Question: keep getting the wrong answer for the last part, please help. 1. Journalize the purchase of the patent. 2. Journalize the amortization expense for the

keep getting the wrong answer for the last part, please help.

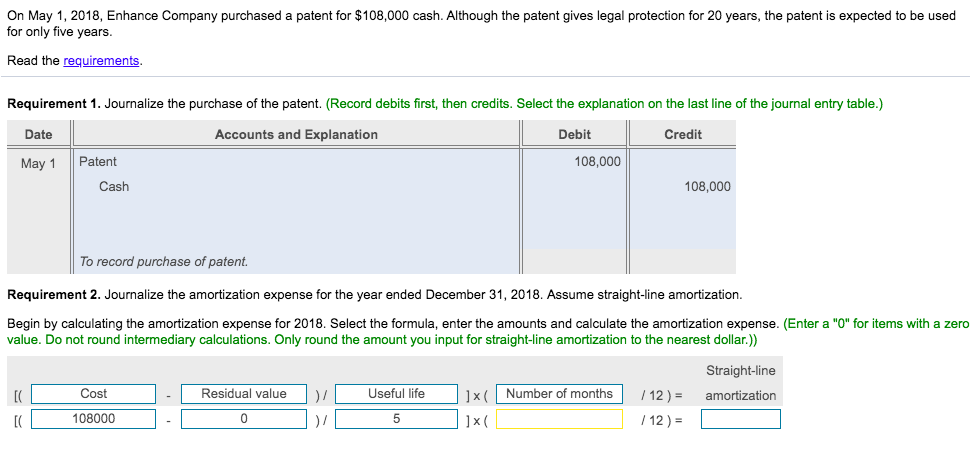

1. Journalize the purchase of the patent. 2. Journalize the amortization expense for the year ended December 31, 2018. Assume straight-line amortization. On May 1, 2018, Enhance Company purchased a patent for $108,000 cash. Although the patent gives legal protection for 20 years, the patent is expected to be used for only five years. Read the requirements. Requirement 1. Journalize the purchase of the patent. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit May 1 Patent 108,000 Cash 108,000 To record purchase of patent. Requirement 2. Journalize the amortization expense for the year ended December 31, 2018. Assume straight-line amortization. Begin by calculating the amortization expense for 2018. Select the formula, enter the amounts and calculate the amortization expense. (Enter a "0" for items with a zero value. Do not round intermediary calculations. Only round the amount you input for straight-line amortization to the nearest dollar.)) Straight-line amortization Cost - Residual value Useful life ) / )/ 1x Number of months ]x / 12) = / 12) = [C 108000 0 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts