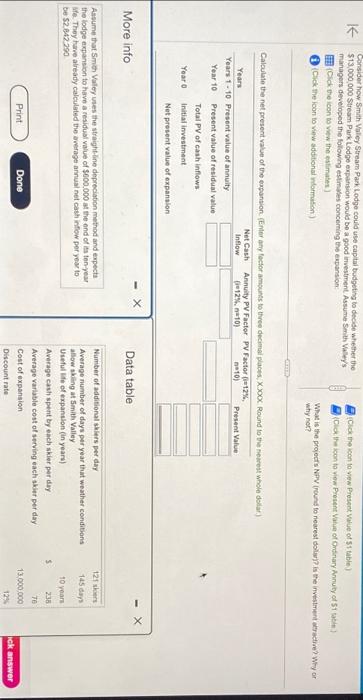

Question: K Consider how Smith Valley Stream Park Lodge could use capital budgeting to decide whether the $13,000,000 Stream Park Lodge expansion would be a good

K \$13,000,000 Slream Park tiodge expelmbion would be a good investment Assume Sm th Wal of? (Cick the igen 10 vien Presect Walue of 51 tabled) franagors developod the lidowing estimates concerning the eupansion (Pick the icon bis vitw the eslimater ] (Cick the ioon bo view sdditionat ingormusion]) What is the projecis Nipy (nound fo nearest dolugi? is whe investment atr actroe? Wry or why not? More info Data table Assume that Smoh Valey unes the straight-line depreciation method and expecta the lodge expansion to havo a residusl value of $600,000 at the ond of ta tenyea ste. They have already calculated the average annual net cash infiow per you to: be S2 EA2 290

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts