease of R18 per unit in the selling price of the product, with the expectation that this would increase the sales volume by 12%. Is this a good idea? Motivate your answer with the relevant calculations. (5 marks) (4 marks) (5 marks) 3.1.4 Determine the selling price per unit (expressed to the nearest cent) that will enable Timera marks) Enterprises to break even. INFORMATION Timera Enterprises produces a single product. The following budgeted information for 2022 is available: Expected production and sales Selling price per unit Annual manufacturing costs: Direct materials cost Direct labour cost Variable manufacturing overheads cost Fixed manufacturing overheads cost Marketing costs: Advertising Sales personnel's salaries Sales commission Administration costs: Salaries Other office costs 45 000 units R246 R1 800 000 R1 350 000 R505 800 R480 000 R24 000 per month R30 000 per month 6% of sales R72 000 per month R248 000 per month plus R12 per unit sold 3.2 Use the information provided below to estimate the monthly sales revenue at which Sebcom (6 marks) Limited would break even. INFORMATION The expected operating results of Sebcom Limited for two months are summarised as follows: Sales Operating profit January R480 000 R160 000 February R560 000 R196 000

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

in Depreciation 97970494900 808000 3 Significants 8 ... View full answer

Get step-by-step solutions from verified subject matter experts

![SECTION A [100 MARKS] Answer ALL the questions in this section. Study the statement of cash flows of Mantis Limited for the y](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/09/631882c87c593_1662550926768.jpg)