Question: keep 4 post decimal digits when entering your final answer and keep 4 post decimal digits in all intermediate steps. Consider a 5 vear bond

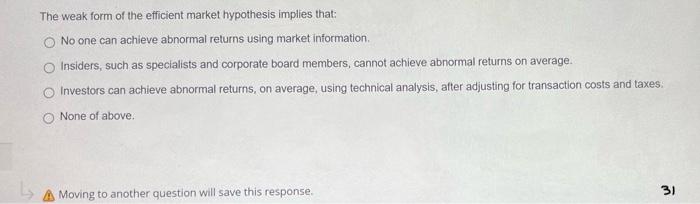

Consider a 5 vear bond with a par value of $1,000 and an 9% annual coupon. If interest rates change from 9% to 5% the bonds price will: increase by 5 A. Moving to another question will save this response. 29 percelved to be fairby priced today, what much be investors' expectation of the price of the stock at the end of the year? Hint [CAPM] Expocted Retim (R)=R. . The weak form of the efficient market hypothesis implies that: No one can achieve abnormal returns using market information. Insiders, such as specialists and corporate board members, cannot achieve abnormal returns on average. Investors can achieve abnormal returns, on average, using technical analysis, after adjusting for transaction costs and taxes: None of above. Moving to another question will save this response. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts