Question: just solve for current liability and non-current liability what will be the entry for redemption of bonds assuming ... part below On January 1, 2024,

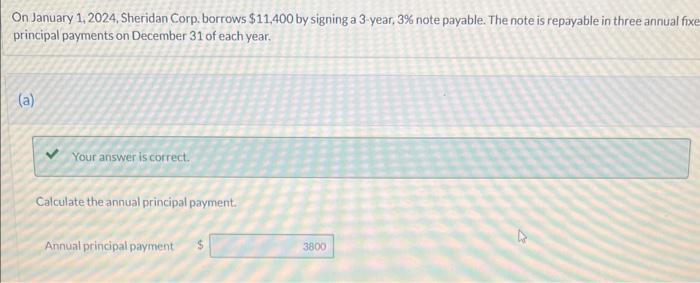

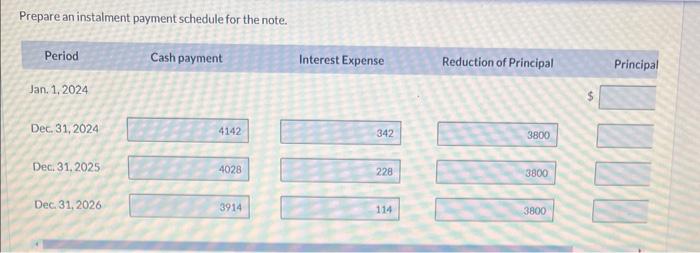

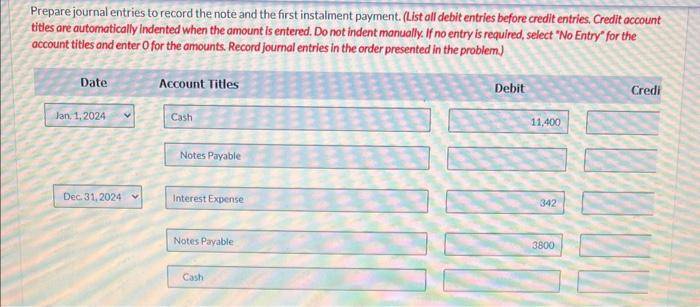

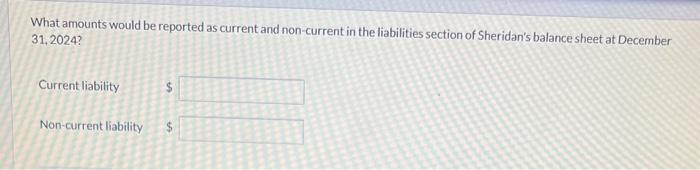

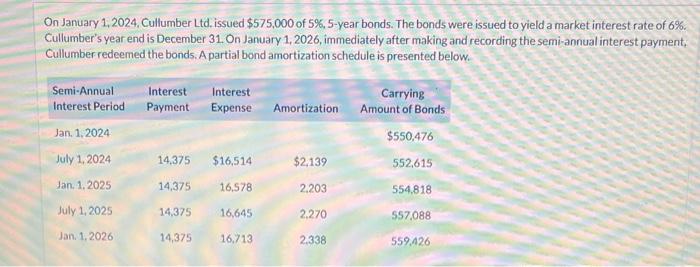

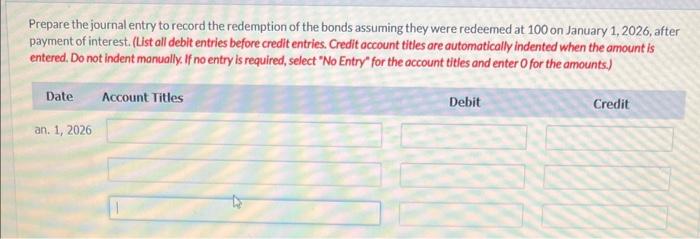

On January 1, 2024, Sheridan Corp. borrows $11,400 by signing a 3-year, 3% note payable. The note is repayable in three annual fixe principal payments on December 31 of each year. (a) Your answer is correct. Calculate the annual principal payment. Annual principal payment Prepare an instalment payment schedule for the note. Prepare journal entries to record the note and the first instalment payment. (List all debit entries before credit entries. Credit occount titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter 0 for the amounts. Record joumal entries in the order presented in the problem) What amounts would be reported as current and non-current in the liabilities section of Sheridan's balance sheet at December 31,2024 ? Current liability Non-current liability On January 1, 2024. Cullumber Ltd. issued $575,000 of 5%,5-year bonds. The bonds were issued to yield a market interest rate of 6%. Cullumber's year end is December 31 . On January 1, 2026, immediately after making and recording the semi-annual interest payment, Cullumber redeemed the bonds. A partial bond amortization schedule is presented below. Prepare the journal entry to record the redemption of the bonds assuming they were redeemed at 100 on January 1,2026 , after payment of interest. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select " No Entry" for the account titles and enter O for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts