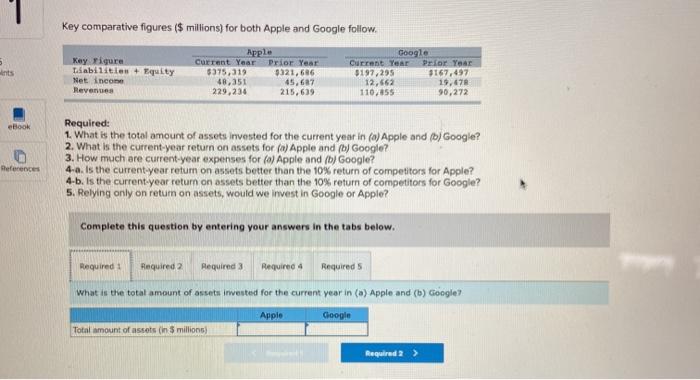

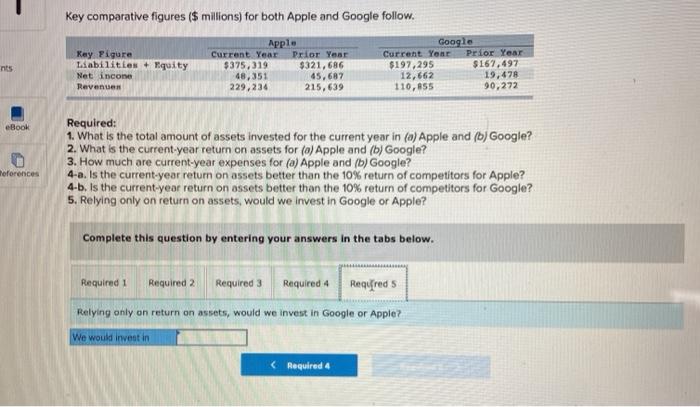

Question: Key comparative figures ($ millions) for both Apple and Google follow, 5 Key Figure Tsabilities + Equity Net income Revenues Apple Current Year Prior Year

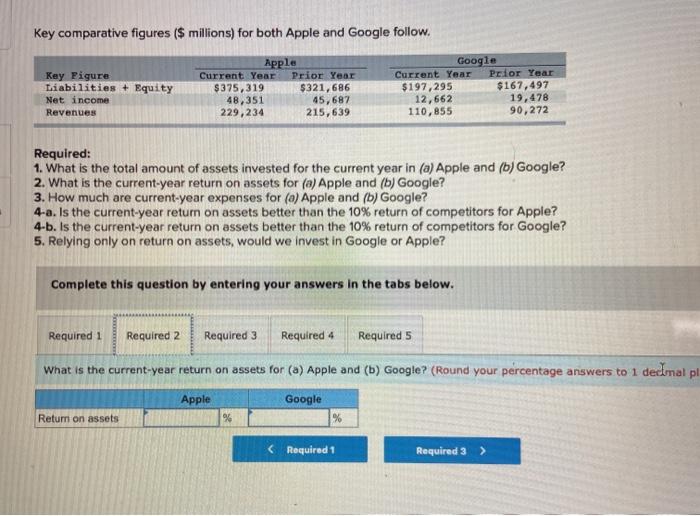

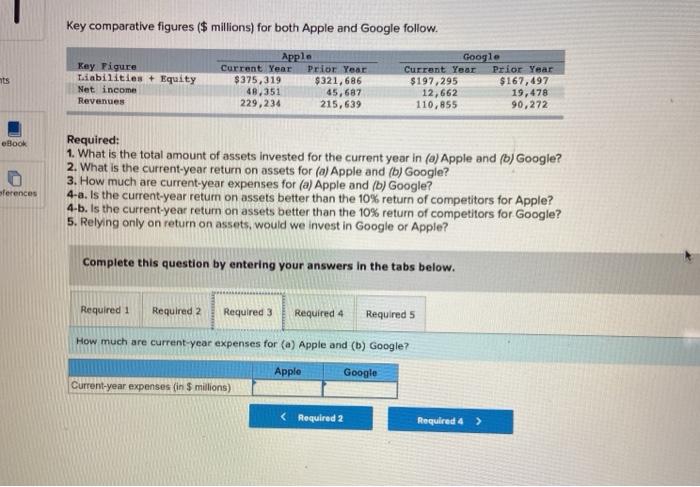

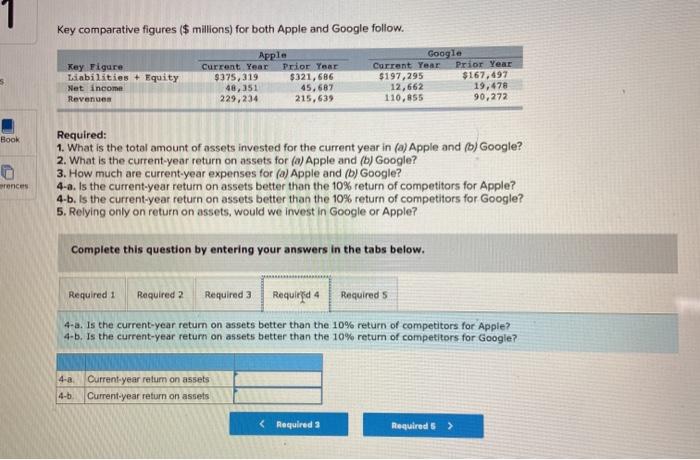

Key comparative figures ($ millions) for both Apple and Google follow, 5 Key Figure Tsabilities + Equity Net income Revenues Apple Current Year Prior Year $375,319 9321,686 48,351 45,687 229,234 215.639 Google Current Year Prior Year $197,295 $167,497 12,562 19.478 110.455 90,272 ebook Required: 1. What is the total amount of assets invested for the current year in (a) Apple and (b) Google? 2. What is the current-year return on assets for (a) Apple and (b) Google? 3. How much are current-year expenses for (a) Apple and (b) Google? 4. Is the current-year return on assets better than the 10% return of competitors for Apple? 4-b. Is the current-year return on assets better than the 10% return of competitors for Google? 5. Relying only on return on assets, would we invest in Google or Apple? References Complete this question by entering your answers in the tabs below. Required Required 2 Required 3 Required 4 Required 5 What is the total amount of assets invested for the current year in (a) Apple and (b) Google? Apple Google Total amount of assets (in 5 millions) Required 2 > Key comparative figures ($ millions) for both Apple and Google follow. Key Figure Liabilities + Equity Net income Revenues Apple Current Year Prior Year $375,319 $321, 686 48,351 45,687 229,234 215,639 Google Current Year Prior Year $197,295 $167,497 12,662 19,478 110,855 90,272 Required: 1. What is the total amount of assets invested for the current year in (a) Apple and (b) Google? 2. What is the current-year return on assets for (a) Apple and (b) Google? 3. How much are current-year expenses for (a) Apple and (b) Google? 4-a. Is the current-year return on assets better than the 10% return of competitors for Apple? 4-b. Is the current-year return on assets better than the 10% return of competitors for Google? 5. Relying only on return on assets, would we invest in Google or Apple? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 What is the current-year return on assets for (a) Apple and (b) Google? (Round your percentage answers to 1 dedinal pl Apple Return on assets Google % Required 1 Required 3 > Key comparative figures ($ millions) for both Apple and Google follow. ats Key Figure Tiabilities + Equity Net income Revenues Apple Current Year Prior Year $375,319 $321,686 48,351 45,687 229,234 215,639 Google Current Year Prior Year $ 197,295 $167,497 12,662 19,478 110,855 90,272 eBook Required: 1. What is the total amount of assets invested for the current year in (a) Apple and (b) Google? 2. What is the current-year return on assets for (a) Apple and (b) Google? 3. How much are current-year expenses for (a) Apple and (b) Google? 4-a. Is the current-year return on assets better than the 10% return of competitors for Apple? 4-b. Is the current-year return on assets better than the 10% return of competitors for Google? 5. Relying only on return on assets, would we invest in Google or Apple? sferences Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 How much are current-year expenses for(a) Apple and (b) Google? Apple Google Current-year expenses (in 9 millions) Key comparative figures ($ millions) for both Apple and Google follow. Key Figure Tiabilities + Equity Net income Revenues Apple Current Year Prior Year $375,319 $321,686 48,351 45.687 229,234 215,639 Google Current Year Prior Year $197,295 $167,497 12,662 19,478 110,855 90,272 Book D Required: 1. What is the total amount of assets invested for the current year in (a) Apple and (b) Google? 2. What is the current-year return on assets for (a) Apple and (b) Google? 3. How much are current-year expenses for (a) Apple and (b) Google? 4-a. Is the current-year return on assets better than the 10% return of competitors for Apple? 4-b. Is the current-year return on assets better than the 10% return of competitors for Google? 5. Relying only on return on assets, would we invest in Google or Apple? rences Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Requirfid 4 Required 5 4-a. Is the current-year return on assets better than the 10% return of competitors for Apple? 4-b. Is the current-year return on assets better than the 10% return of competitors for Google? 4- Current-year return on assets 4-1 Current-year return on assets Key comparative figures ($ millions) for both Apple and Google follow. Key Figure abilities - Equity Net incon Ravenues Apple Current Year Prior Year $375,319 $321,686 48,351 45,687 229,234 215, 639 Google Current Yon Prior Year $197,295 $167,497 12,662 19,478 110,855 90,272 eBook Required: 1. What is the total amount of assets invested for the current year in (a) Apple and (b) Google? 2. What is the current-year return on assets for (0) Apple and (b) Google? 3. How much are current-year expenses for (a) Apple and (b) Google? 4-a. Is the current-year return on assets better than the 10% return of competitors for Apple? 4-b. Is the current-year return on assets better than the 10% return of competitors for Google? 5. Relying only on return on assets, would we invest in Google or Apple? References Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Requred Relying only on return on assets, would we invest in Google or Apple? We would invest in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts