Question: K . Mini - Case Case 1 Accounting Changes ( 4 0 minutes ) You are the external auditor of Iron Company, a publicly accountable

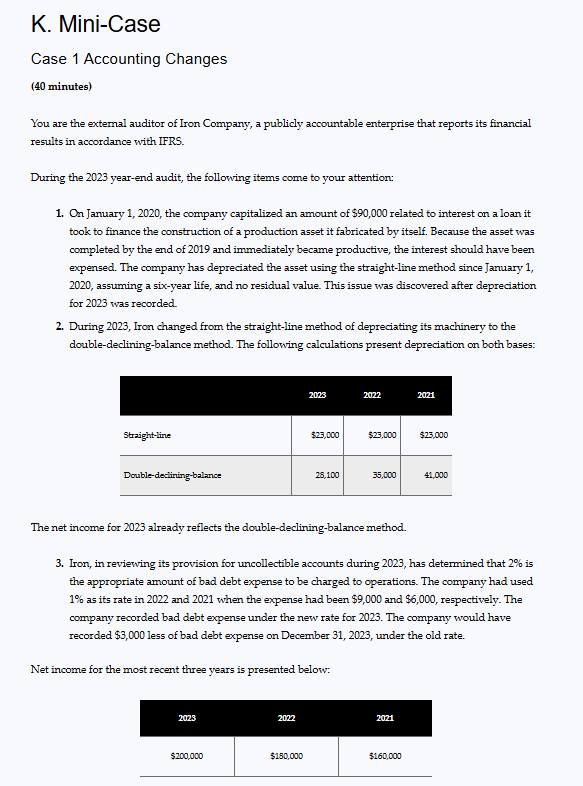

K MiniCase Case Accounting Changes minutes You are the external auditor of Iron Company, a publicly accountable enterprise that reports its financial results in accordance with IFRS. During the yearend audit, the following items come to your attention: On January the company capitalized an amount of $ related to interest on a loan it took to finance the construction of a production asset it fabricated by itself. Because the asset was completed by the end of and immediately became productive, the interest should have been expensed. The company has depreciated the asset using the straightline method since January assuming a sixyear life, and no residual value. This issue was discovered after depreciation for was recorded. During Iron changed from the straightline method of depreciating its machinery to the doubledecliningbalance method. The following calculations present depreciation on both bases: The net income for already reflects the doubledecliningbalance method. Iron, in reviewing its provision for uncollectible accounts during has determined that is the appropriate amount of bad debt expense to be charged to operations. The company had used as its rate in and when the expense had been $ and $ respectively. The company recorded bad debt expense under the new rate for The company would have recorded $ less of bad debt expense on December under the old rate. Net income for the most recent three years is presented below:

Required: Please help answer all parts

a Prepare, in general journal form, the entries necessary to correct the books for the transactions described above, assuming that the books have not been closed for the current year. Describe the situation for each transaction and support the appropriate accounting treatment according to GAAP, if any, for the change. Ignore all income tax effects.

b Present comparative income statement data for the years to starting with income before cumulative effect of accounting changes and adjusting the net income balance based on your analysis in part a

c Assume that the beginning retained earnings balance unadjusted for is $ and that noncomparative financial statements are prepared. Show the adjusted amount of the beginning retained earnings balance.

d Suppose that, when you looked into the increase in the estimates of uncollectible accounts, you learned that by all other companies in Iron Company's industry were using Would this change your treatment of the change? Explain no need to provide calculations

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock