Question: just the unasnwered problem is needed James Smith operates a kiosk in downtown Chicago, at which he sells one style of baseball hat. He buys

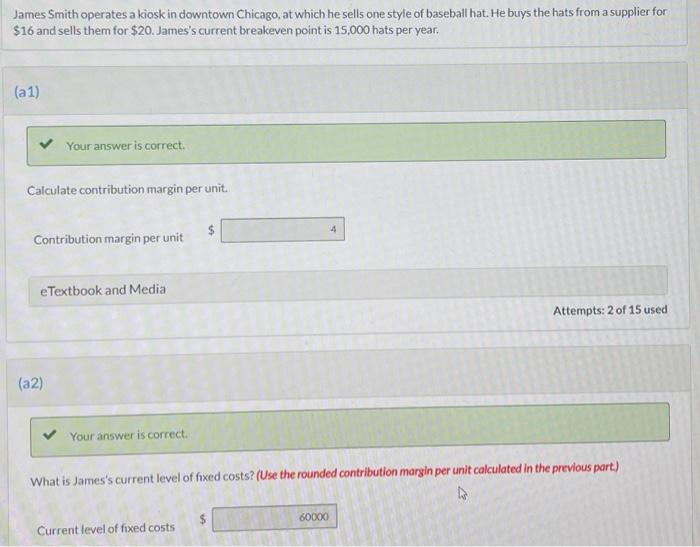

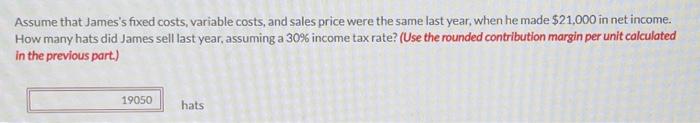

James Smith operates a kiosk in downtown Chicago, at which he sells one style of baseball hat. He buys the hats from a supplier for $16 and sells them for $20. James's current breakeven point is 15,000 hats per year. (a 1) Your answer is correct. Calculate contribution margin per unit. 4 Contribution margin per unit eTextbook and Media Attempts: 2 of 15 used (a2) Your answer is correct. What is James's current level of fixed costs? (Use the rounded contribution margin per unit calculated in the previous part) 80000 Current level of fixed costs Assume that James's fixed costs, variable costs, and sales price were the same last year, when he made $21,000 in net income. How many hats did James sell last year, assuming a 30% income tax rate? Use the rounded contribution margin per unit calculated in the previous part.) 19050 hats

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts