Question: Just want verification that its the correct answer on all three questions! please help! Consider a C corporation. The corporation earns $2.5 per share before

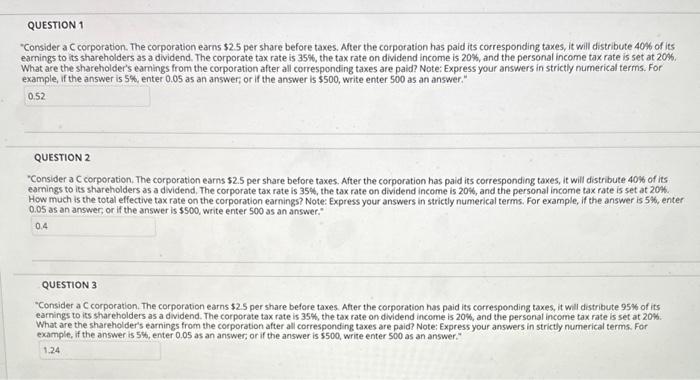

"Consider a C corporation. The corporation earns $2.5 per share before taxes. Ater the corporation has paid its corresponding taxes, it will distribute 406 of its earnings to its shareholders as a dividend. The corporate tax rate is 35%, the tax rate on dividend income is 20%, and the personal income tax rate is set at 20%. What are the shareholder's eamings from the corporation after all corresponding taxes are paid? Note: Express your answers in strictly numerical terms. For example. if the answer is 5%, enter 0.05 as an answer; or if the answer is $500, write enter 500 as an answer." QUESTION 2 "Consider a C corporation. The corporation earns $2.5 per share before taxes. After the corporation has paid its corresponding taxes, it will distribute 40% of its earnings to its shareholders as a didend. The corporate tax rate is 35%, the tax rate on dividend income is 20%, and the personal income tax rate is set at 20%. How much is the total effective tax rate on the corporation earnings? Note: Express your answers in strictly numerical terms. For example, if the answer is 5 . enter 0.05 as an answer, or if the answer is $500, write enter 500 as an answer." QUESTION 3 "Consider a C corporation. The corporation earns $2.5 per share before taxes. After the corporation has paid its corresponding taxes, it will distribute 95% of its earnings to its shareholders as a dividend. The corporate tax rate is 35%, the tax rate on dividend income is 20%, and the personal income tax rate is set at 20%. What are the shareholder's earnings from the corporation after all corresponding taxes are paid? Note; Express your answers in strictly numerical terms. For exampie. if the answer is 5%. enter 0.05 as an answer; or if the answer is $500, write enter 500 as an

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts