Question: ke BIV-aA $ % 9 $8.98 Number ry Format as Table Cell Styles 58 Delete Format board IS Font Alignment ly Styles Cells M N

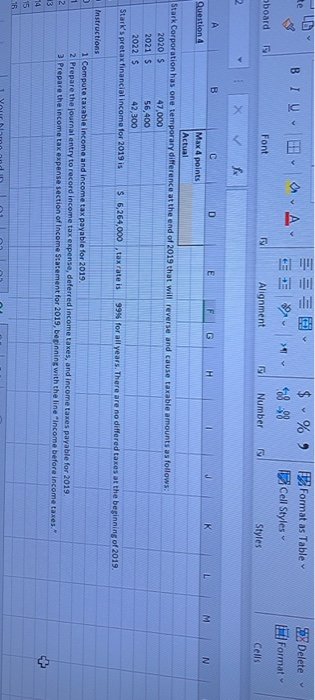

ke BIV-aA $ % 9 $8.98 Number ry Format as Table Cell Styles 58 Delete Format board IS Font Alignment ly Styles Cells M N B C D E F G H K Question Max 4 points Actual Stark Corporation has one temporary difference at the end of 2019 that will reverse and cause taxable amounts as follows: 2020 $ 47.000 2021 $ 56,400 2022 S 42,300 Stark's pretax financial income for 2019 is S 5,264,000 taxrate is 99% for all years. There are no differed taxes at the beginning of 2019. Instructions 1 Compute taxable income and income tax payable for 2019. 2 Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2019. 3 Prepare the income tax expense section of Income Statement for 2019, bepinning with the line income before income taxes." 2 3 + 14 15 1R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts