Question: K performs services for the existing JAC equal partnership to help obtain a patent. As compensation, she receives a one-forth interest in the partnership,

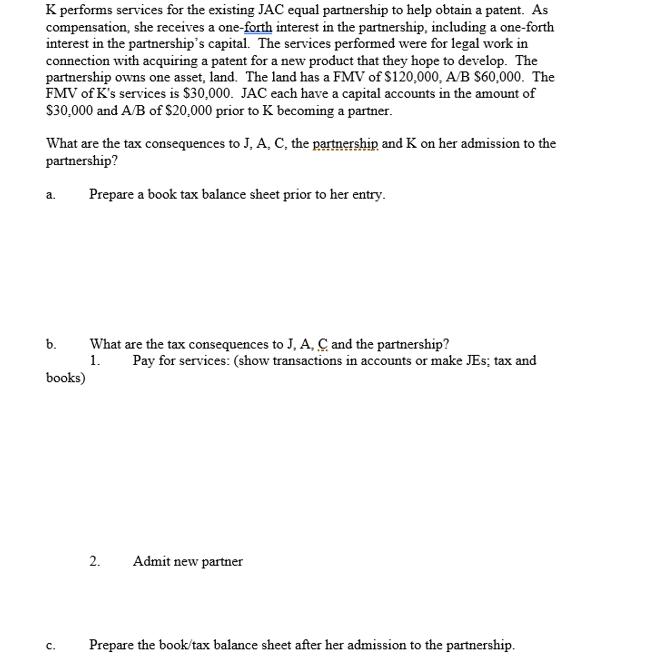

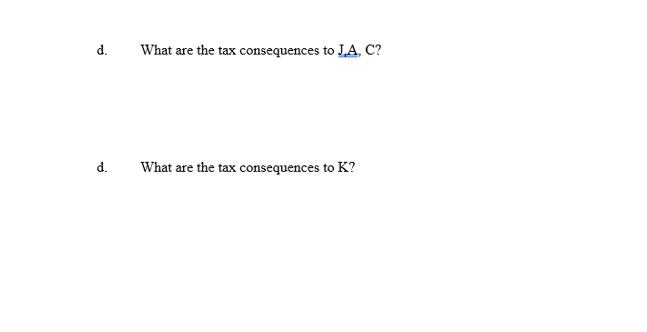

K performs services for the existing JAC equal partnership to help obtain a patent. As compensation, she receives a one-forth interest in the partnership, including a one-forth interest in the partnership's capital. The services performed were for legal work in connection with acquiring a patent for a new product that they hope to develop. The partnership owns one asset, land. The land has a FMV of $120,000, A/B $60,000. The FMV of K's services is $30,000. JAC each have a capital accounts in the amount of $30,000 and A/B of $20,000 prior to K becoming a partner. What are the tax consequences to J, A, C, the partnership and K on her admission to the partnership? Prepare a book tax balance sheet prior to her entry. a. b. books) C. What are the tax consequences to J, A, C and the partnership? 1. 2. Pay for services: (show transactions in accounts or make JEs; tax and Admit new partner Prepare the book/tax balance sheet after her admission to the partnership. d. d. What are the tax consequences to J,A, C? What are the tax consequences to K? 2. Assume the services are managerial services performed over the past year. What are the tax consequences to JAC and K and the partnership on her admission? Answer the same questions as in part 1b above (a. will be the same). 3. Assume that K procures the patent prior to becoming a partner and the patent is worth $40,000. Katie then contributes the patent to the partnership for a 1/4 interest in the partnership. Answer the same questions as in part 1.

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

To proceed with the question I will need to address each of the parts a through d and then the additional scenarios outlined in the last image The question is welldefined and complete as it requires a... View full answer

Get step-by-step solutions from verified subject matter experts