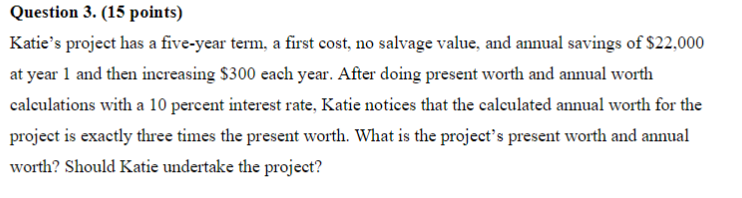

Question: Katie's project has a five-year term, a first cost, no salvage value, and annual savings of $22,000 at year 1 and then increasing $300 each

Katie's project has a five-year term, a first cost, no salvage value, and annual savings of $22,000 at year 1 and then increasing $300 each year. After doing present worth and annual worth calculations with a 10 percent interest rate, Katie notices that the calculated annual worth for the project is exactly three times the present worth. What is the project's present worth and annual worth? Should Katie undertake the project?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts