Question: Just write me the formulas https://www.chegg.com/homework-help/Succeeding-in-Business-with-Microsoft-Excel-2013-1st-edition-chaptes Chegg Study TEXTBOOK SOLUTIONS EXPERT Q&A Chapter 6, Problem 1CP (4 Bookmarks) Show all steps: tne 1. Open the

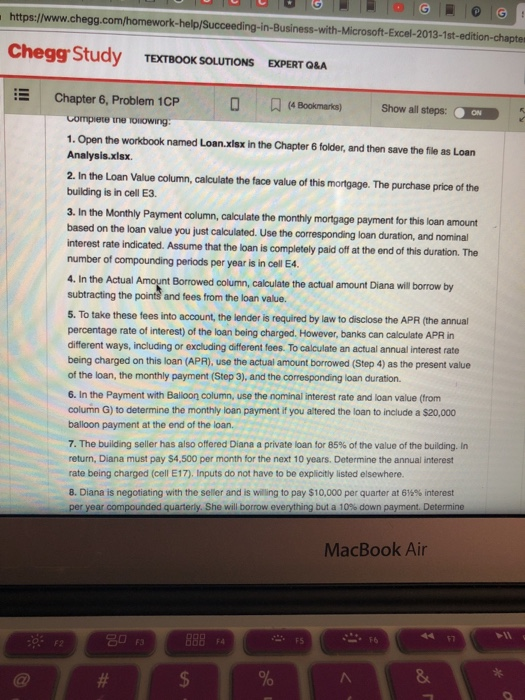

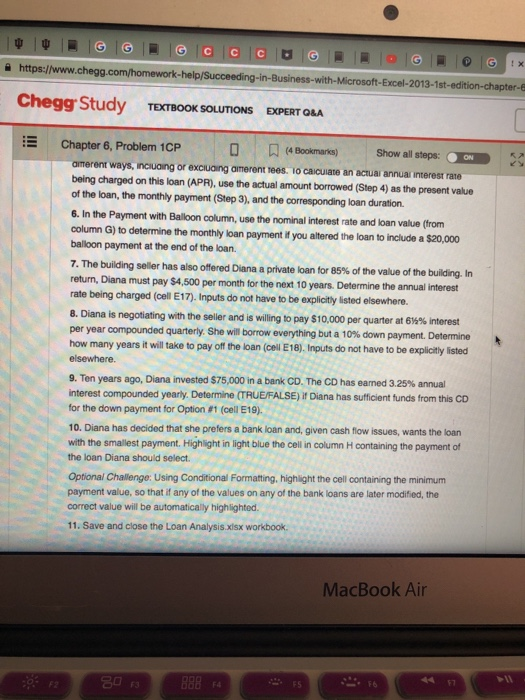

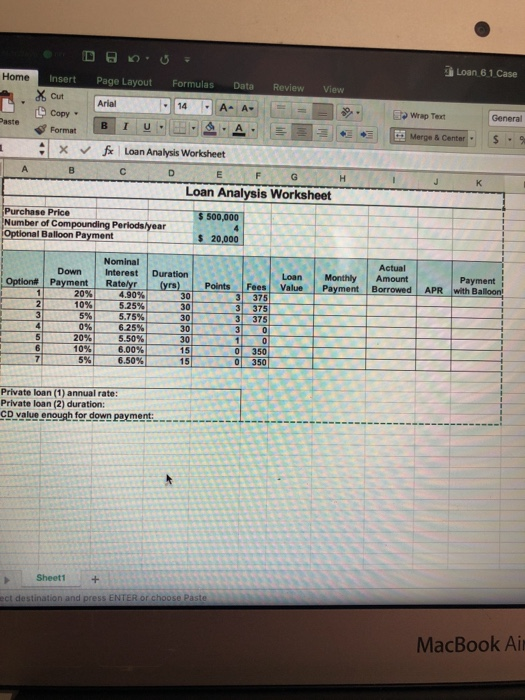

https://www.chegg.com/homework-help/Succeeding-in-Business-with-Microsoft-Excel-2013-1st-edition-chaptes Chegg Study TEXTBOOK SOLUTIONS EXPERT Q&A Chapter 6, Problem 1CP (4 Bookmarks) Show all steps: tne 1. Open the workbook named Loan.xisx in the Chapter 6 folder, and then save the file as Loan Analysis.xlsx 2. In the Loan Value column, calculate the face value of this mortgage. The purchase price of the building is in cell E3. 3. In the Monthly Payment column, calculate the monthly mortgage payment for this loan amount based on the loan value you just calculated. Use the corresponding loan duration, and nominal interest rate indicated. Assume that the loan is completely paid off at the end of this duration. The number of compounding periods per year is in cell E4. 4. In the Actual subtracting the points and fees from the loan value. 5. To take these fees into account, the lender is required by law to disclose the APR (the annual percentage rate of interest) of the loan being charged. However, banks can calculate APR in different ways, including or excluding different fees. To calculate an actual annual interest rate being charged on this loan (APR), use the actual amount borrowed (Step 4) as the present value of the loan, the monthly payment (Step 3), and the corresponding loan duration. Borrowed column, calculate the actual amount Diana will borrow by 6. In the Payment with Balloon column, use the nominal interest rate and loan value (trom column G) to determine the monthly loan payment if you altered the loan to include a $20,000 balloon payment at the end of the loan. 7. The building seller has also offered Diana a private loan for 85% of the value of the building. In return, Diana must pay $4,500 per month for the next 10 years. Determine the annual interest rate being charged (cell E17). Inputs do not have to be explicitly listed elsewhere 8. Diana is negotiating with the seller and is willing to pay S10, per quarter at 614% interest peryear compounded quarterly. She will borrow everything but a 10% down payment. Determine MacBook Air 30 988 FA 8 https://www.chegg.com/homework-help/Succeeding-in-Business-with-Microsoft-Excel-2013-1st-edition-chaptes Chegg Study TEXTBOOK SOLUTIONS EXPERT Q&A Chapter 6, Problem 1CP (4 Bookmarks) Show all steps: tne 1. Open the workbook named Loan.xisx in the Chapter 6 folder, and then save the file as Loan Analysis.xlsx 2. In the Loan Value column, calculate the face value of this mortgage. The purchase price of the building is in cell E3. 3. In the Monthly Payment column, calculate the monthly mortgage payment for this loan amount based on the loan value you just calculated. Use the corresponding loan duration, and nominal interest rate indicated. Assume that the loan is completely paid off at the end of this duration. The number of compounding periods per year is in cell E4. 4. In the Actual subtracting the points and fees from the loan value. 5. To take these fees into account, the lender is required by law to disclose the APR (the annual percentage rate of interest) of the loan being charged. However, banks can calculate APR in different ways, including or excluding different fees. To calculate an actual annual interest rate being charged on this loan (APR), use the actual amount borrowed (Step 4) as the present value of the loan, the monthly payment (Step 3), and the corresponding loan duration. Borrowed column, calculate the actual amount Diana will borrow by 6. In the Payment with Balloon column, use the nominal interest rate and loan value (trom column G) to determine the monthly loan payment if you altered the loan to include a $20,000 balloon payment at the end of the loan. 7. The building seller has also offered Diana a private loan for 85% of the value of the building. In return, Diana must pay $4,500 per month for the next 10 years. Determine the annual interest rate being charged (cell E17). Inputs do not have to be explicitly listed elsewhere 8. Diana is negotiating with the seller and is willing to pay S10, per quarter at 614% interest peryear compounded quarterly. She will borrow everything but a 10% down payment. Determine MacBook Air 30 988 FA 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts